Embed presentation

Downloaded 54 times

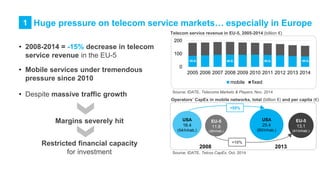

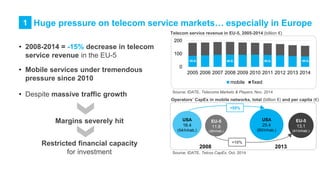

The document discusses the challenges facing telecom companies in Europe, including a 15% decrease in telecom service revenue from 2008-2014. It notes that 5G networks present both opportunities and risks for telecom business models. New pricing models, services, and a shift away from ARPU metrics could drive growth. However, factors like regulation, market structure, and economic conditions will also impact success in the 5G era. The document concludes there is potential for a "renaissance" scenario with average annual growth of 3.2% if telecoms focus on productivity, fixed-mobile convergence, and real-time network management.