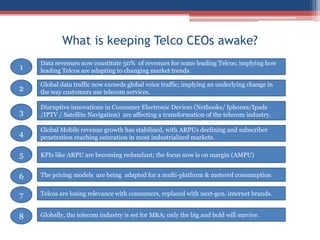

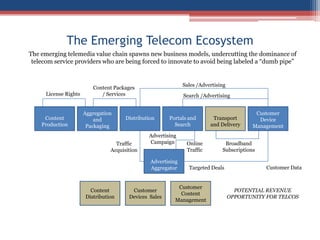

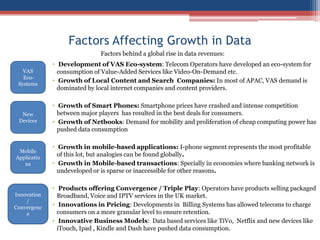

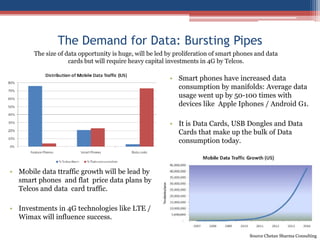

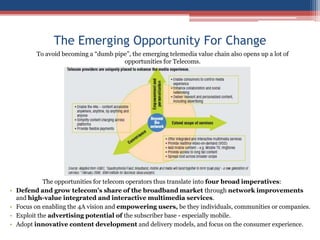

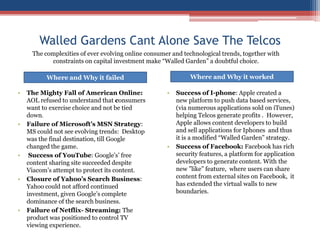

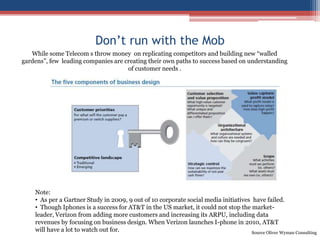

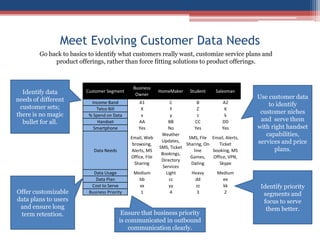

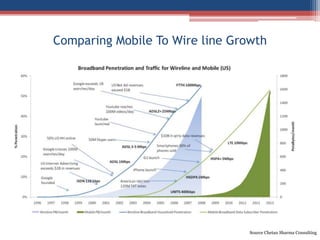

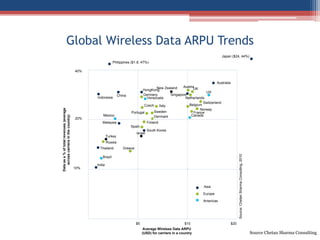

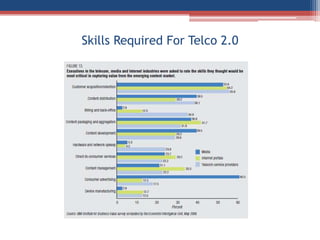

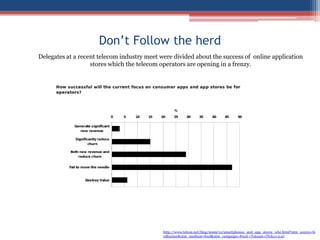

Telecom companies are facing declining revenues due to competition from online players and must adapt to retain a share of data revenues. Key strategies for survival include improving broadband services, empowering users, leveraging advertising potential, and adopting innovative content models. To avoid becoming ‘dumb pipes,’ telcos need to recognize evolving customer needs and organize for a competitive future.