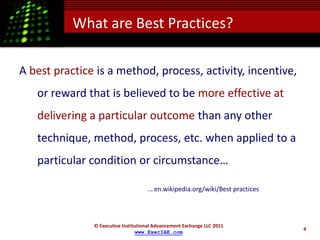

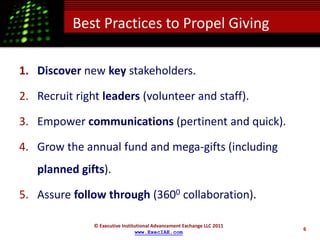

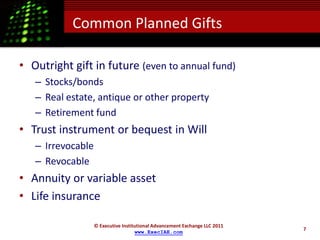

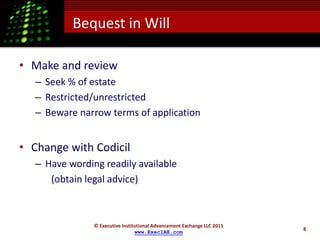

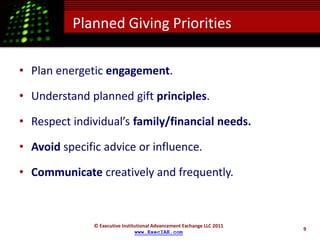

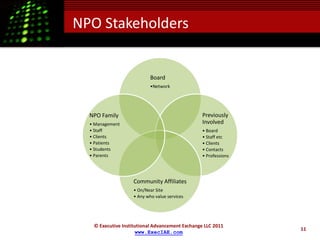

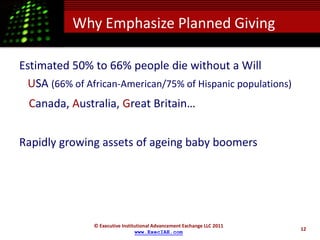

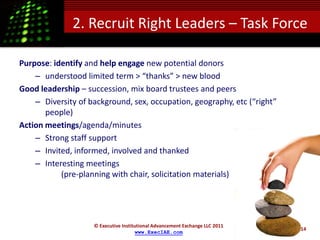

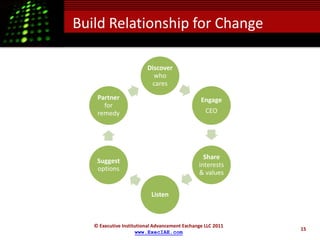

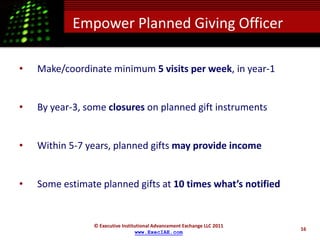

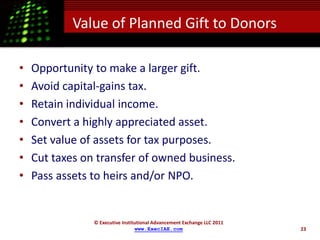

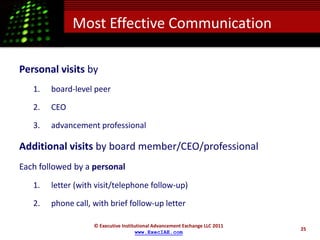

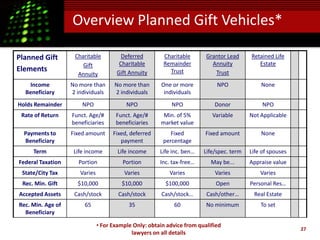

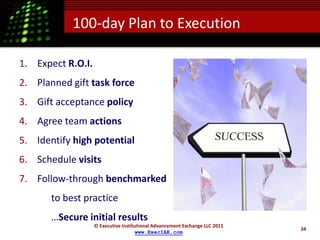

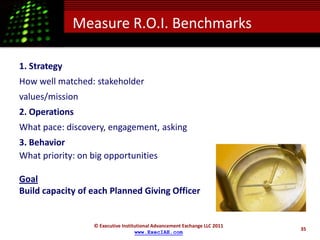

The document outlines best practices for advancing planned giving in nonprofits, emphasizing the importance of assessment, stakeholder engagement, and communication strategies. It details steps such as discovering key stakeholders, empowering leaders, and ensuring follow-through to enhance fundraising potential. Additionally, the document highlights various types of planned gifts and effective communication techniques to encourage donor participation.