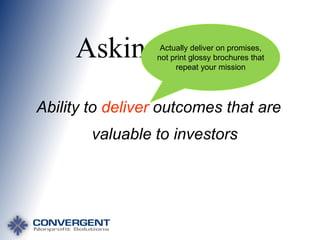

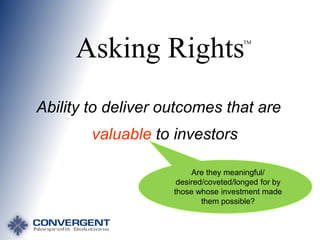

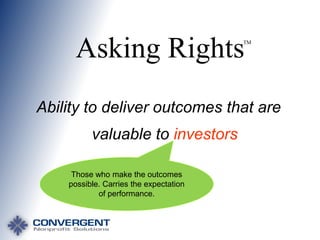

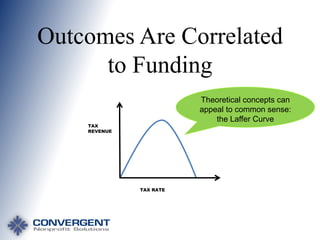

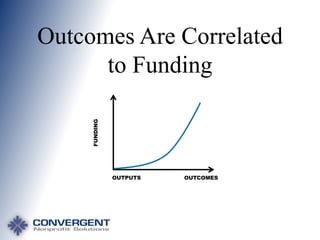

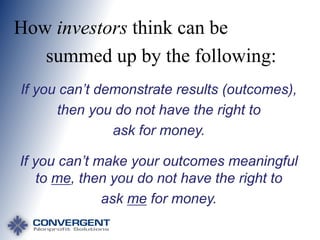

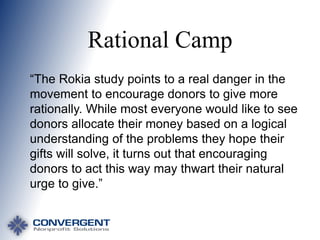

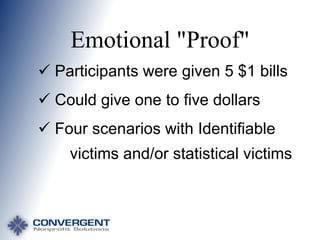

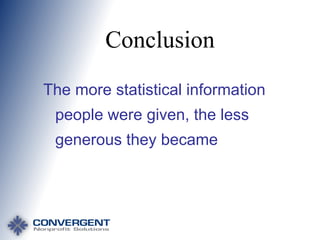

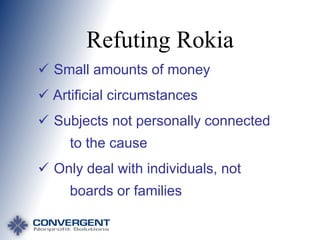

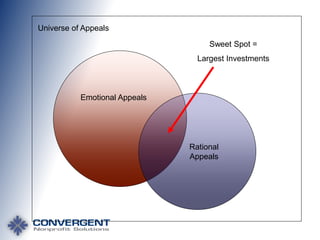

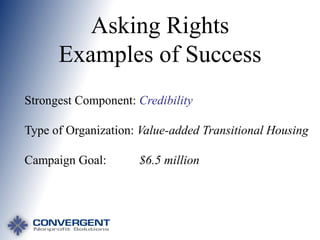

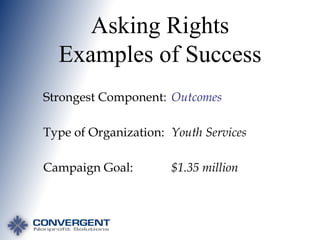

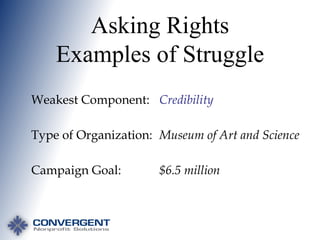

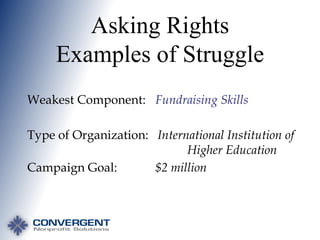

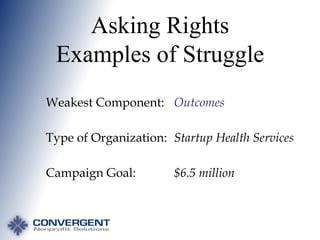

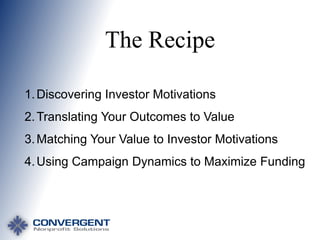

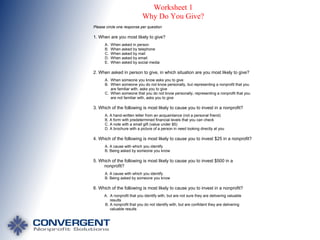

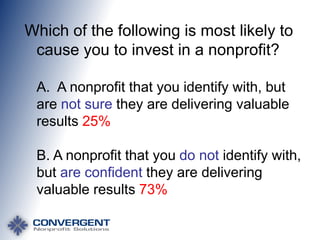

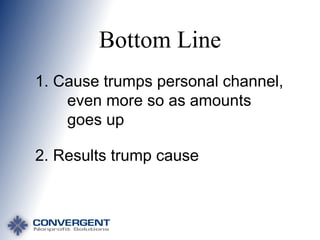

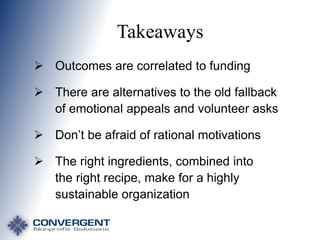

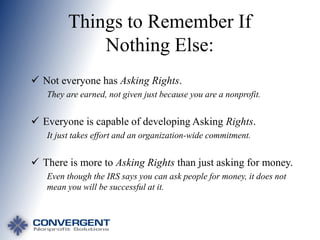

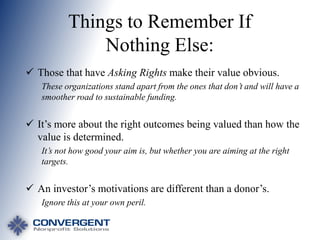

The document outlines the concept of 'asking rights' for nonprofits, emphasizing that organizations must demonstrate their ability to deliver valuable outcomes to earn the right to ask for funding. It differentiates between emotional and rational motivations of investors, urging nonprofits to focus on measurable results rather than just emotional appeals. Ultimately, it stresses that successful fundraising relies on a combination of outcomes, credibility, and effective fundraising skills.