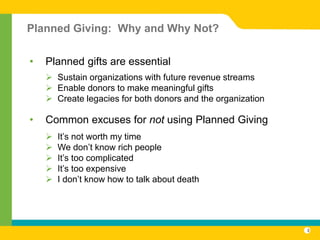

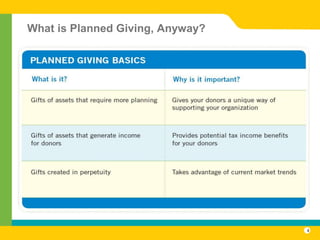

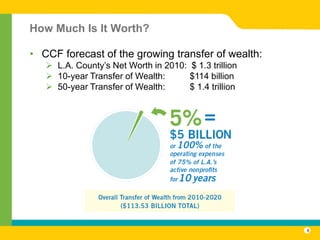

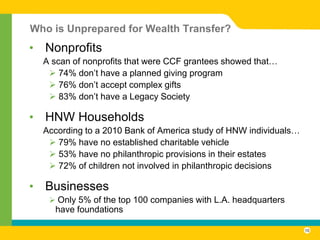

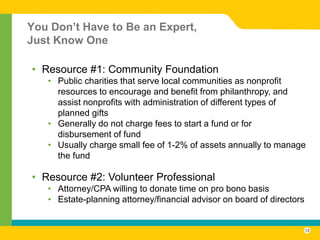

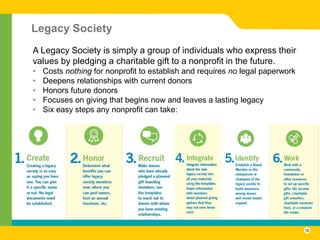

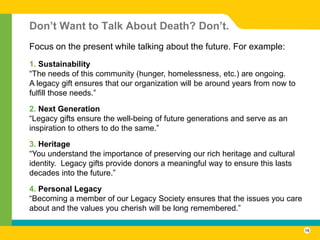

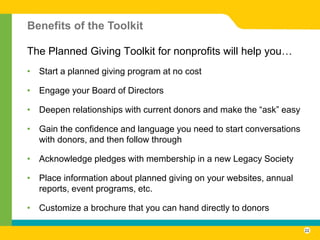

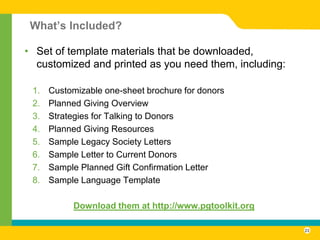

The document outlines the importance of planned giving for nonprofits, highlighting its potential to provide sustainable funding and support organizational growth. It introduces a planned giving toolkit developed by the California Community Foundation, which offers practical steps and resources for nonprofits to establish planned giving programs. It emphasizes that many nonprofits lack these programs and presents a call to action for leaders to embrace planned giving to ensure their organizations' futures.