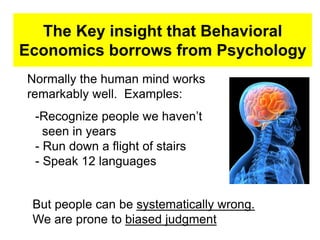

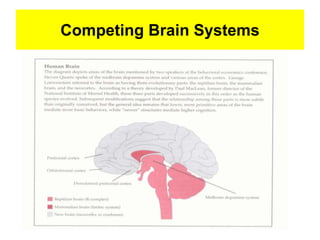

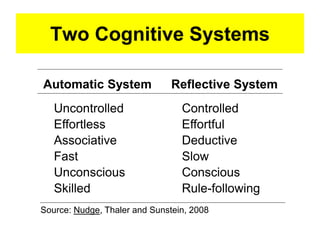

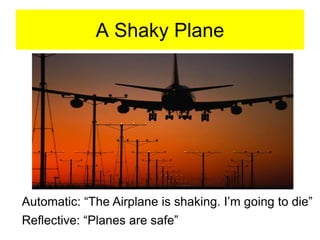

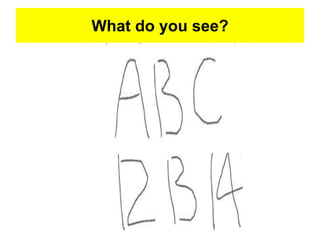

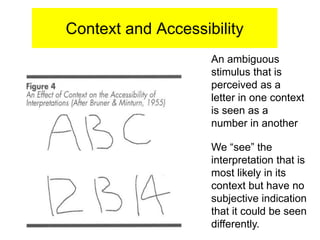

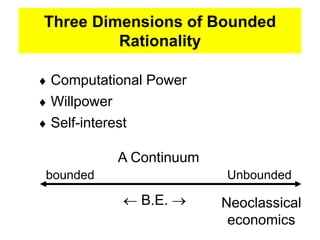

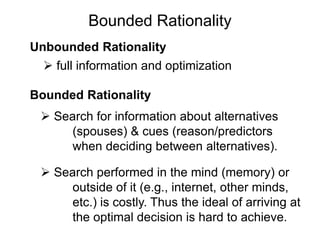

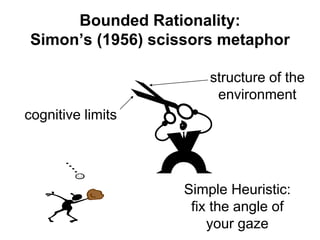

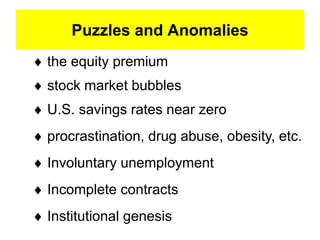

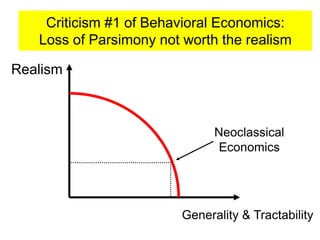

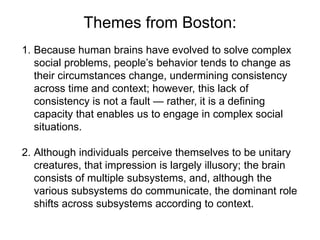

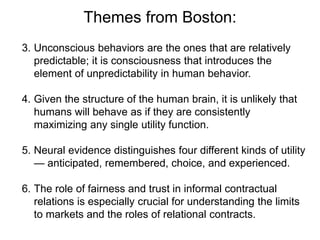

Behavioral economics borrows insights from psychology to understand human decision-making. It recognizes that people can be systematically irrational or make biased judgments due to two types of thinking: intuitive/automatic vs reflective/rational. The automatic system is fast but prone to errors, while the reflective system is slower but more accurate. Behavioral economics also acknowledges that people have bounded rationality, willpower, and self-interest due to cognitive limitations. This helps explain puzzles like market bubbles and procrastination that cannot be understood from a traditional economic assumption of perfect rationality.