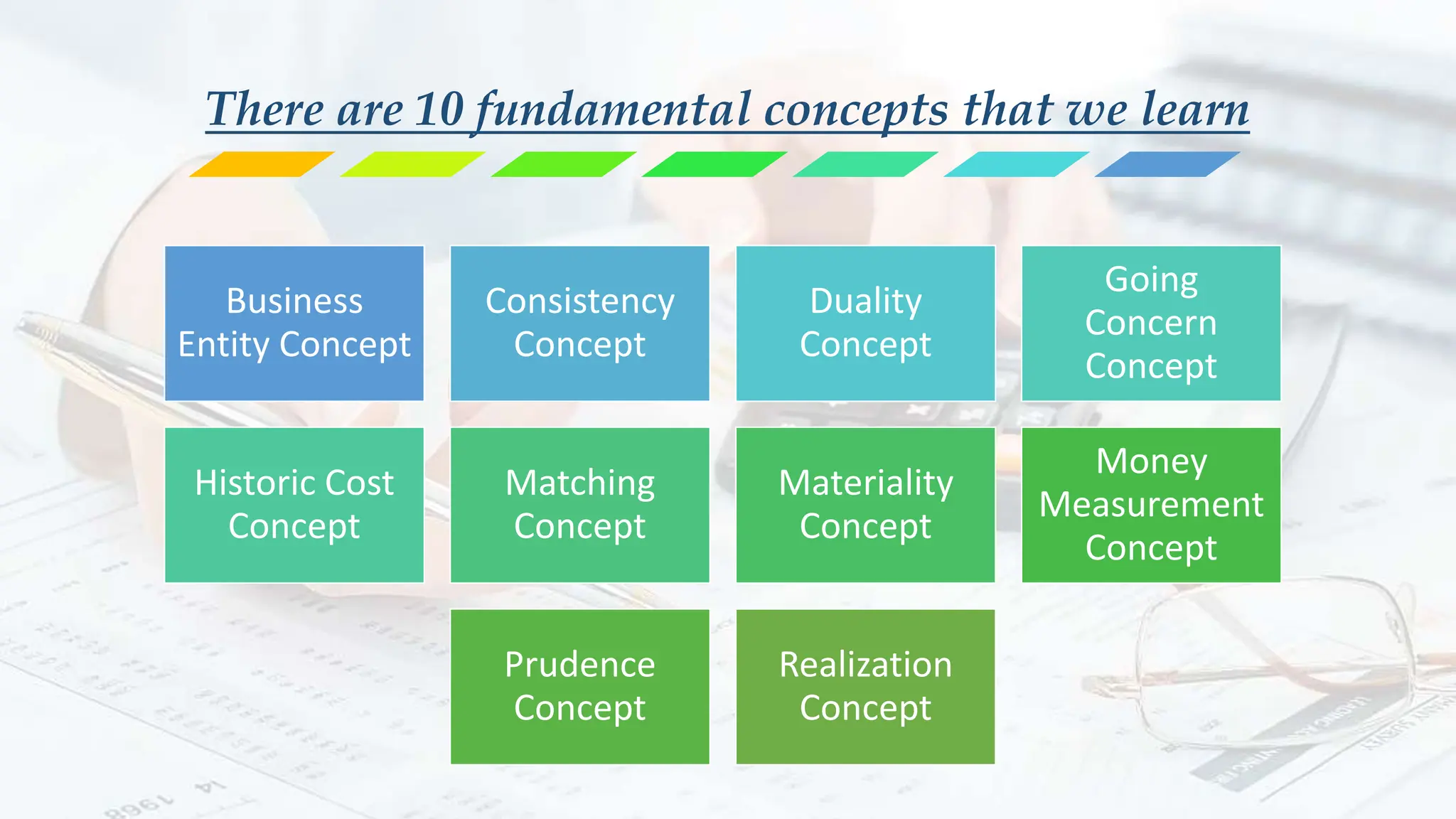

The document outlines ten fundamental accounting concepts that are essential for reporting financial statements and maintaining accurate records. These include concepts such as the business entity concept, consistency, duality, and going concern, each highlighting key principles in recording financial transactions and policies. Overall, these concepts ensure integrity and consistency in financial reporting.