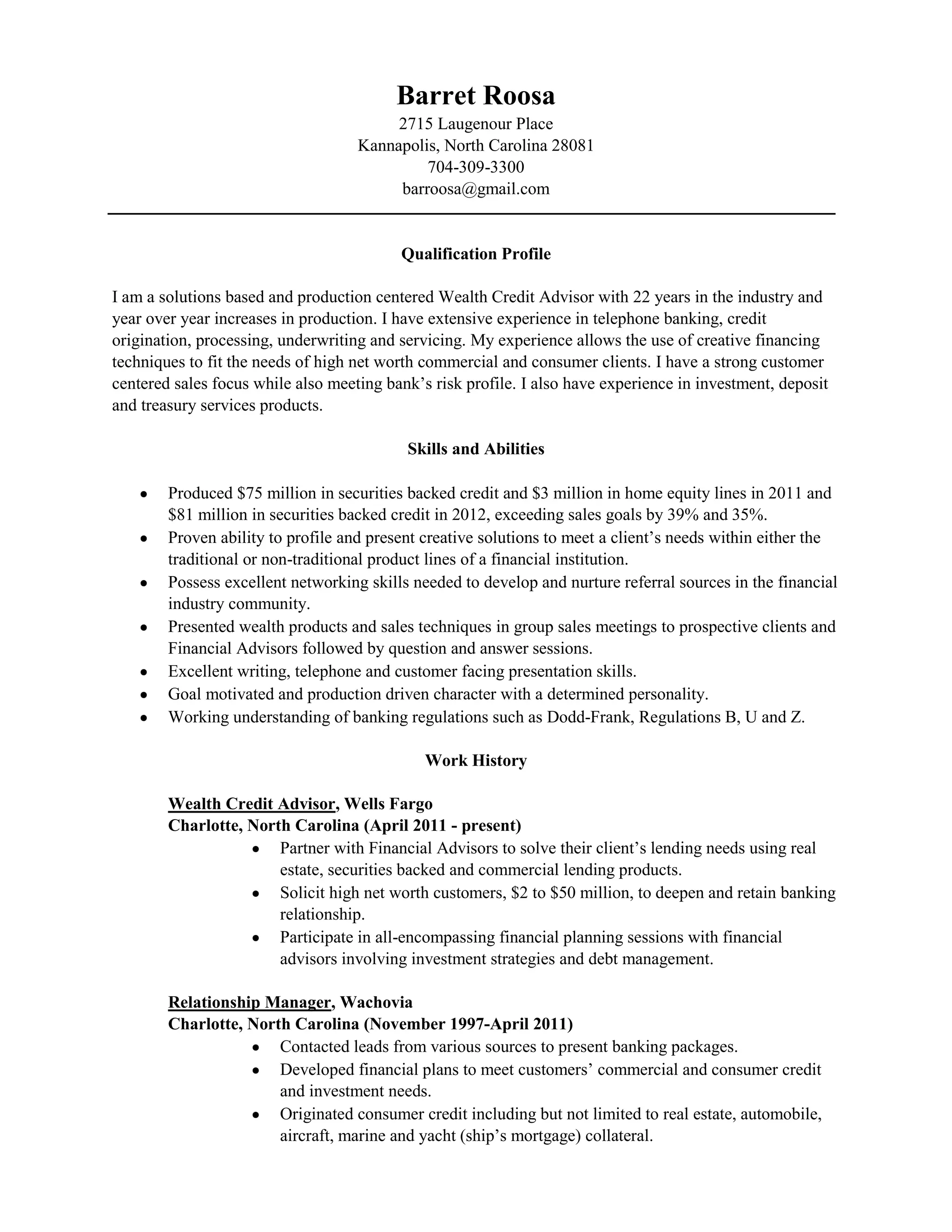

Barret Roosa is a solutions-based wealth credit advisor with over 22 years of experience in banking. He has a strong track record of exceeding sales goals, with $75 million in sales in 2011 and $81 million in 2012. He has experience in credit origination, underwriting, servicing, and developing creative financing solutions for high net worth clients. His skills include relationship building, presenting financial solutions, and working knowledge of banking regulations. He has held positions at several banks including Wells Fargo, Wachovia, and First Union, gaining experience in lending, financial planning, and developing new business.