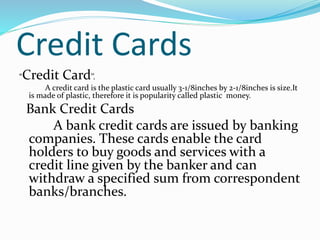

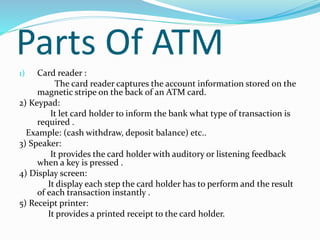

The document discusses different types of bank cards including their origins, definitions, functions and key features. It describes credit cards as plastic cards that allow cardholders to make purchases with a line of credit from the issuing bank. ATM cards are discussed as allowing cardholders to withdraw cash from ATMs 24/7. Debit cards are defined as payment cards where the transaction amount is deducted directly from the cardholder's bank account upon authorization, without any grace period. Advantages and disadvantages are provided for each type of card from the perspective of cardholders and businesses.