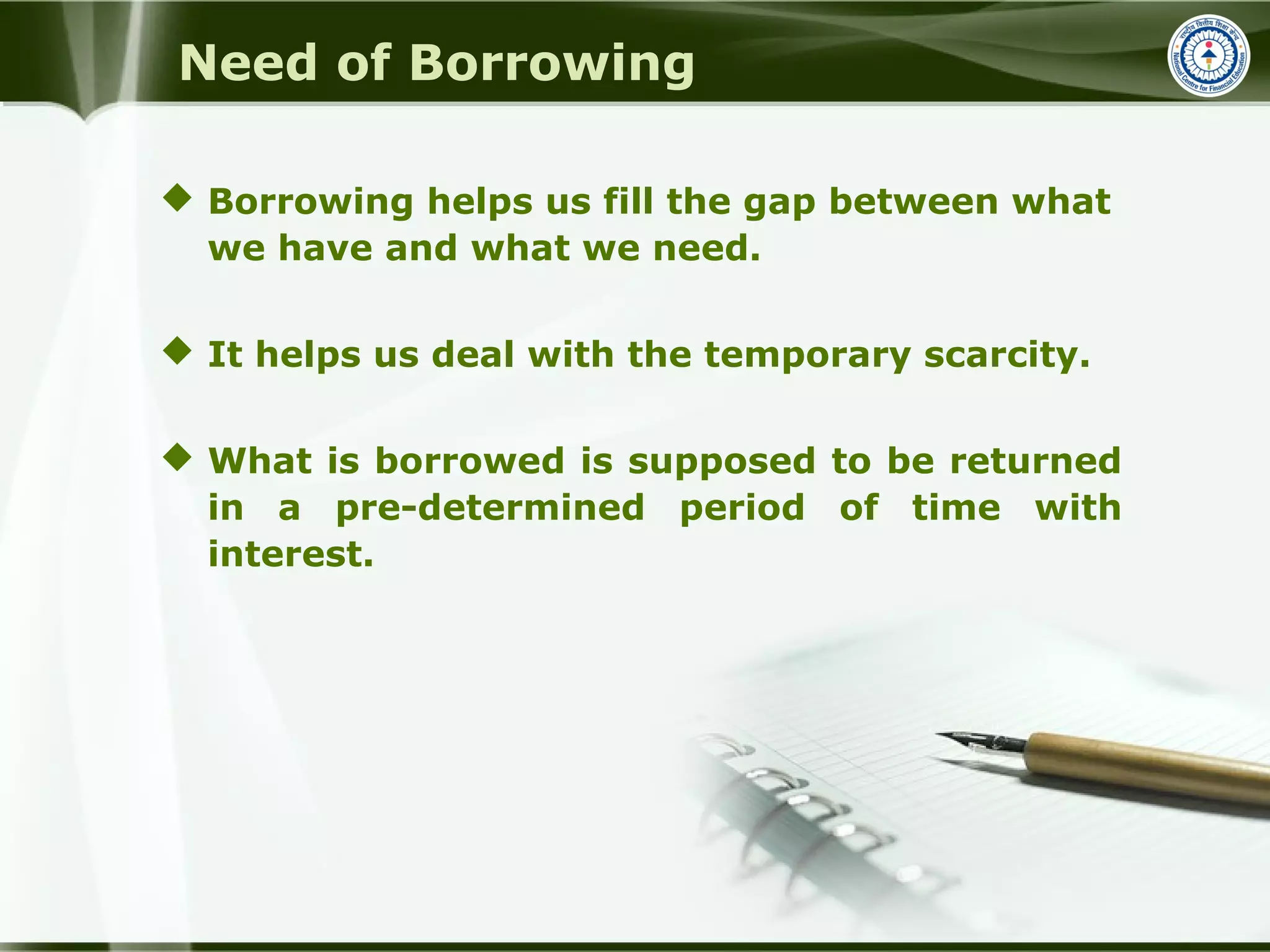

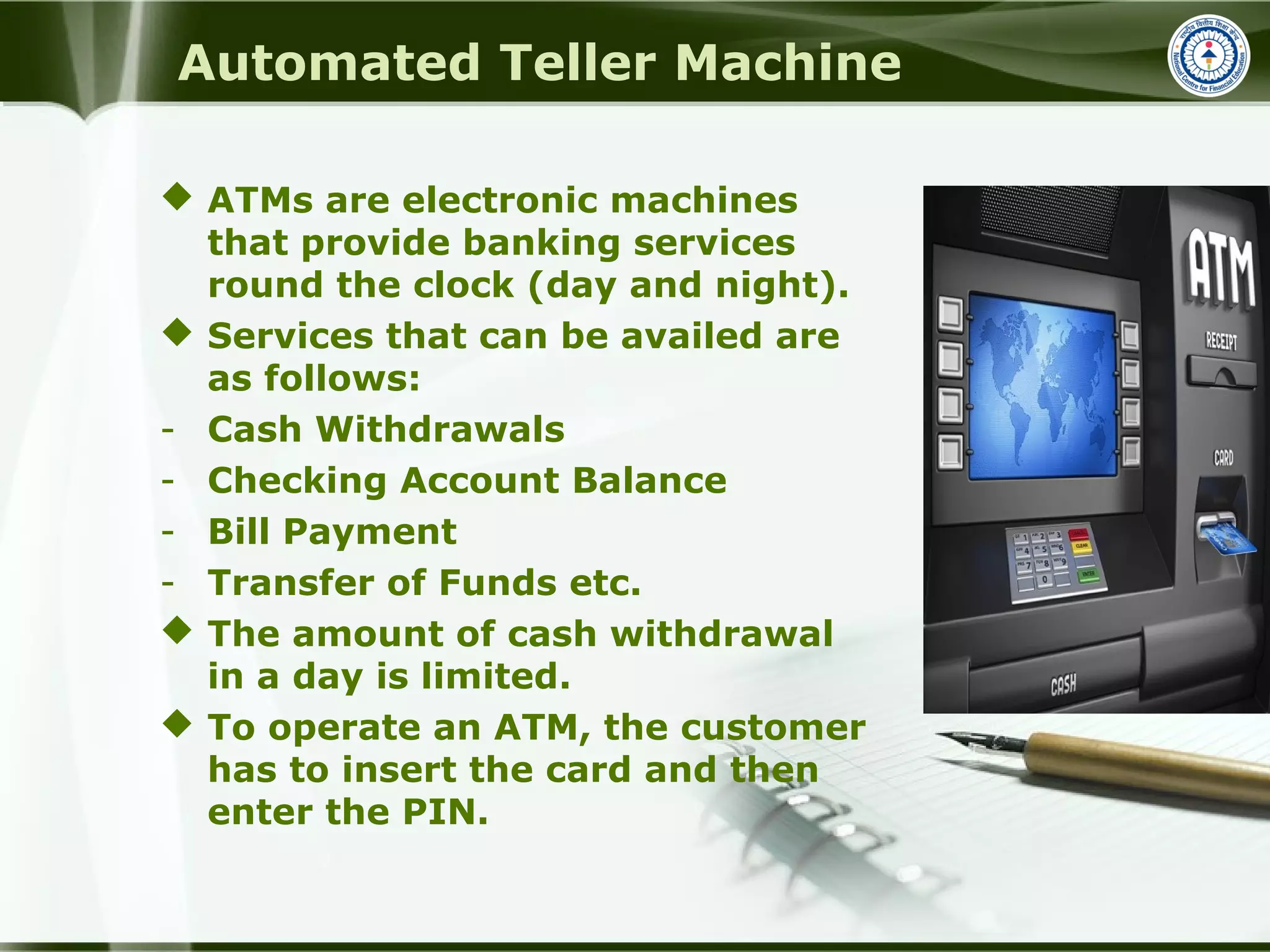

The document discusses various banking and financial concepts. It explains the need for borrowing and different sources of borrowing including internal sources like friends and family and external sources like banks. It defines key banking terms like loans, interest, and the role of the Reserve Bank of India in regulating banks and maintaining financial stability. The document also covers consumer rights and introduces concepts like types of bank accounts, cheques, debit cards, credit cards, ATMs and digital banking facilities like internet banking and mobile banking.