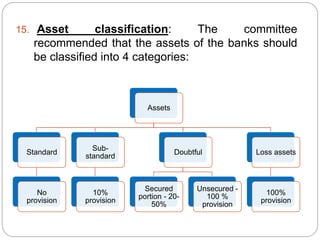

The document discusses the history and evolution of banking sector reforms in India over several decades. It covers key milestones like the Banking Regulation Act of 1949, nationalization of banks in 1969 and 1980, and establishment of committees like Narasimham Committee I and II that led banking reforms in 1991 and 1998 respectively. The reforms focused on aspects like reducing government control, increasing competition and privatization, improving asset quality and regulatory changes to strengthen the banking system in India.