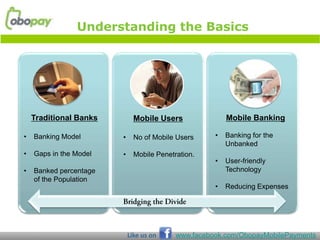

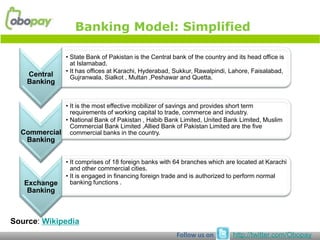

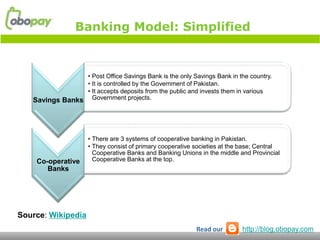

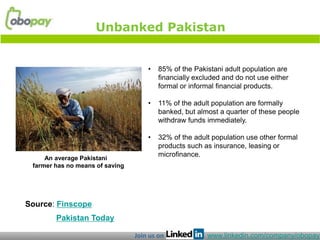

The document discusses banking in Pakistan, including traditional banking models, the large number of mobile users compared to those with bank accounts, and how mobile banking can help address gaps by serving the unbanked population through user-friendly technology and reducing expenses. It provides statistics on banking penetration, mobile connectivity rates, and the potential of mobile banking to bridge the gap between mobile subscribers and bank account holders.