Embed presentation

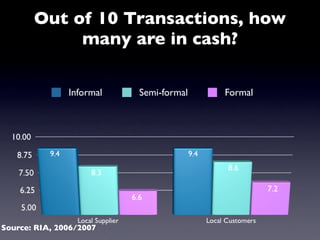

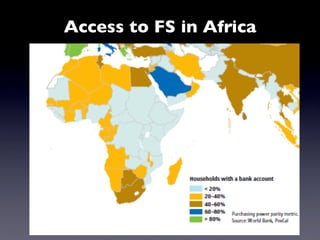

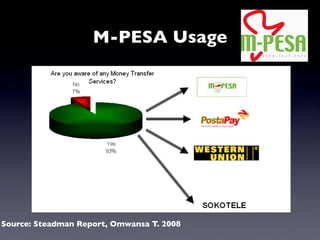

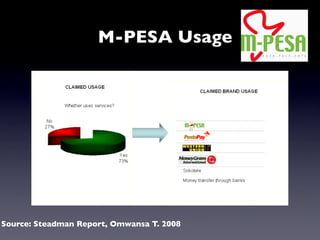

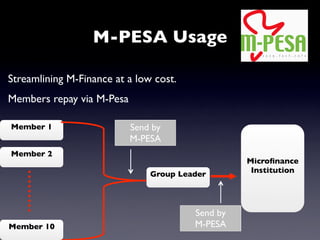

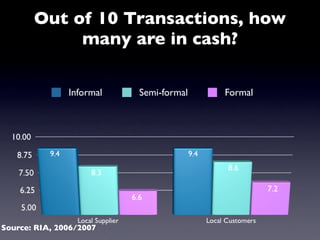

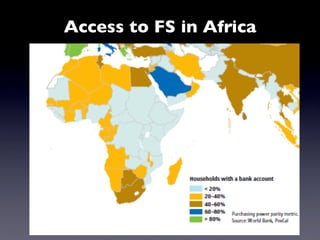

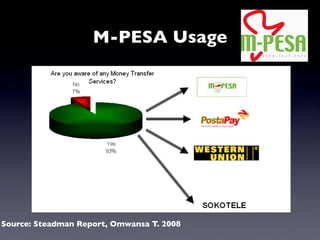

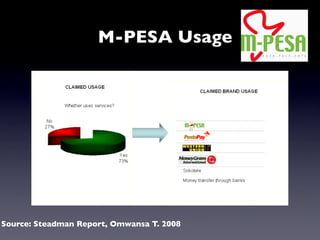

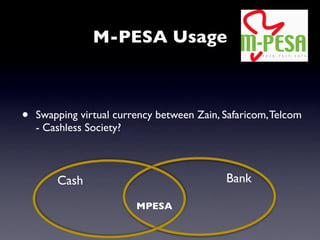

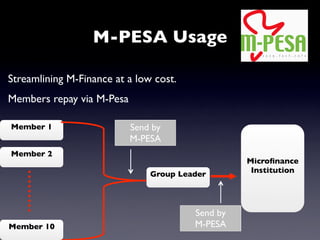

The document discusses mobile money transfer systems in Africa and their impact on financial inclusion. Key points include: 1) Mobile money systems like M-PESA in Kenya have allowed millions of previously unbanked or underbanked individuals to conduct financial transactions and access financial services via their mobile phones. 2) Studies show a positive correlation between increased mobile phone access and socioeconomic development indicators, especially in rural areas where mobile money can improve prices for farmers. 3) Mobile money ecosystems involving mobile network operators, banks, microfinance institutions, and retailers have expanded access to financial services across Africa in a low-cost manner.