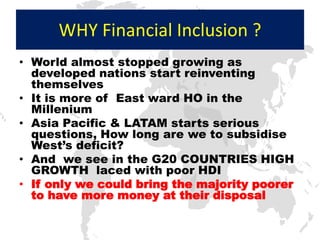

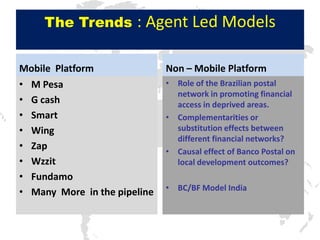

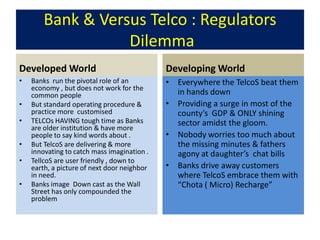

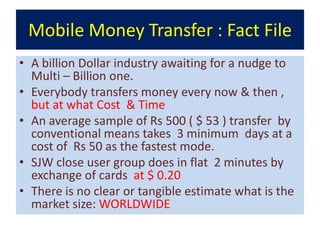

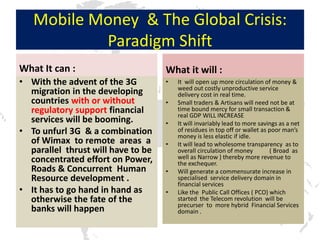

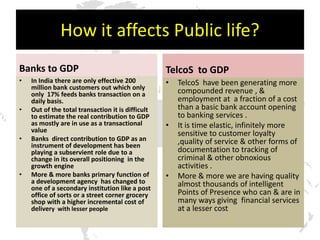

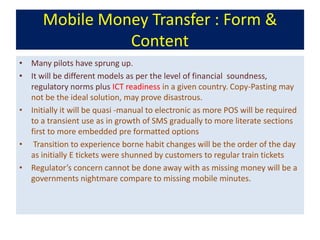

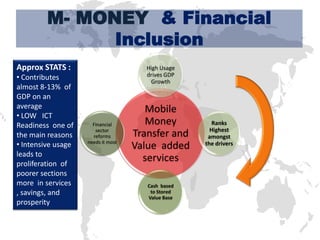

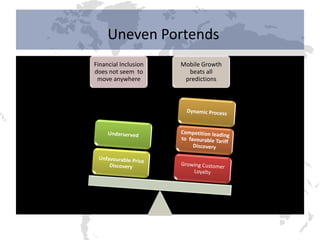

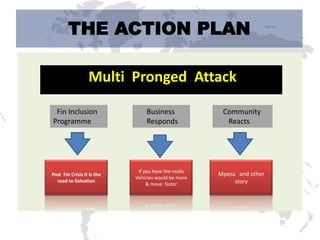

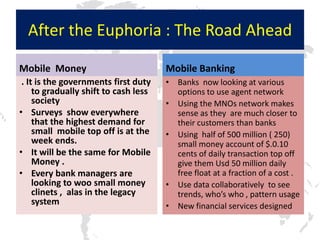

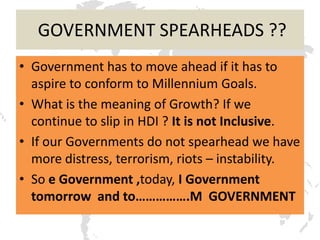

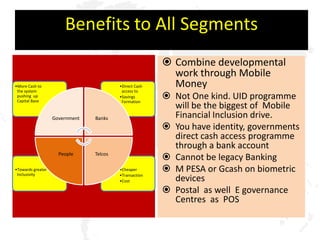

The document discusses mobile money and banking as a way to promote financial inclusion. It notes that mobile platforms are increasingly being used to provide financial services and access to banking in developing countries through agent-led models. While this trend provides opportunities to expand access, it also creates regulatory dilemmas around the roles of banks versus telecommunications companies. The document argues that increased use of mobile money can boost economic growth and circulation of money.