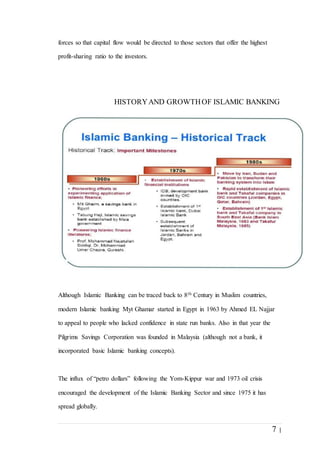

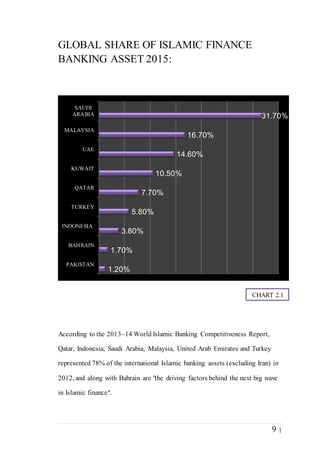

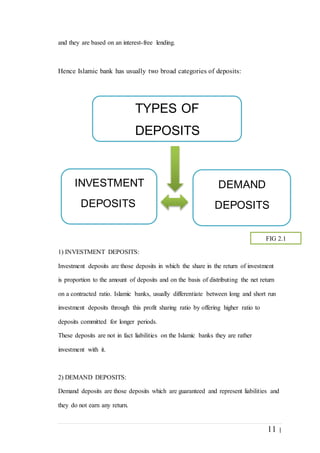

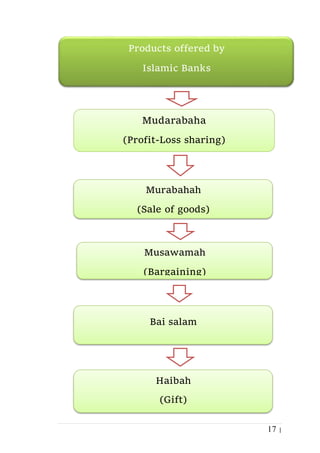

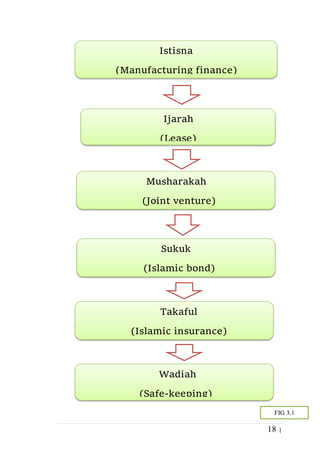

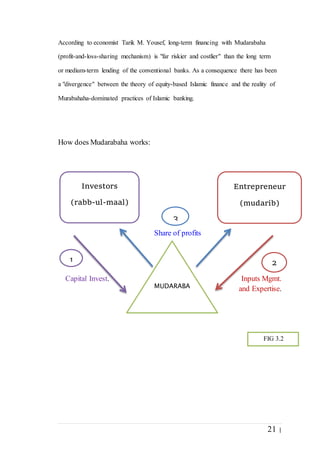

Islamic banking is gaining popularity globally as an interest-free alternative to conventional banking that complies with Sharia (Islamic law). Some key financing models used in Islamic banking include Mudarabah (profit-loss sharing), Murabahah (cost-plus sale), and Ijarah (leasing). While Islamic banks operate similarly to conventional banks in mobilizing deposits and allocating funds, they prohibit interest and invest funds using Sharia-compliant contracts. The emergence of Islamic banking has provided an innovative financial system, though it faces challenges in developing new products to better compete with conventional banks.