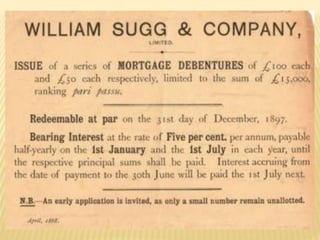

Borrowed capital consists of funds raised through loans and credit from various sources such as debentures, bonds, and financial institutions. It creates obligations for the company to repay the principal and pay interest. Borrowed capital is temporary in nature compared to equity capital. Debentures are debt instruments used by companies to borrow money at fixed interest rates. Bonds are also debt instruments where an investor loans money to a corporate or government body. Financial institutions such as banks provide long-term loans to companies. Borrowed capital allows companies to raise funds for expansion while creating repayment obligations.