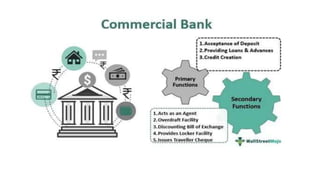

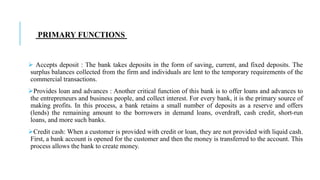

The document provides an overview of the Indian financial system. It defines a financial system as one that manages the flow of funds between market participants by facilitating the transfer of funds and assets between borrowers, lenders, and investors. The key components of the Indian financial system are financial assets, institutions, markets, and services. Financial institutions in India include banking institutions like scheduled commercial banks, cooperative banks, and non-banking financial companies. Together, these components work to efficiently allocate resources and promote economic growth.