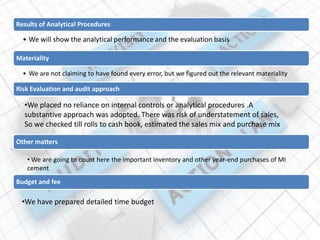

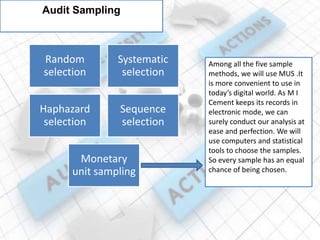

The document summarizes the audit planning procedures for M.I. Cement Factory Ltd. It discusses developing an audit strategy that involves understanding the company, assessing risks, determining materiality, and planning the nature, timing and extent of audit procedures. It also discusses developing an audit plan, evaluating internal controls, testing controls related to purchasing and revenue, audit sampling techniques, and recommendations for the audit.