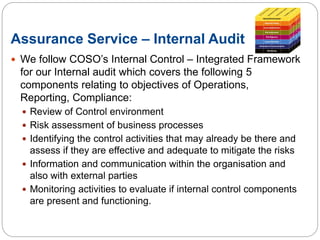

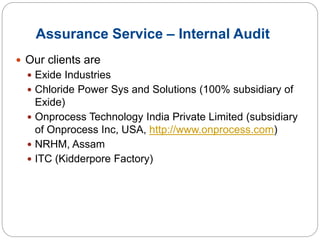

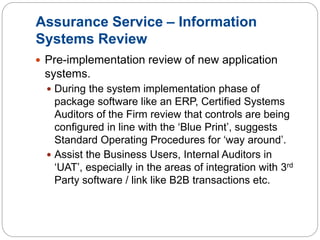

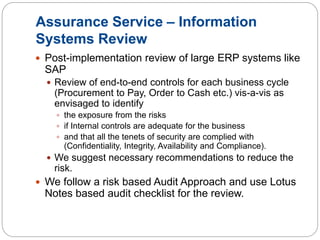

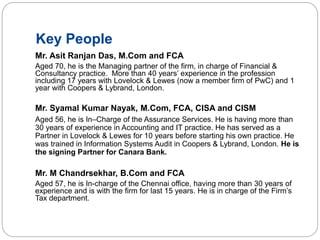

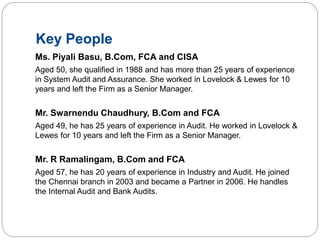

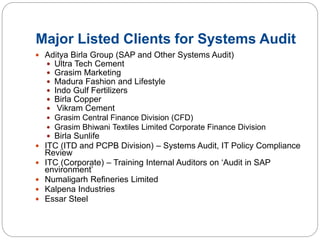

A R Das & Associates is an accounting firm based in Kolkata with a branch in Chennai. It was established in 1985 and provides audit, taxation, business advisory, and assurance services. The firm specializes in systems audits and has experience auditing large ERP systems like SAP. It has a diverse client portfolio including large Indian corporations and multinationals. Key individuals at the firm have extensive experience with large accounting firms in India and abroad.