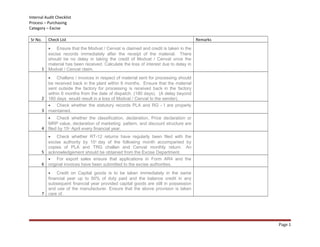

This internal audit checklist provides guidance on excise-related processes for purchasing. It includes 11 items to check that: 1) excise credits are claimed immediately for received materials and processing is completed within 6 months; 2) statutory excise records are properly maintained; 3) annual excise declarations are filed by April 15th; 4) monthly excise returns are filed on time; 5) export documentation is submitted; and 6) capital goods credits are correctly applied within the financial year. The checklist also confirms excise lease agreements and credit timing are properly considered.