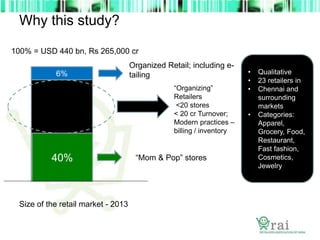

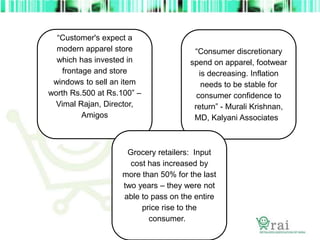

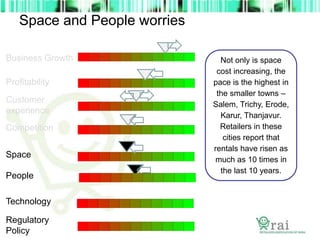

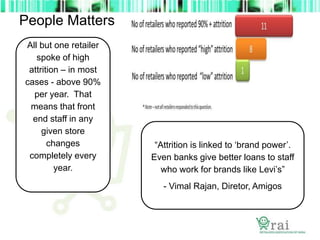

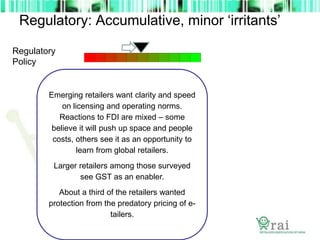

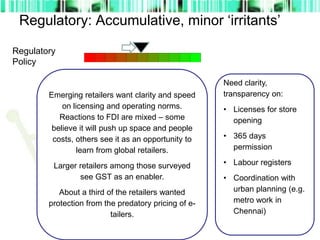

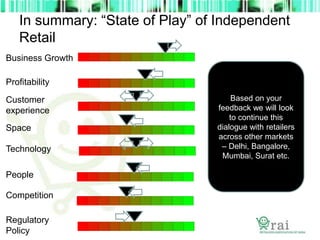

This document summarizes the findings of a study on the state of independent retailers in Chennai and surrounding areas. It identifies the key challenges they face as business growth slowing while margins shrink, high rent and staff attrition, and increasing competition from e-commerce and organized retailers. Retailers expressed a need for clearer regulations around licensing and operating norms to reduce minor irritants and speed up processes. Overall, the study aimed to understand the on-ground issues facing independent retailers to help address their needs through policy changes.