- Capital budgeting is the process of evaluating potential capital expenditures and choosing projects that maximize return on investment.

- There are several quantitative techniques used for capital budgeting including annual rate of return, cash payback, and discounted cash flow methods like net present value and internal rate of return.

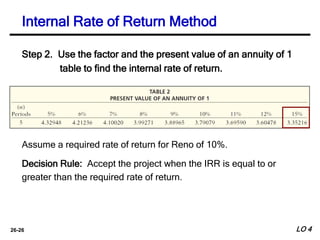

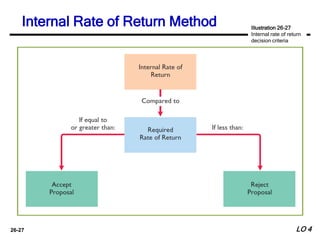

- Net present value discounts the expected cash flows of a project to the present using a minimum required rate of return, and a project is acceptable if its NPV is zero or greater. Internal rate of return finds the discount rate that sets the present value of cash inflows equal to the initial investment.