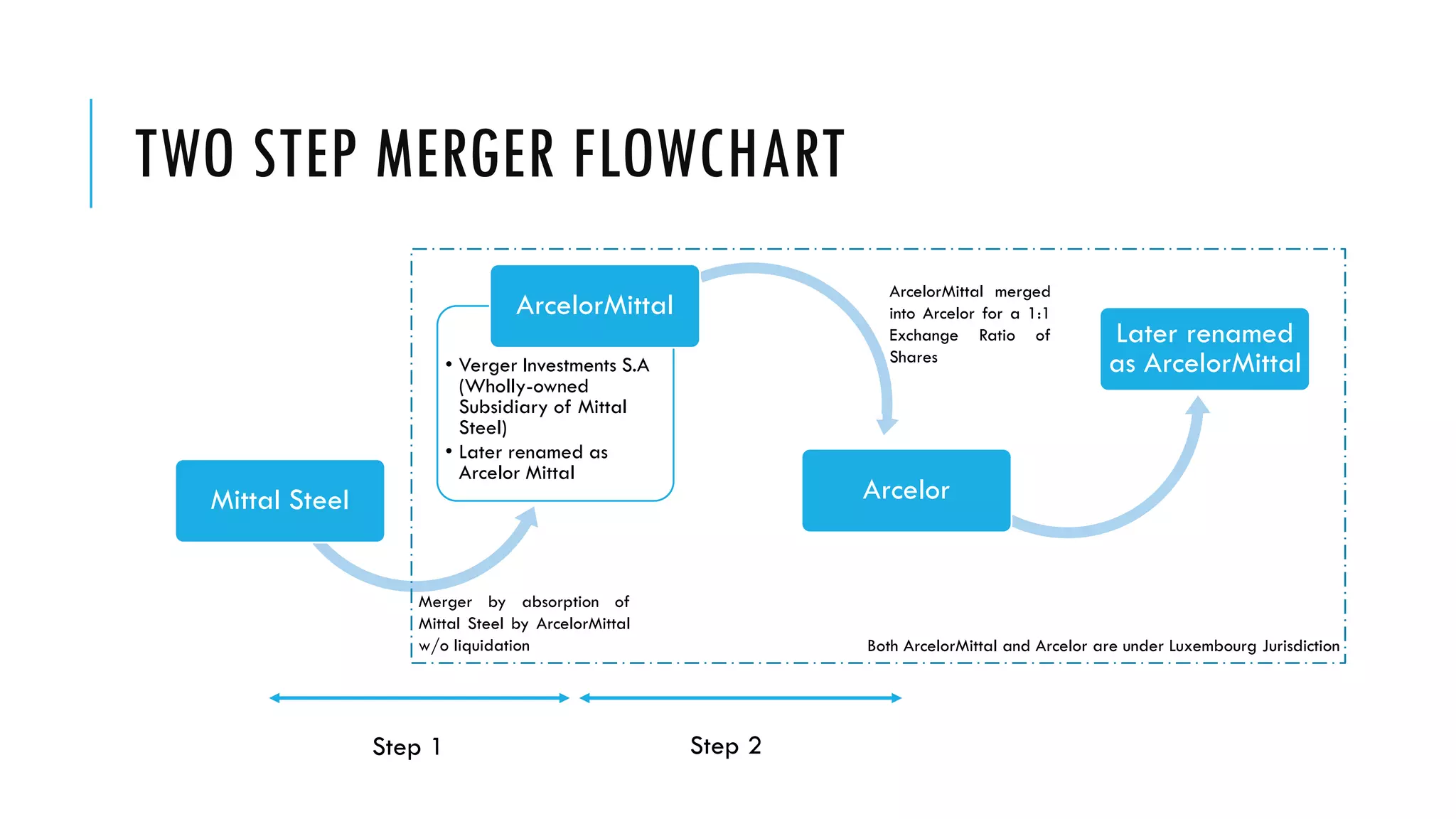

The document discusses the merger of Arcelor and Mittal Steel, highlighting the background of both companies and the financial details of the merger. The initial offer in January 2006, valued at $27.05 billion, faced controversy but was eventually raised to $35.3 billion, leading to a two-step merger finalized in June 2006. The merger resulted in the creation of ArcelorMittal, the world's largest steel producer, facilitating a more efficient integration of their operations under Luxembourg jurisdiction.