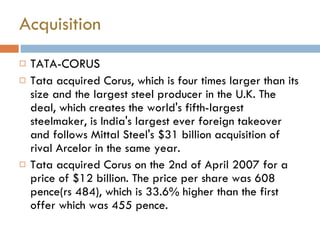

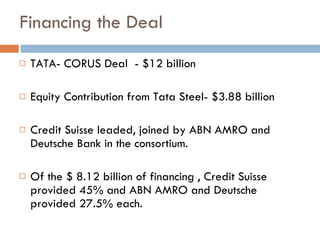

The document summarizes a merger between Tata Steel and Corus Group. Tata Steel acquired Corus, which was four times larger, for $12 billion, making it India's largest foreign takeover. The acquisition created the world's fifth largest steelmaker and expanded Tata Steel's global presence. Negotiations took place over several months, with Tata Steel increasing its initial offer several times before winning Corus shareholders' approval. The rationale for the deal was to increase Tata Steel's production capacity and access new markets, establishing it as a major global steel producer.