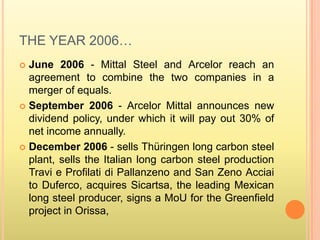

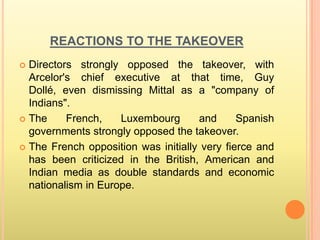

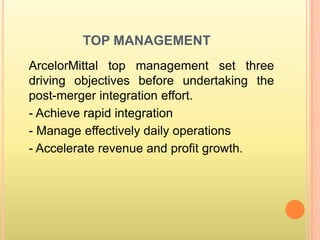

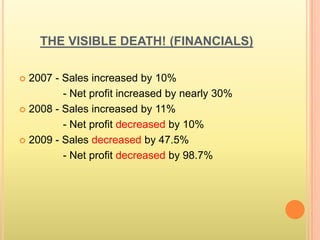

Arcelor Mittal is the world's largest steel company formed by the 2006 merger of Arcelor and Mittal Steel. Arcelor was the largest steel producer in Europe while Mittal Steel was one of the world's largest. The $33 billion merger combined the two companies to form ArcelorMittal with global steel production of 10% and over 300,000 employees. While the merger created scale efficiencies, the combined company struggled with integration challenges and was heavily impacted by the global recession in its early years.