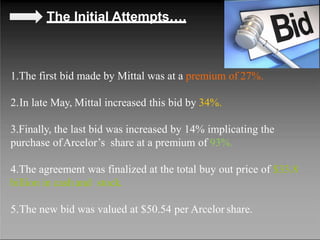

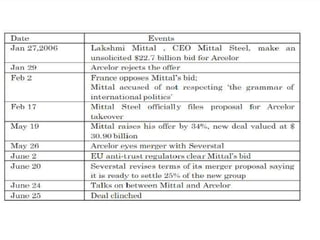

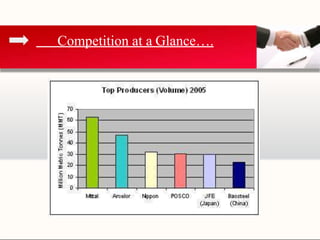

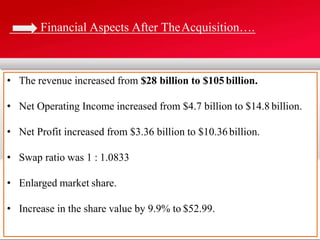

Mittal Steel acquired Arcelor in 2006 in a $33.8 billion deal, creating ArcelorMittal, the world's largest steelmaker. Mittal Steel made several bids at increasing premiums to purchase Arcelor's shares. Arcelor resisted the takeover due to concerns about job losses and loss of control to an Indian company. However, Mittal Steel was eventually able to clinch the deal when shareholders approved its highest bid of $50.54 per Arcelor share. The acquisition resulted in increased revenues, profits, and market share for the combined company.