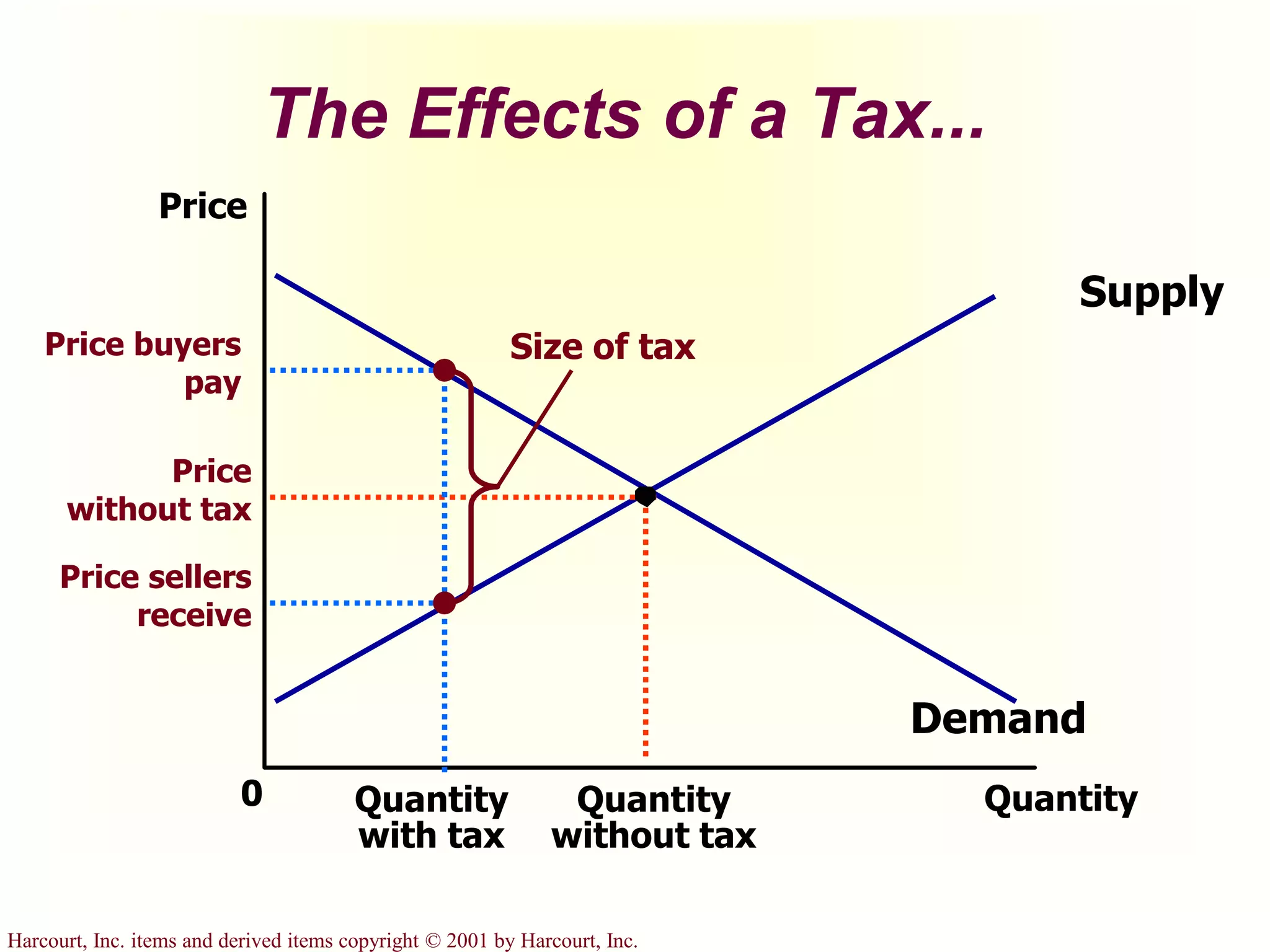

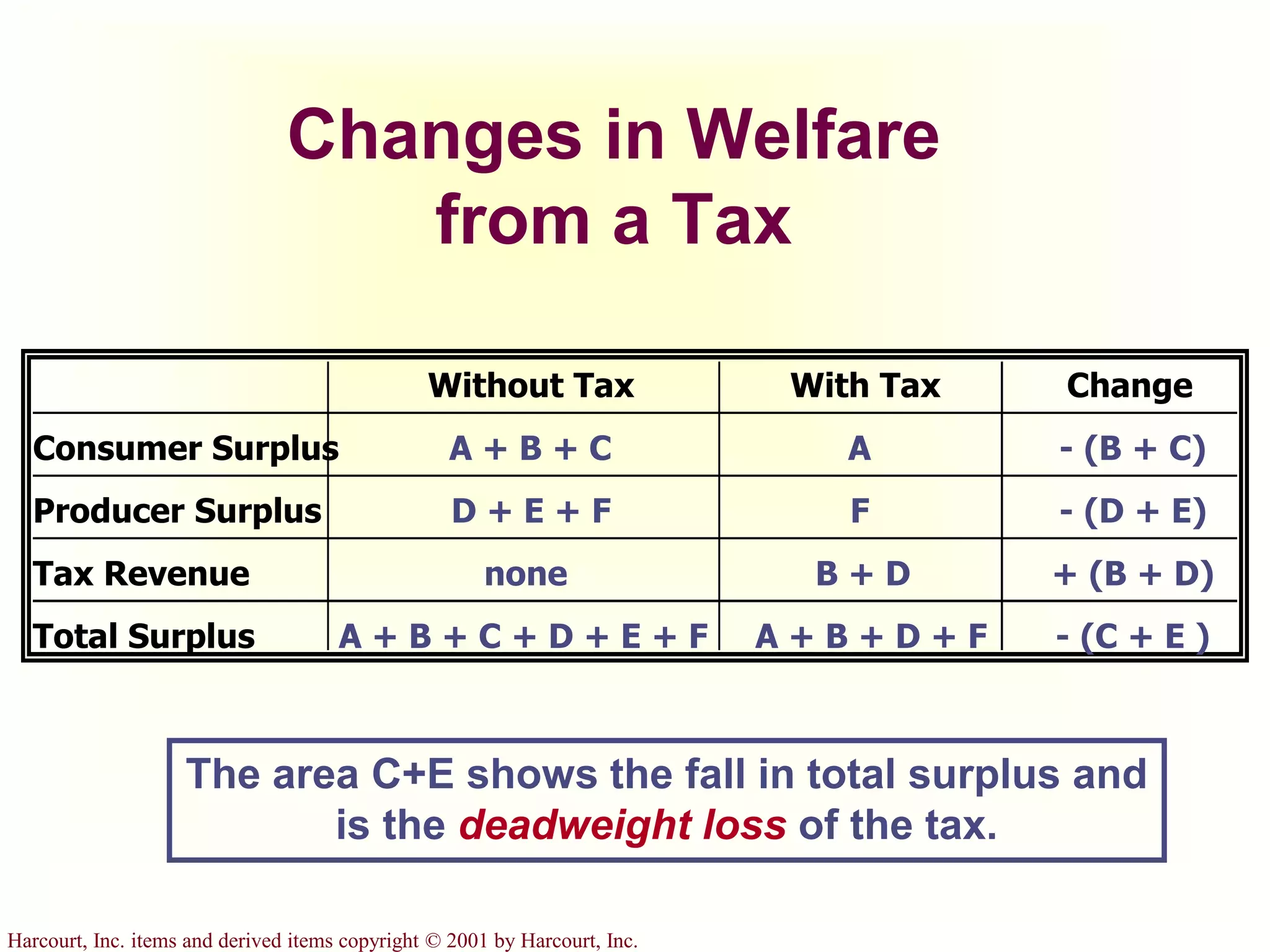

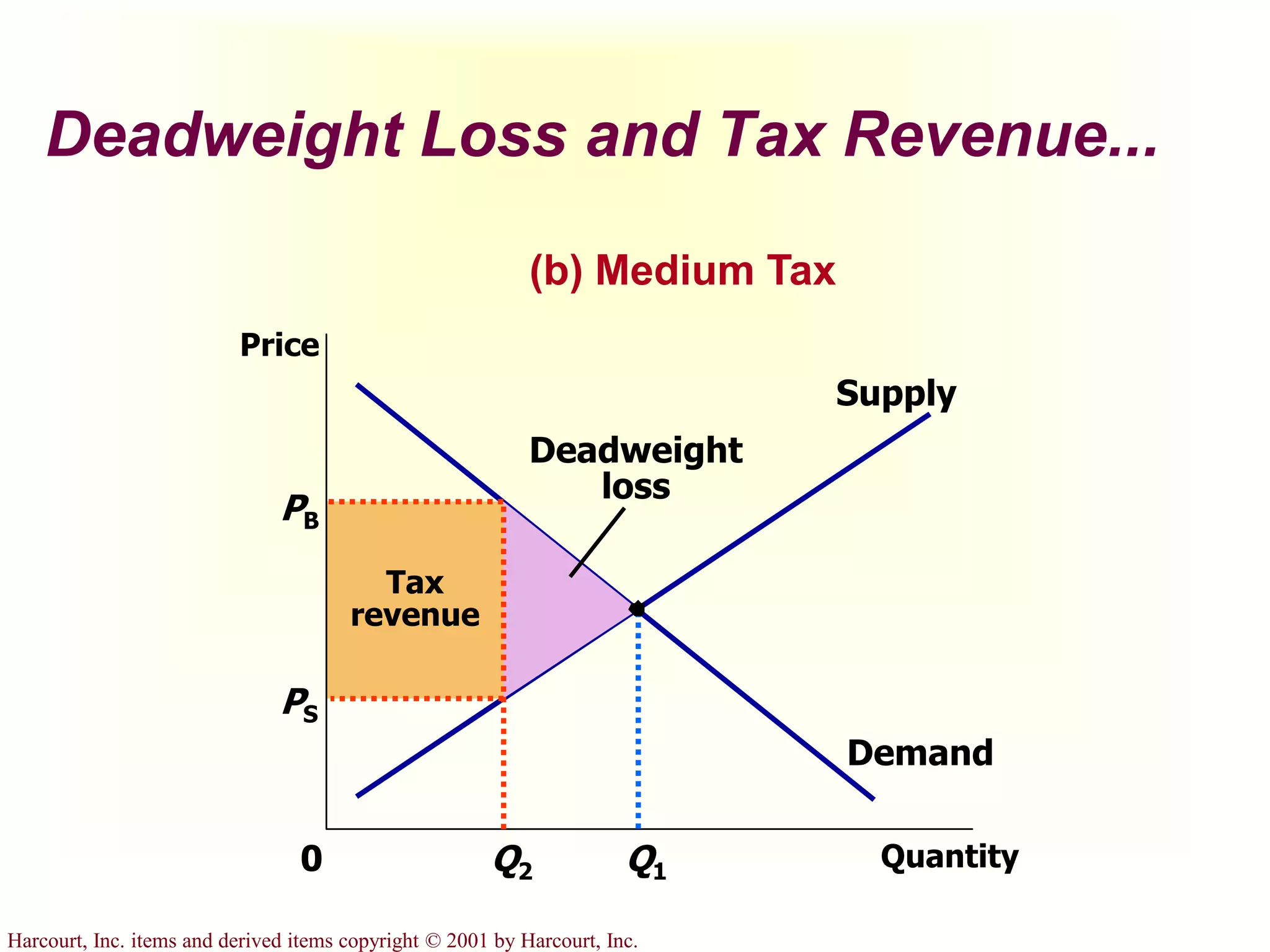

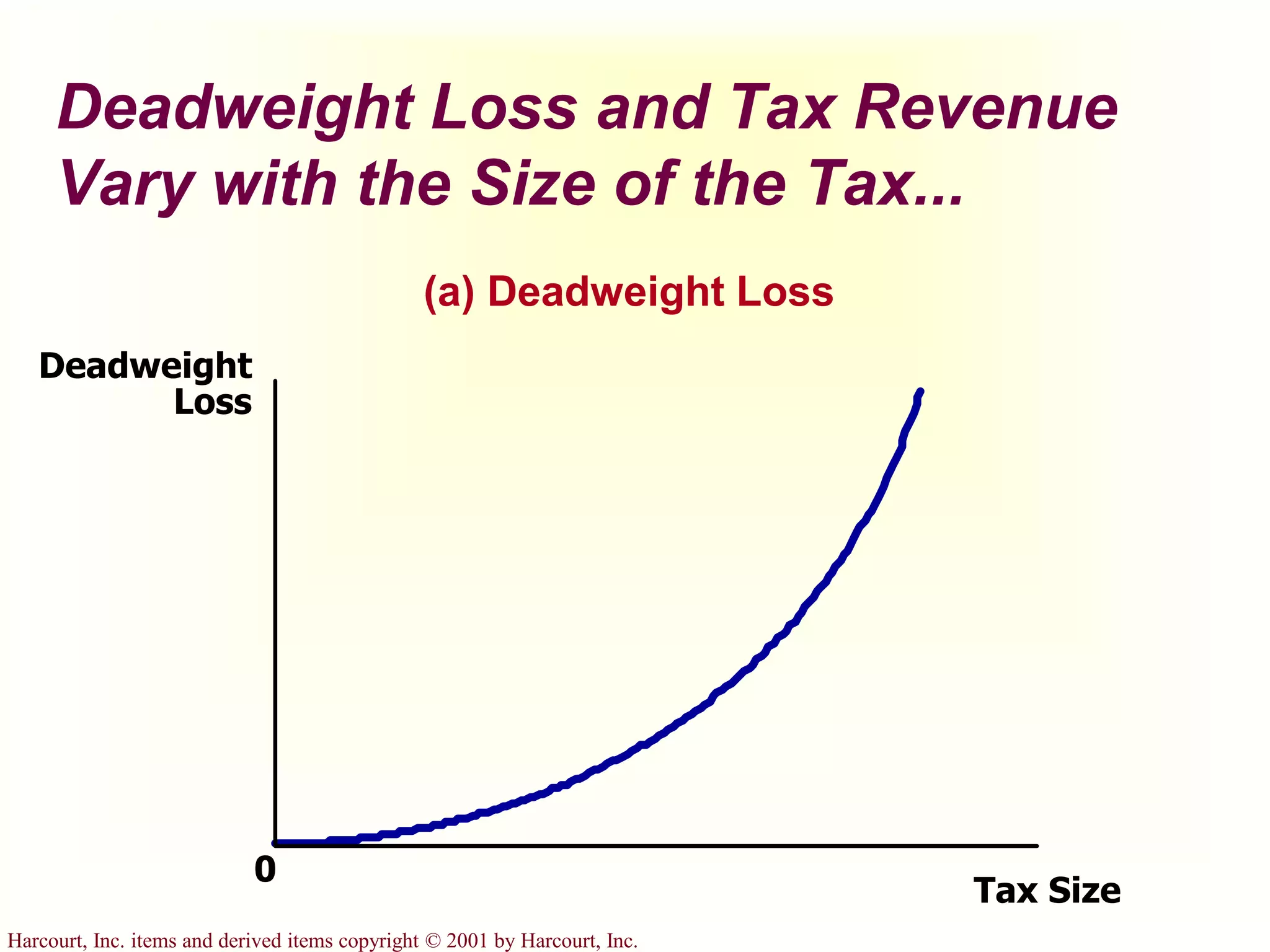

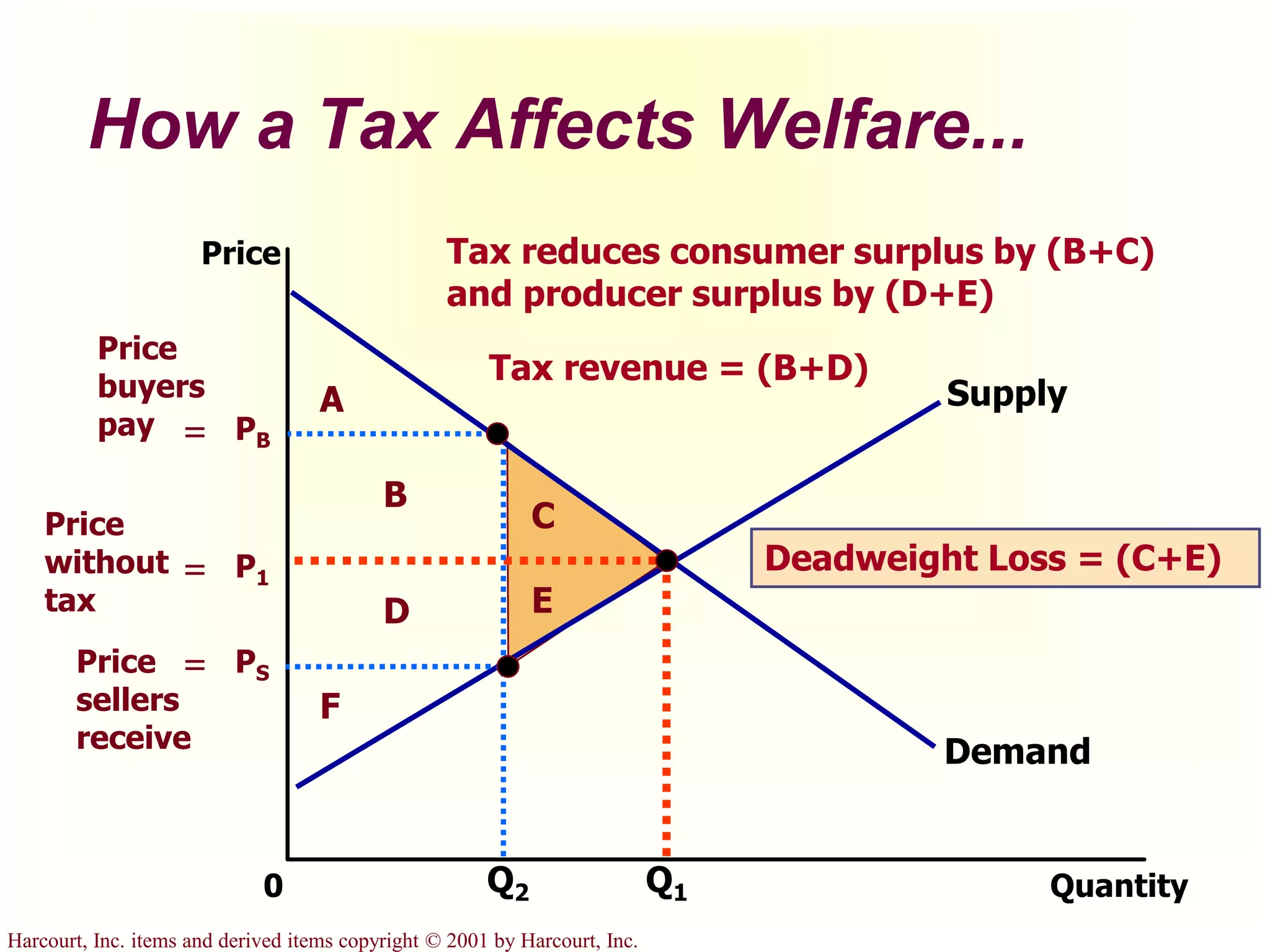

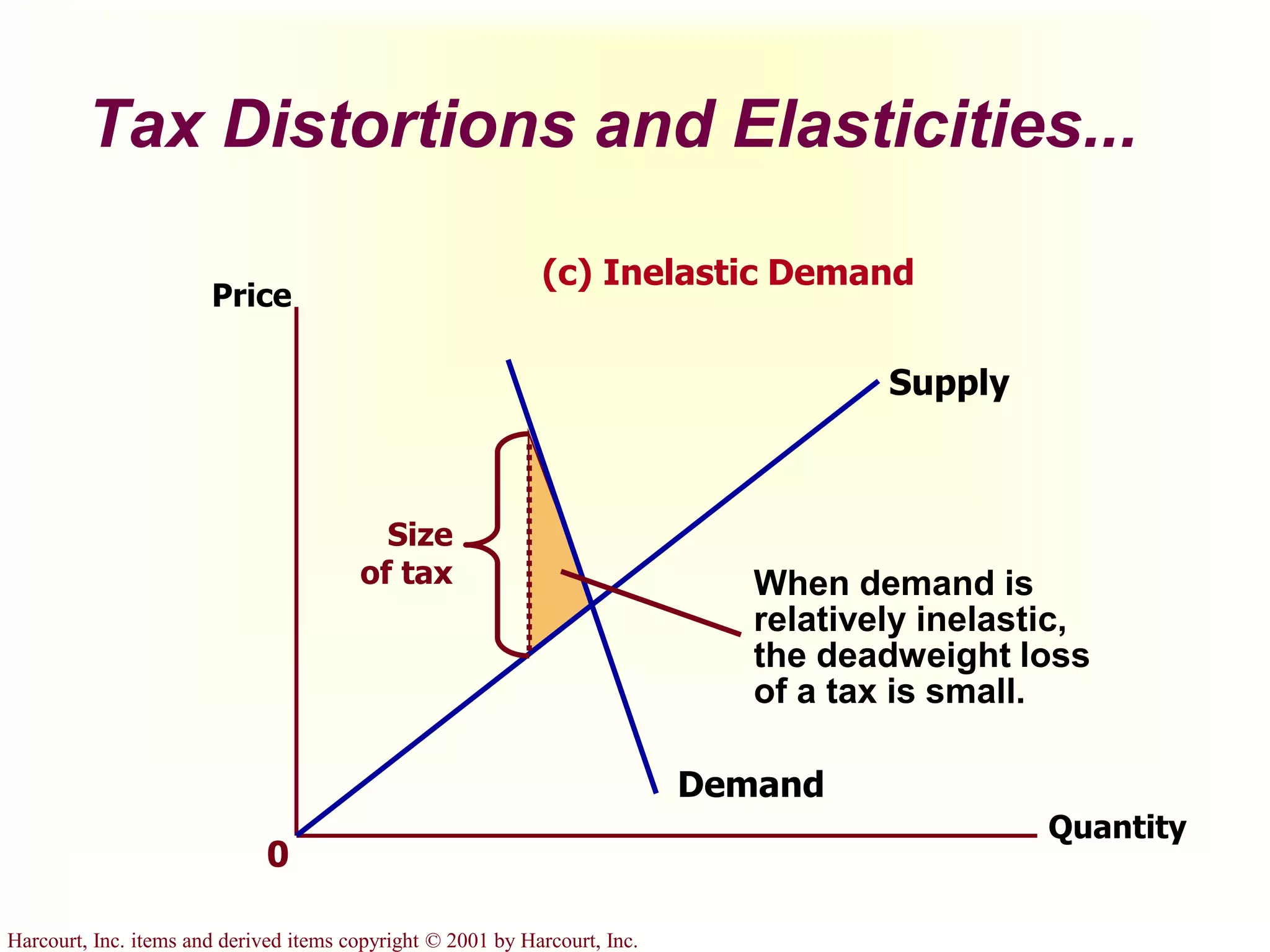

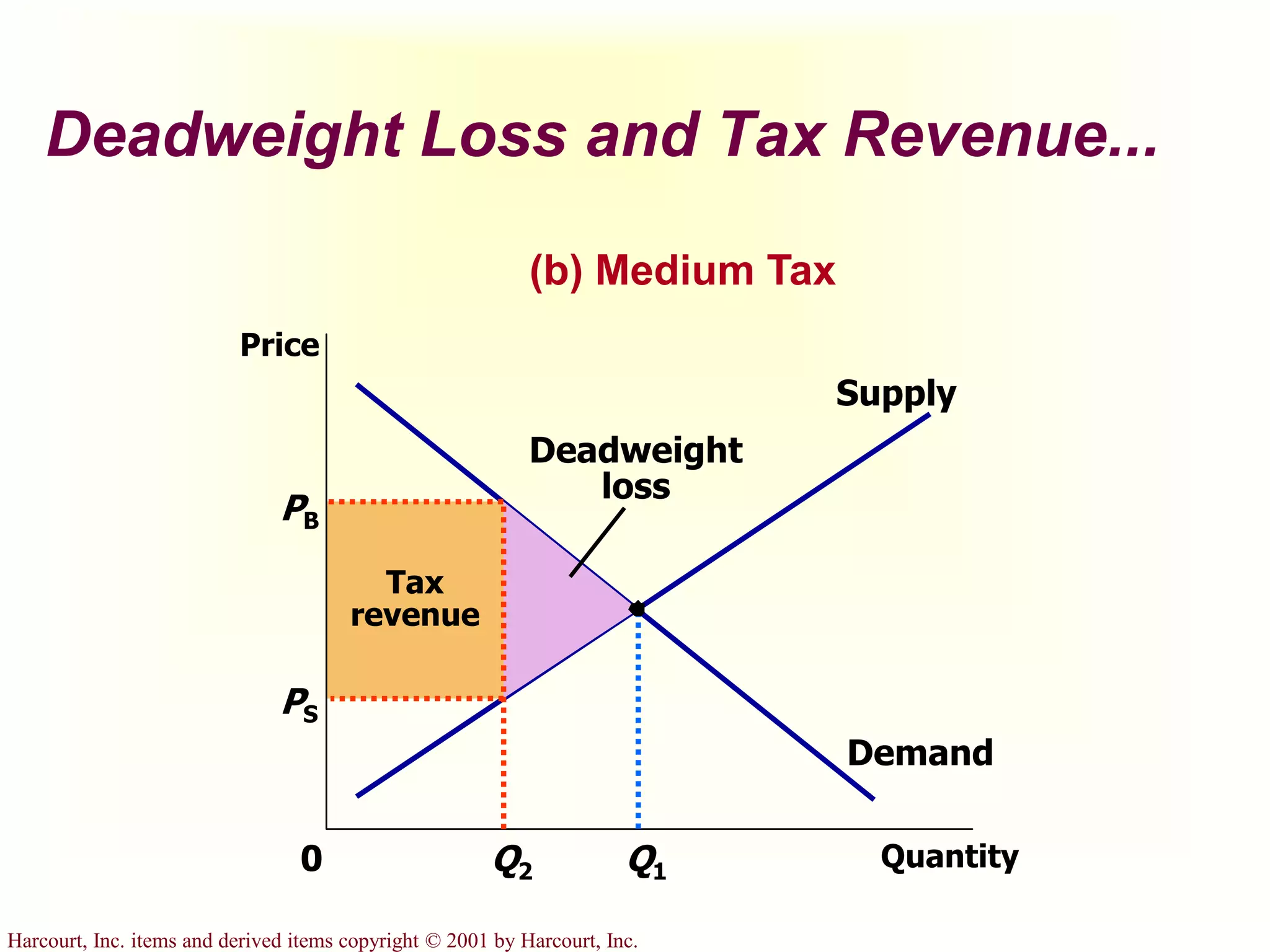

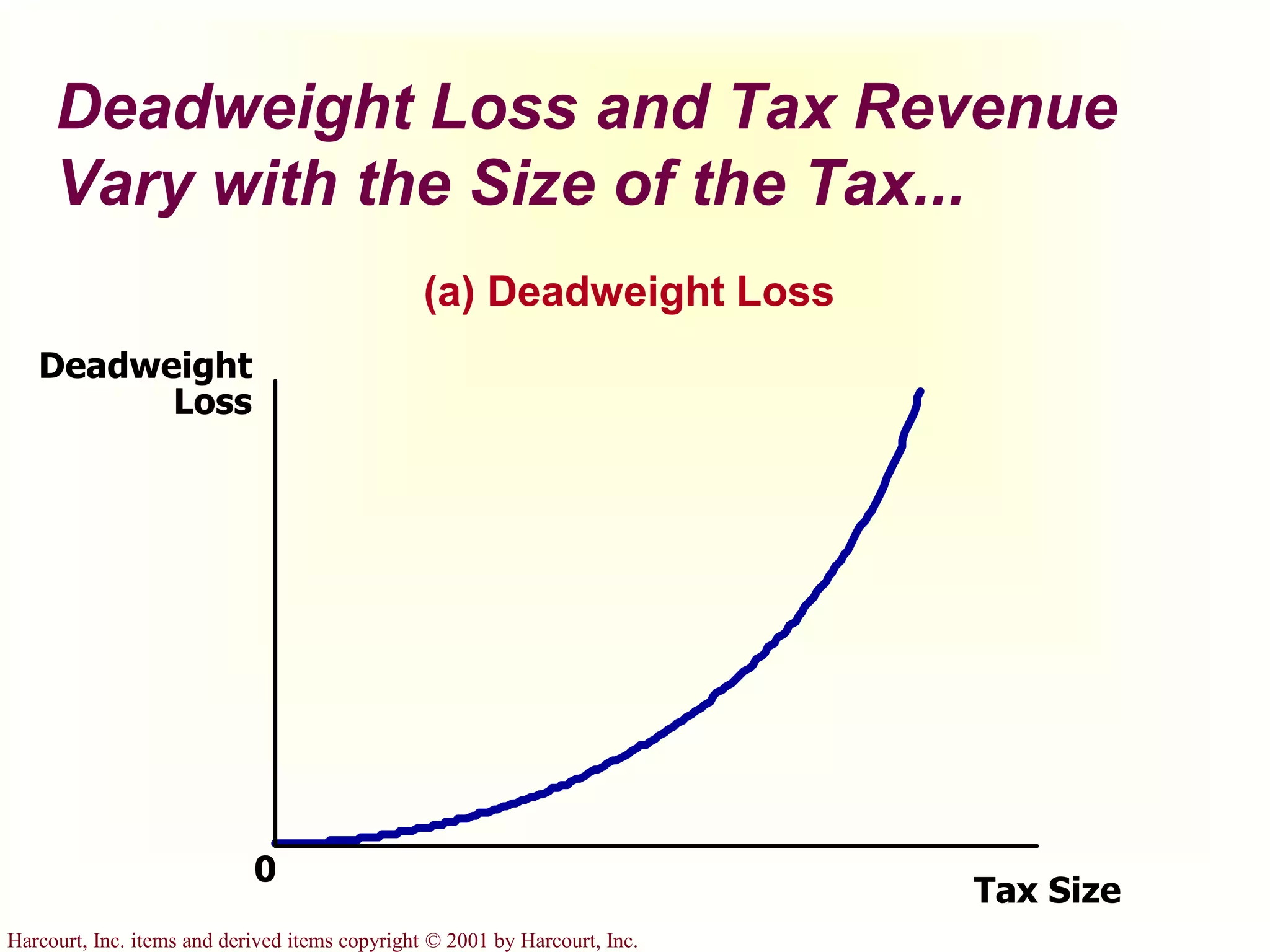

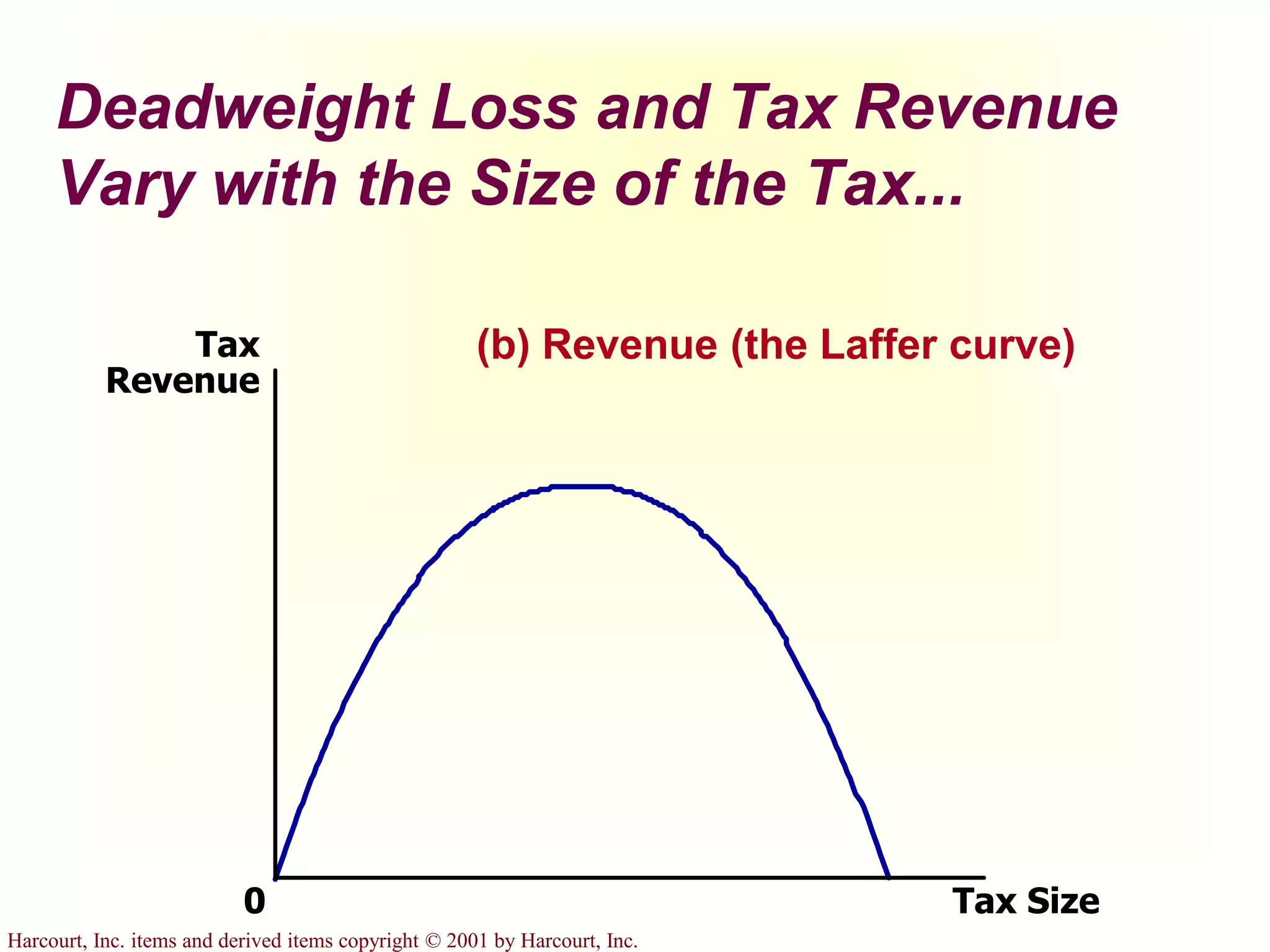

The document discusses the costs of taxation. It explains that taxes reduce economic efficiency by creating a wedge between the price paid by buyers and received by sellers. This leads to a reduction in quantity traded from the efficient level. The difference between the total benefits and costs without the tax, compared to with the tax, is called the deadweight loss. The size of the deadweight loss depends on how responsive supply and demand are to price changes - the more responsive they are, the greater the efficiency reduction from the tax. While tax revenue increases with moderate tax rates, very high taxes can reduce market size and quantity traded so much that they ultimately lower tax revenues too.