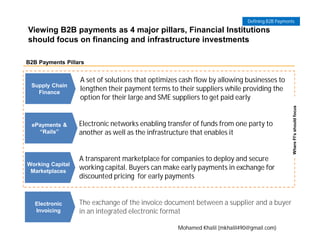

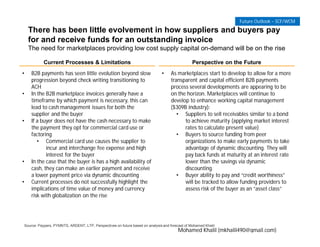

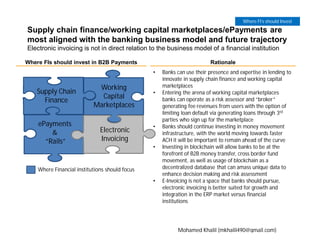

Financial institutions should focus their investments in transforming B2B payments on supply chain finance, working capital marketplaces, and ePayments infrastructure. These areas are most aligned with traditional banking business models around lending and money movement. Supply chain finance allows banks to innovate using their lending expertise, while working capital marketplaces generate fees by connecting buyers and suppliers. Continued investment in faster payment rails and emerging technologies like blockchain will position banks to facilitate faster, global B2B money transfers.