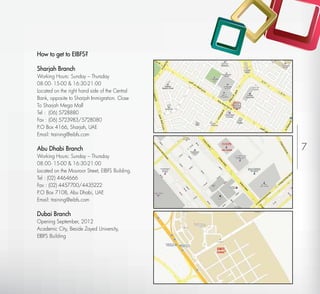

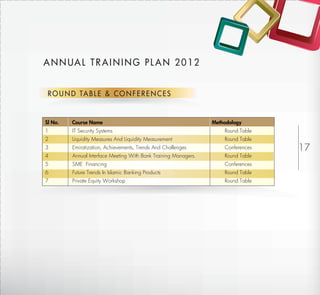

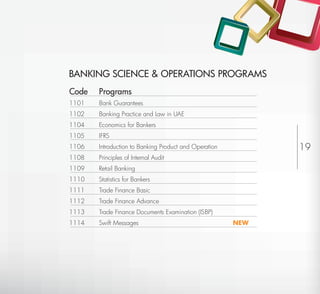

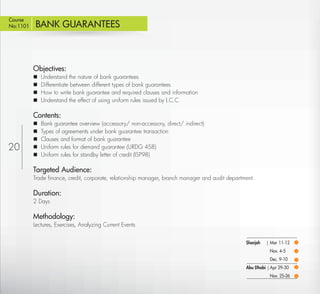

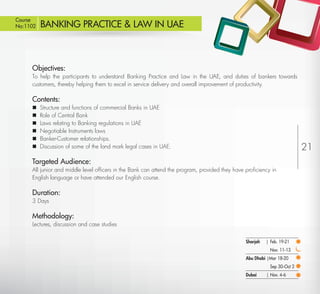

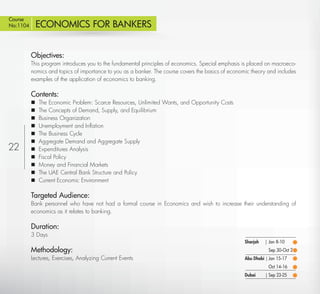

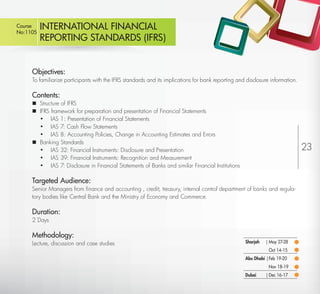

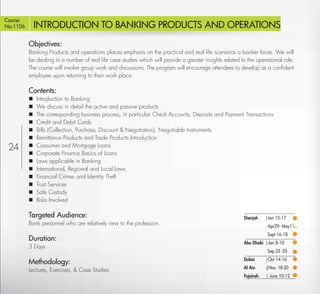

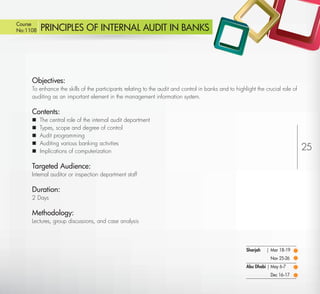

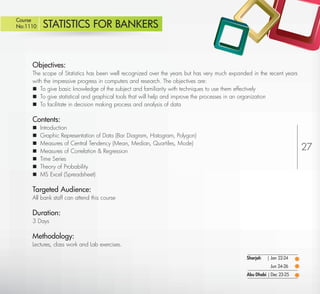

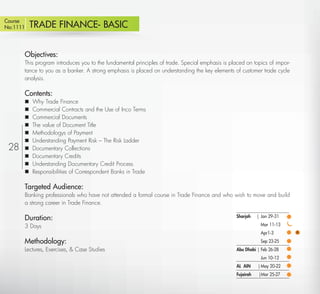

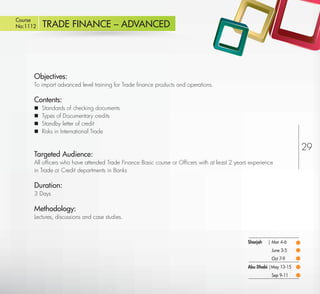

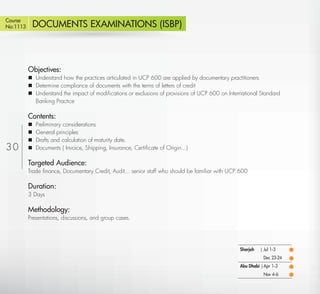

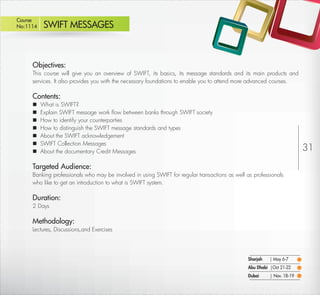

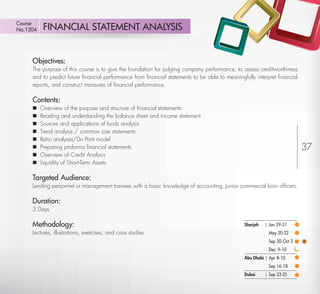

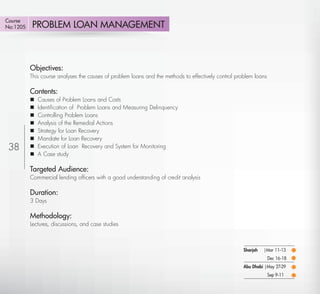

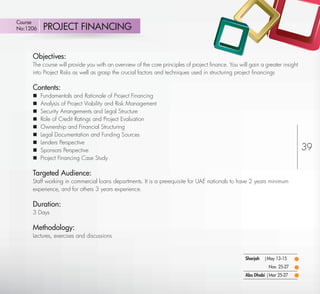

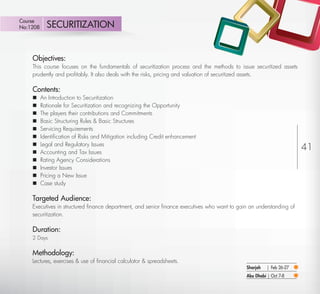

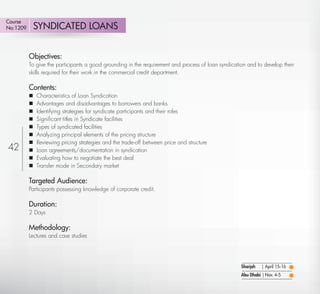

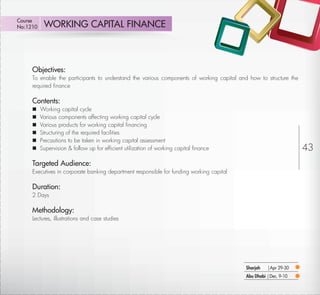

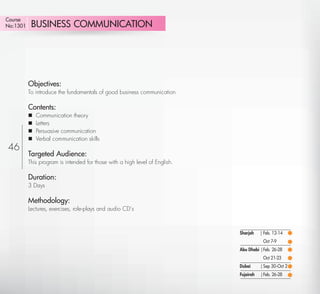

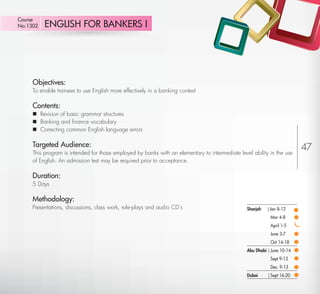

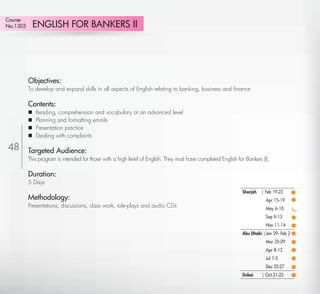

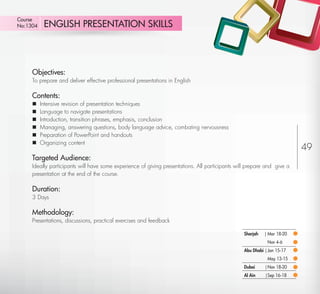

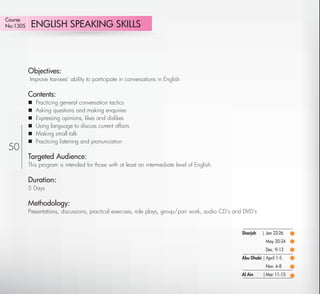

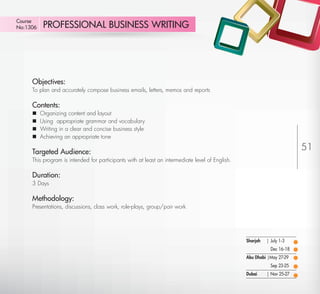

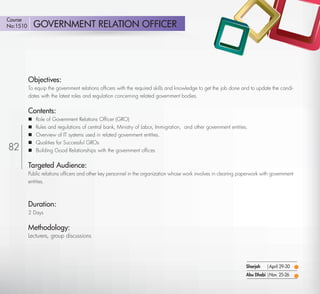

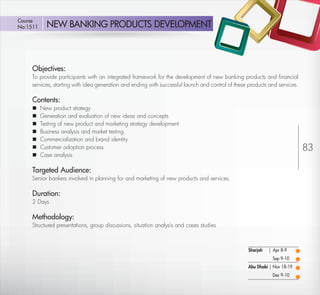

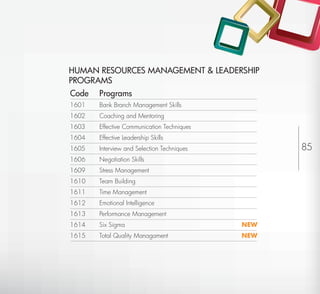

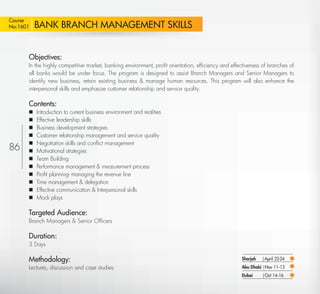

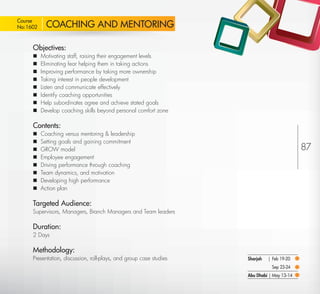

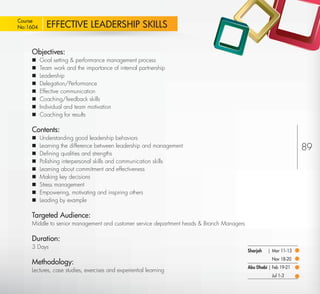

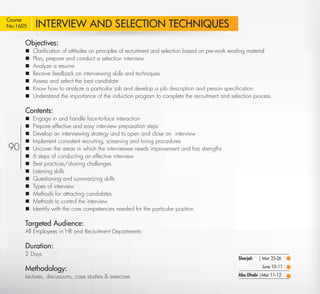

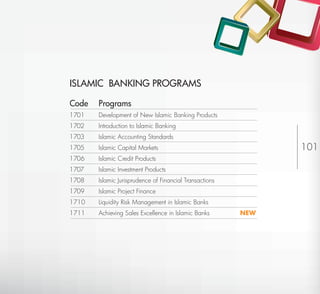

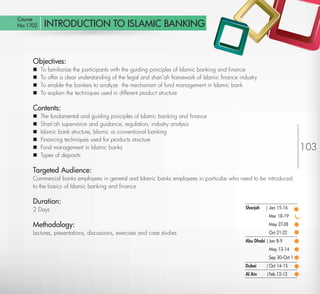

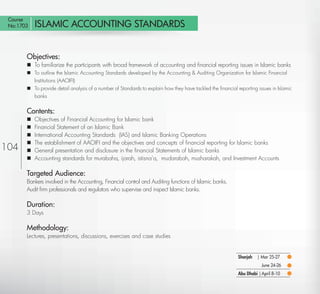

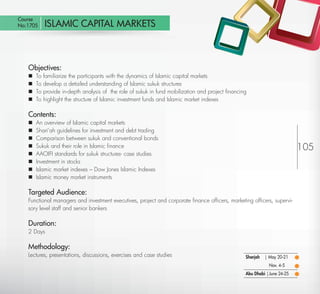

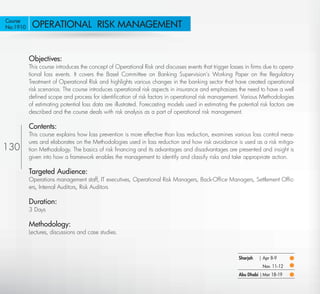

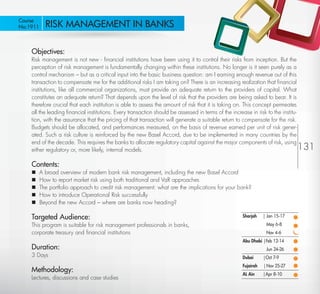

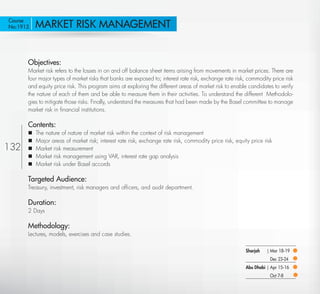

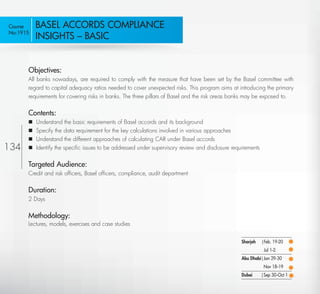

The document provides details of the Emirates Institute for Banking & Financial Studies' (EIBFS) annual training plan for 2012. The plan offers over 400 programs across various disciplines including banking science and operations, credit management, corporate and project finance, banking English, and others. The programs will be conducted in EIBFS branches in Sharjah, Abu Dhabi, Dubai, Al Ain, and Fujairah. New programs have been added and the Dubai branch will expand EIBFS' geographical reach. The training plan aims to enhance the skills of UAE's banking and finance sector employees through continuous learning opportunities.