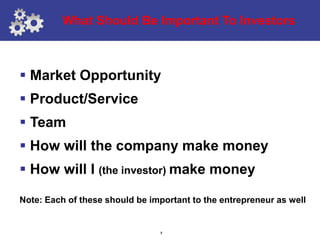

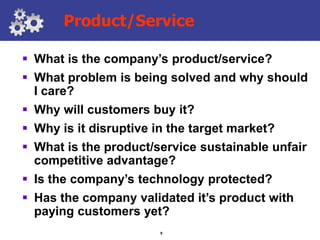

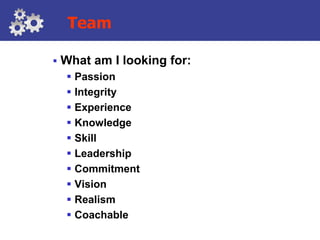

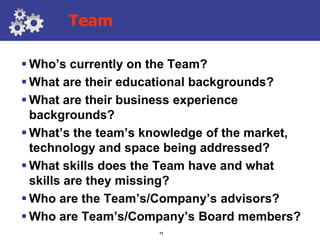

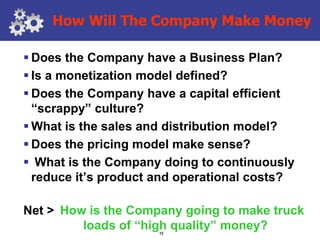

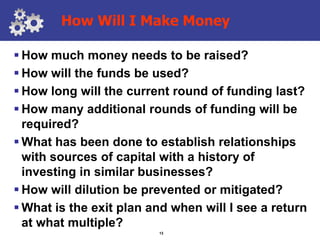

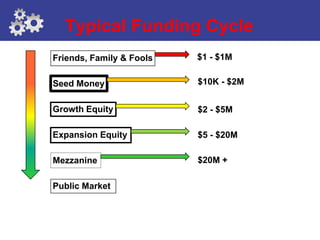

The document outlines an angel investor program led by Paul Twombly, a seasoned expert in technology and startups. It covers essential investment topics including market opportunity, product/service evaluation, team assessment, monetization strategies, and how investors can achieve returns. Additionally, it emphasizes the importance of relationships and networking in the investment process.