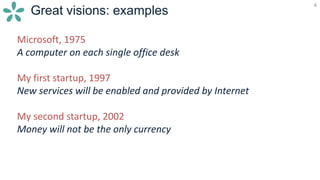

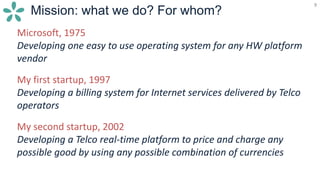

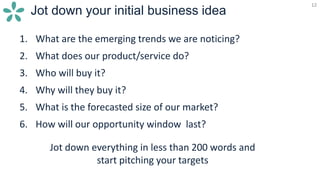

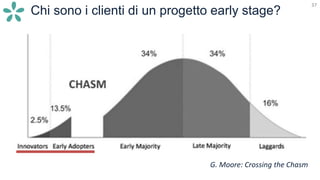

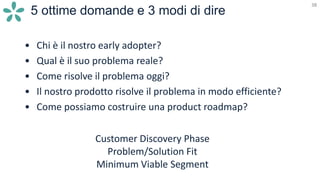

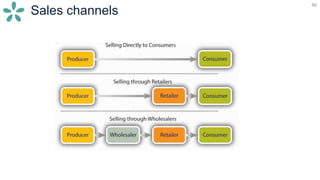

1. The document provides an overview of starting a startup, from developing the initial business idea to understanding investors. It discusses developing a vision and mission, building the right team, validating the market fit, and establishing growth strategies.

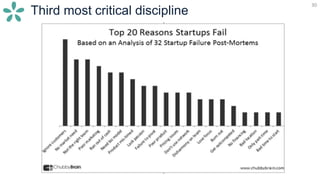

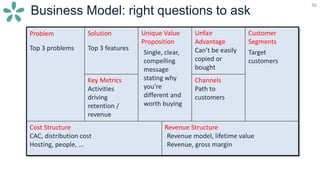

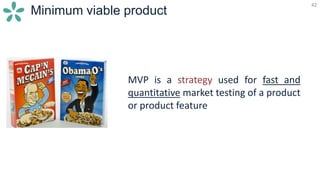

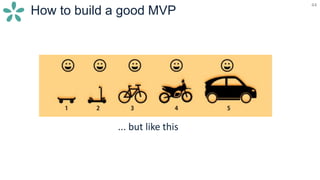

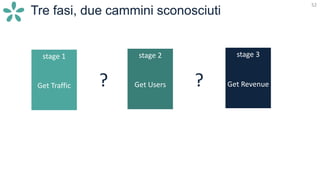

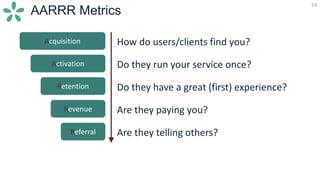

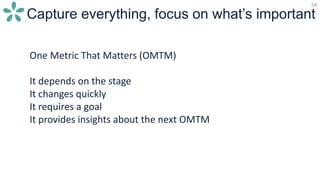

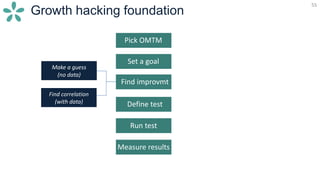

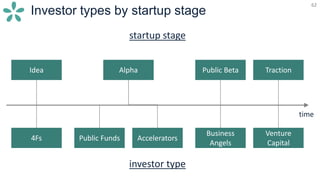

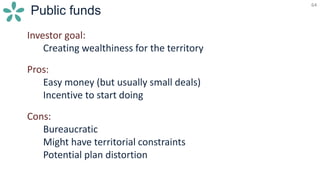

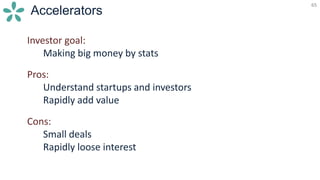

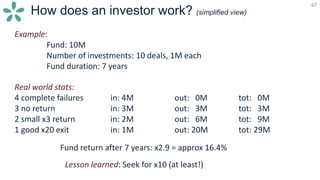

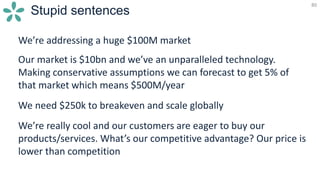

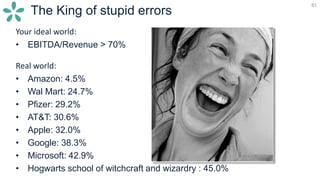

2. Key aspects covered include defining problems and solutions, creating minimum viable products, focusing on acquisition and retention metrics, understanding different investor types and fundraising stages, and avoiding common startup mistakes.

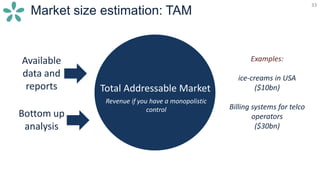

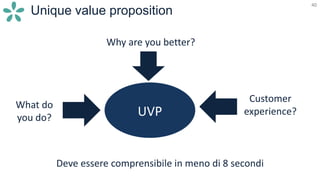

3. Examples and case studies are provided throughout to illustrate concepts like unique value propositions, growth hacking tactics, and competition analysis. Readers are advised to thoroughly understand customers and markets in order to build scalable business models that attract investment.