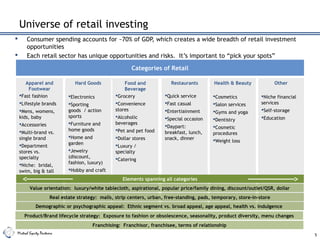

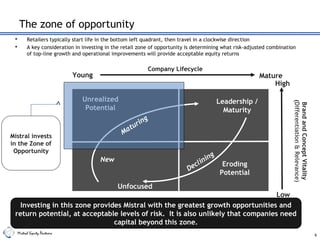

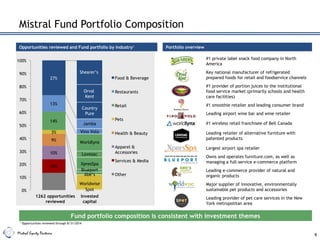

Mistral Equity Partners, founded in 2007, focuses on control-oriented buyout and growth equity investments in lower middle-market companies within the consumer industry, applying a unique thematic approach based on changing consumer demographics. The firm utilizes flexible transaction structures and an experienced management board to enhance value creation and mitigate risks, targeting investment themes that align with emerging consumer trends. Mistral actively engages in various retail sectors, emphasizing the importance of identifying opportunities that offer substantial growth potential while managing acceptable levels of risk.