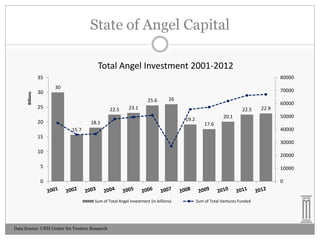

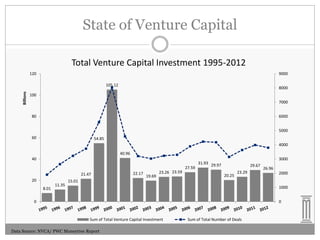

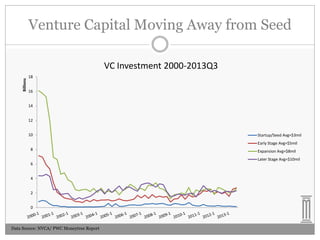

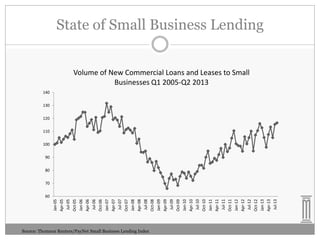

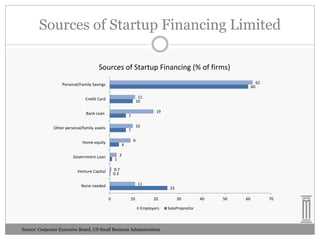

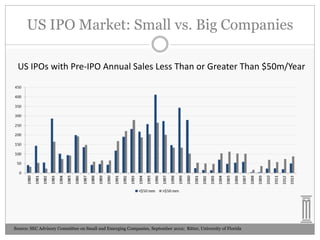

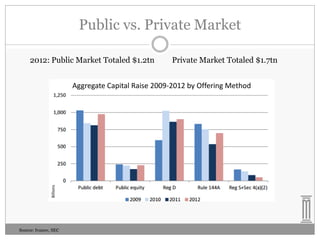

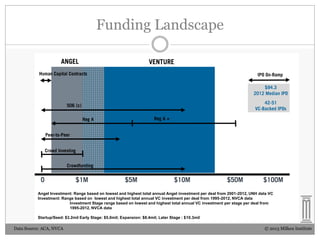

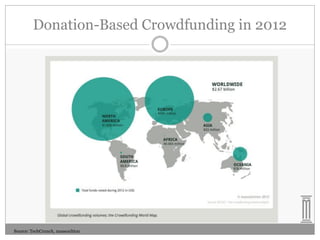

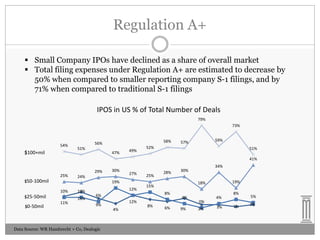

The document provides an overview of investment trends in angel capital and venture capital from 2001 to 2013, indicating fluctuations in funding amounts and sources. It highlights the transition in venture capital investment stages and the impact of regulations on funding methods, including crowdfunding. Furthermore, it reveals the limitations in startup financing sources, the changes in small business lending, and the IPO landscape for small versus large companies.