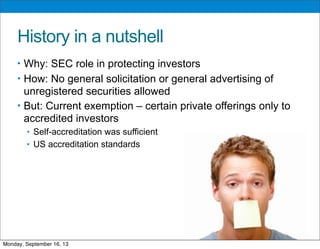

The SEC issued new rules on general solicitation as part of the JOBS Act, allowing private offerings to advertise to potential investors as long as they only sell to accredited investors. Companies must now verify accreditation rather than accept self-certification, and are subject to "bad actor" provisions and additional reporting requirements. OurCrowd operates as both a venture capital and crowdfunding platform, focusing on Israeli startups while complying with US and Israeli regulations.