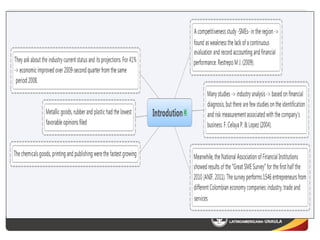

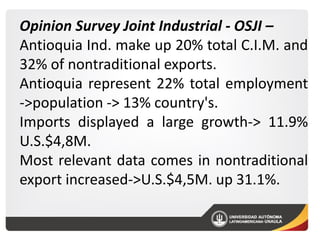

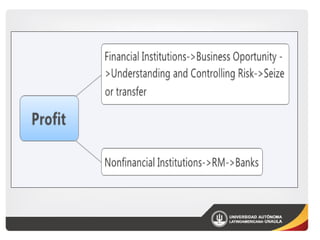

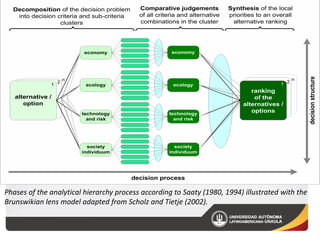

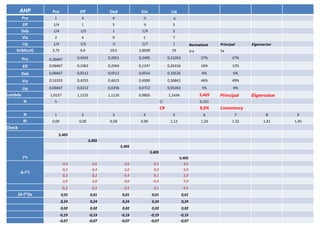

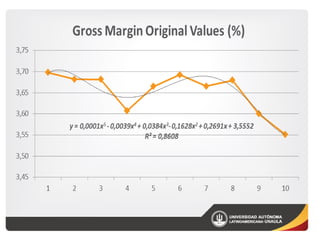

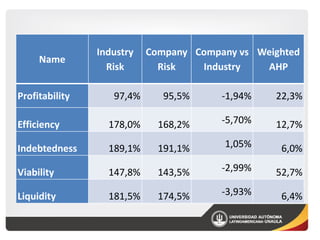

This document analyzes the operational risk of small and medium industrial enterprises (SMEs) in Antioquia, Colombia. It presents statistics showing that SMEs make up 20% of the total industry in Antioquia and 32% of non-traditional exports. Imports grew 11.9% while non-traditional exports increased 31.1%. The document analyzes risk using the analytical hierarchy process to evaluate five indices of operational risk for a particular company compared to its industry: profitability, efficiency, indebtedness, viability, and liquidity. It determines the company has slightly higher risk than its industry for most indices except indebtedness and liquidity.