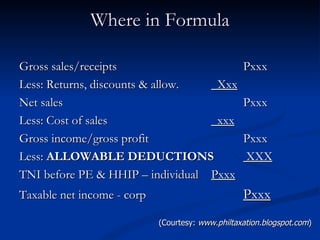

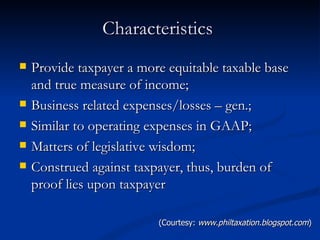

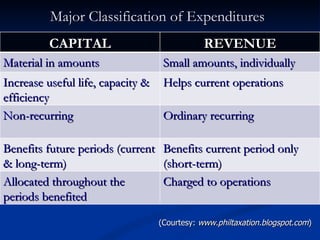

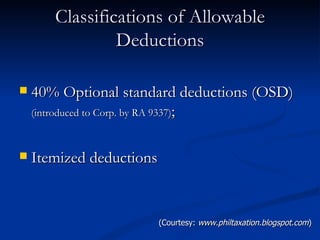

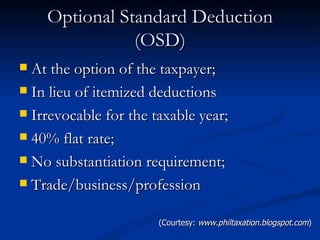

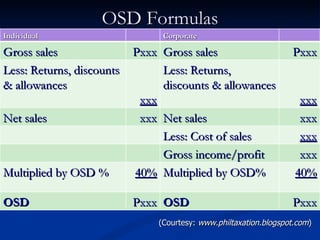

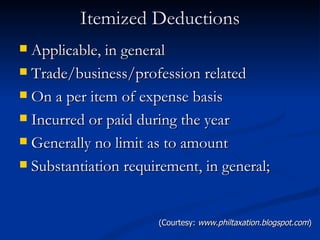

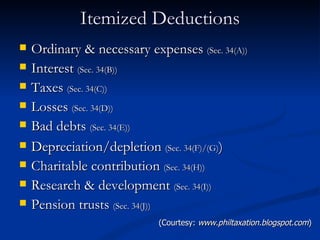

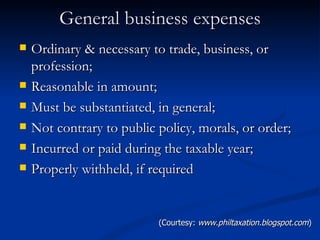

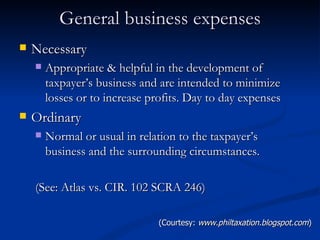

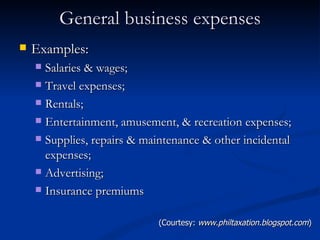

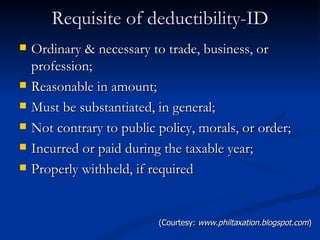

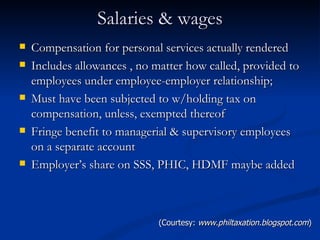

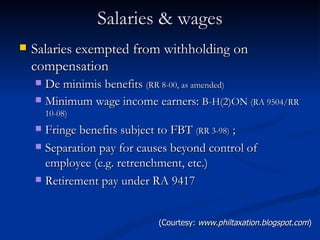

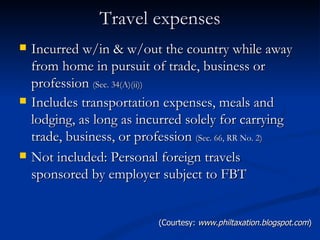

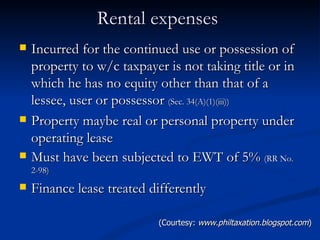

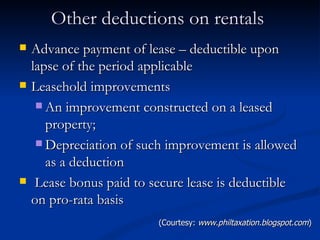

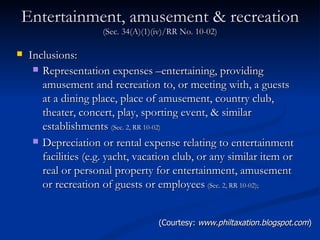

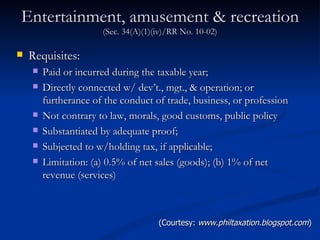

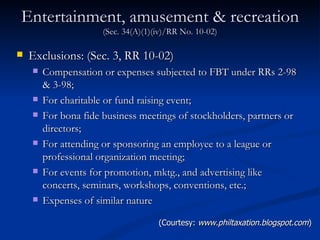

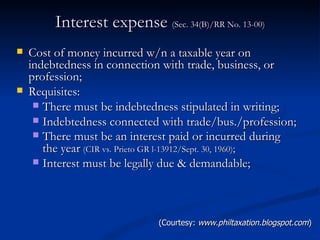

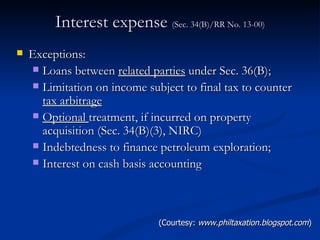

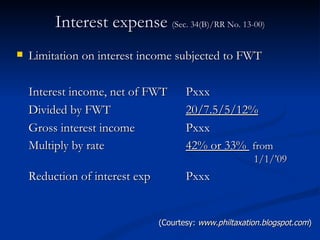

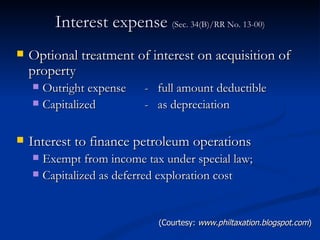

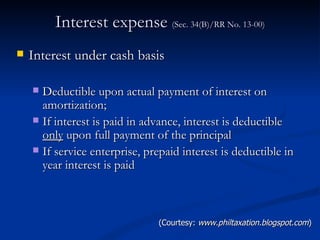

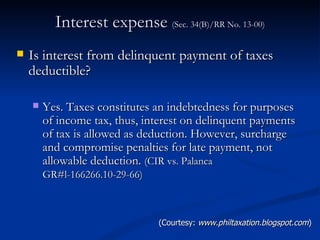

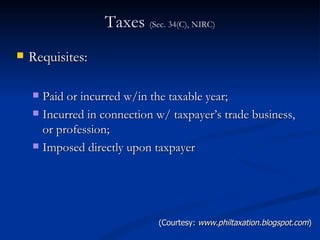

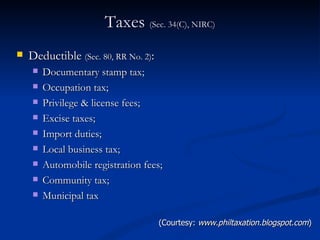

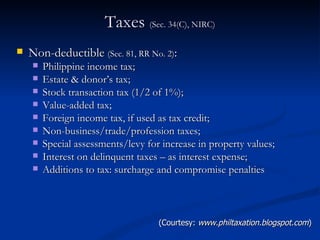

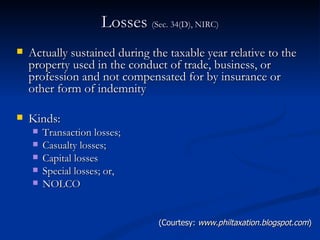

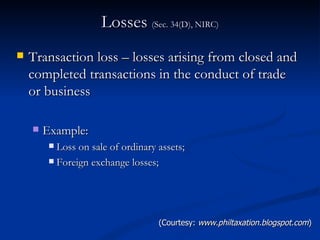

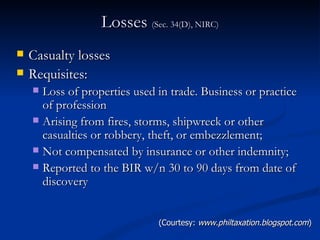

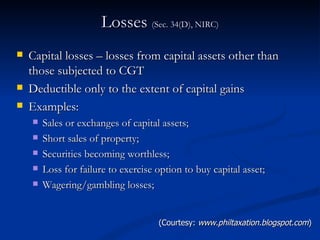

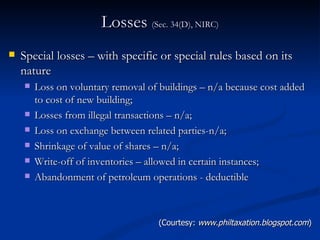

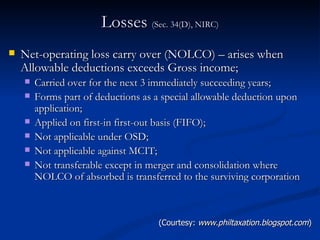

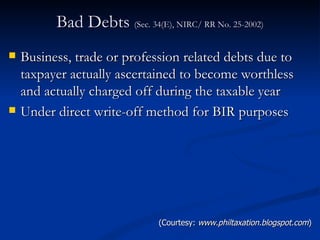

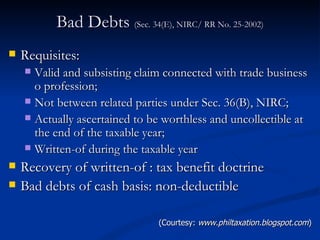

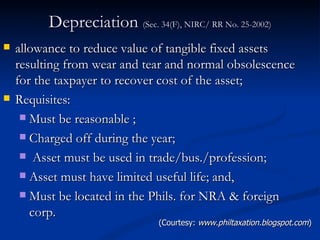

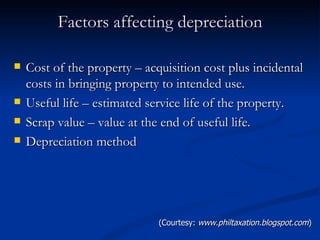

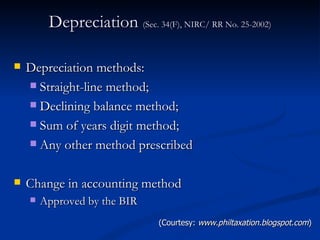

Allowable deductions from gross income include optional standard deductions, itemized deductions, and net operating loss carryovers. Optional standard deductions allow taxpayers to deduct 40% of gross income in lieu of itemizing expenses. Itemized deductions must be ordinary and necessary expenses incurred for business purposes and substantiated. Major categories of itemized deductions include salaries and wages, travel expenses, rental expenses, interest expenses, taxes, losses, bad debts, and depreciation.