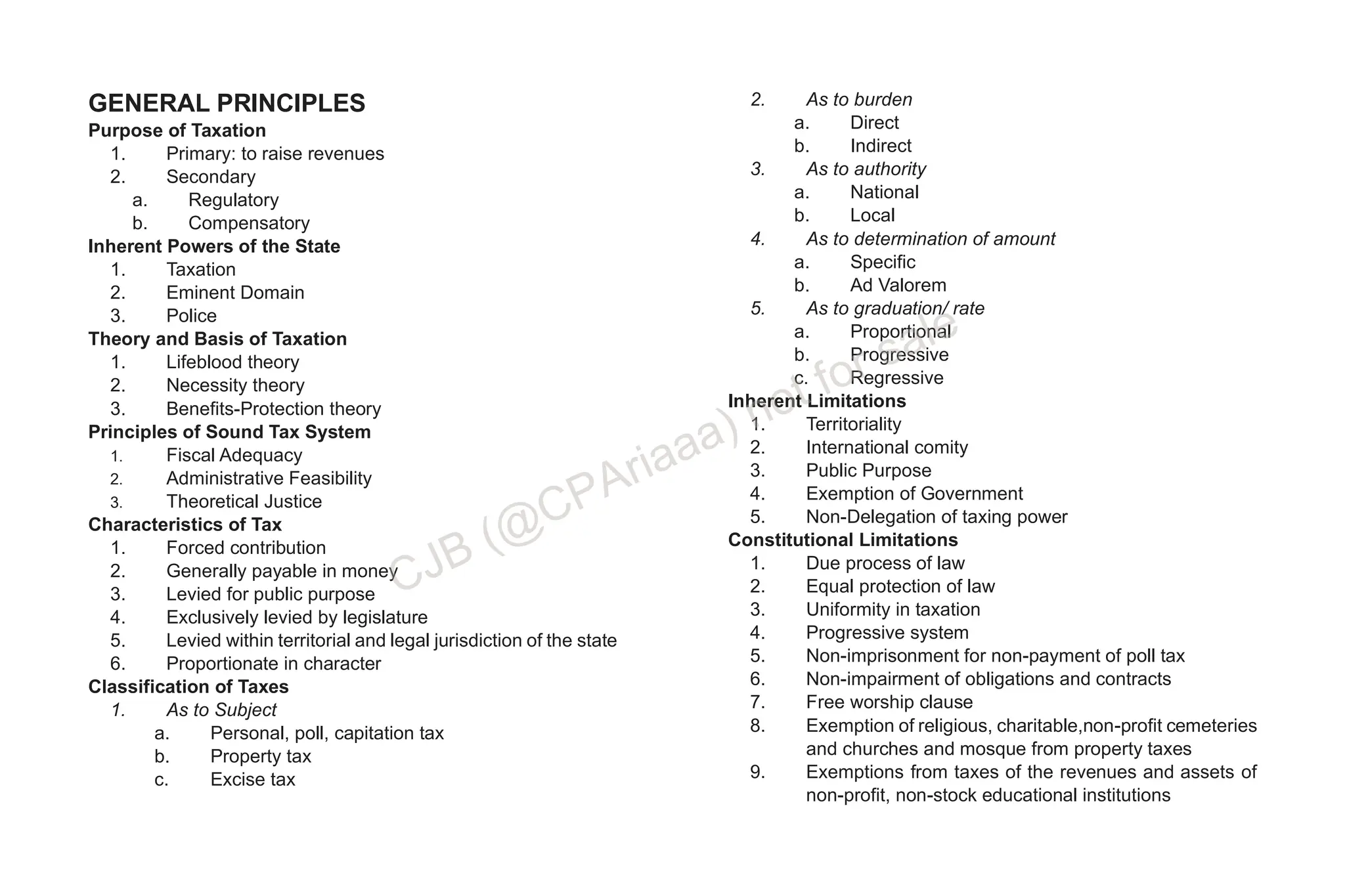

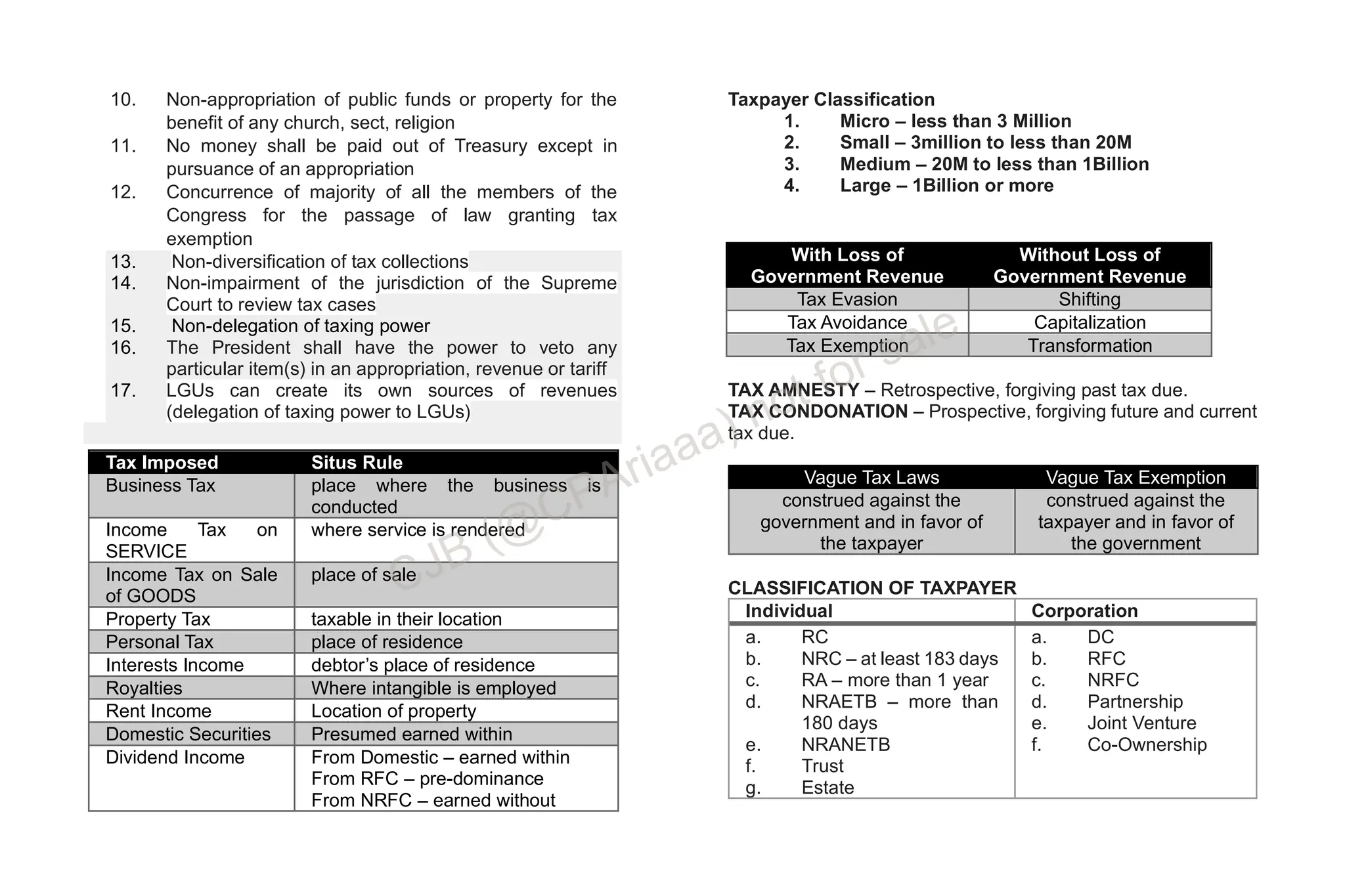

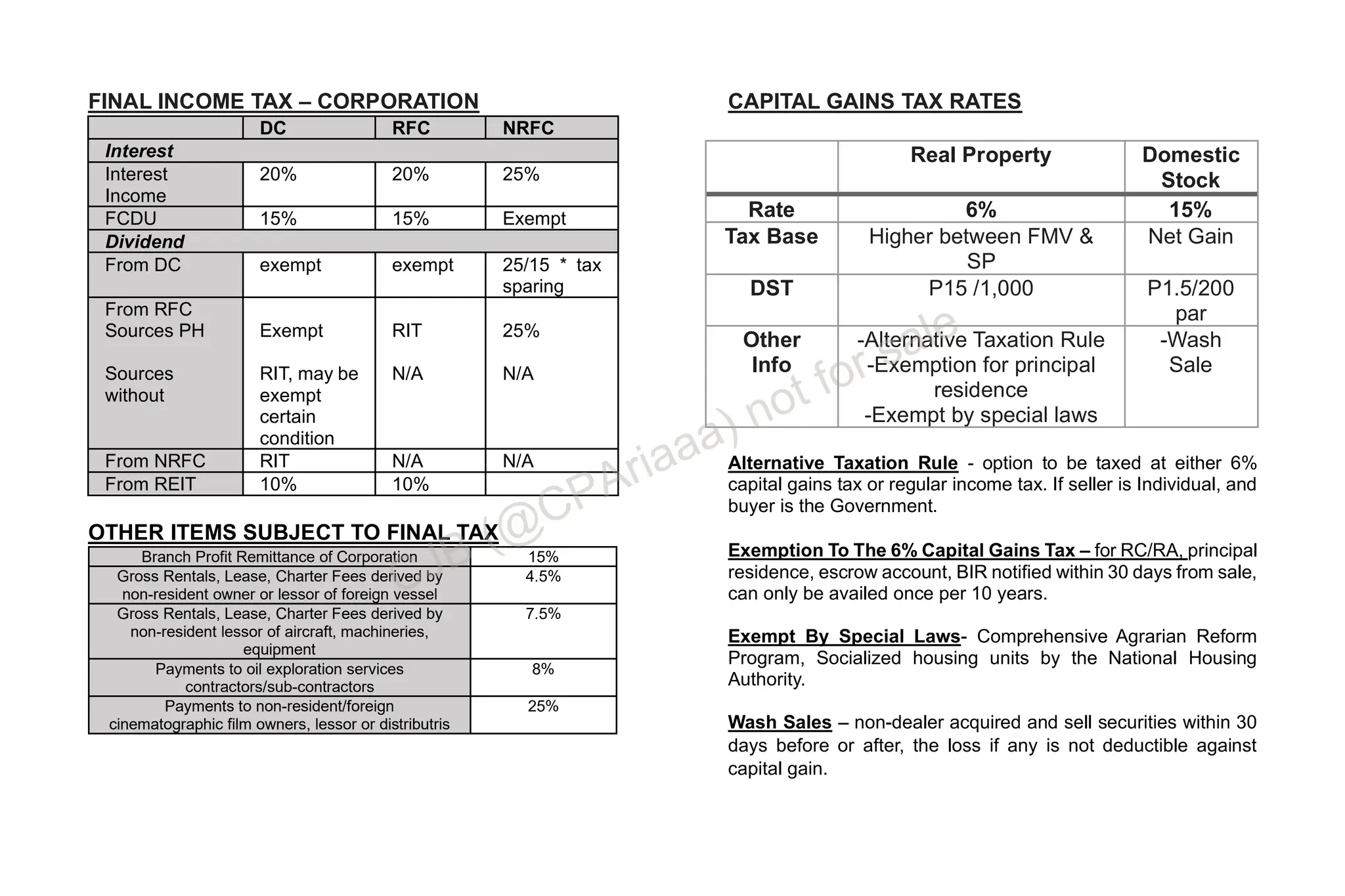

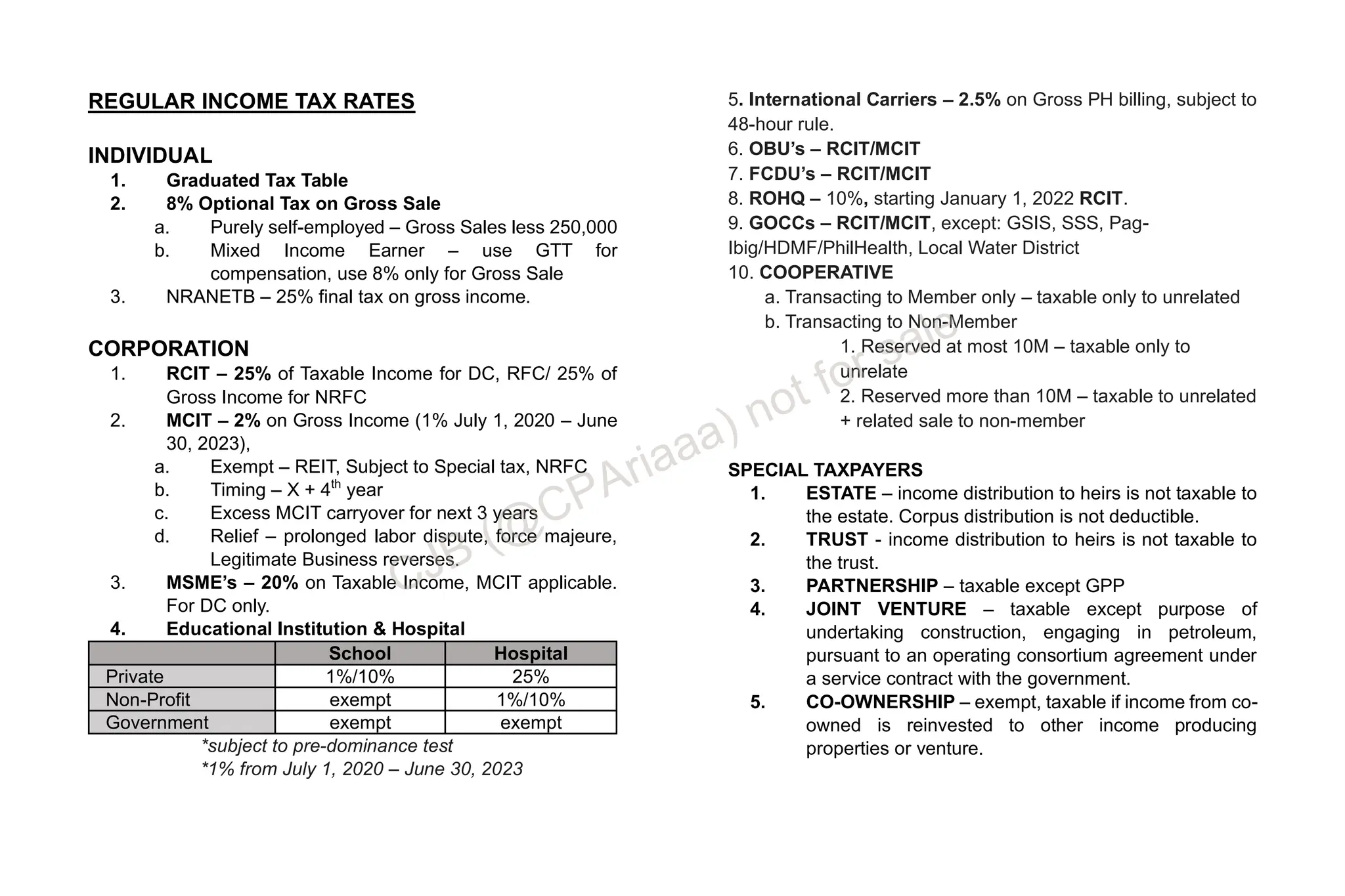

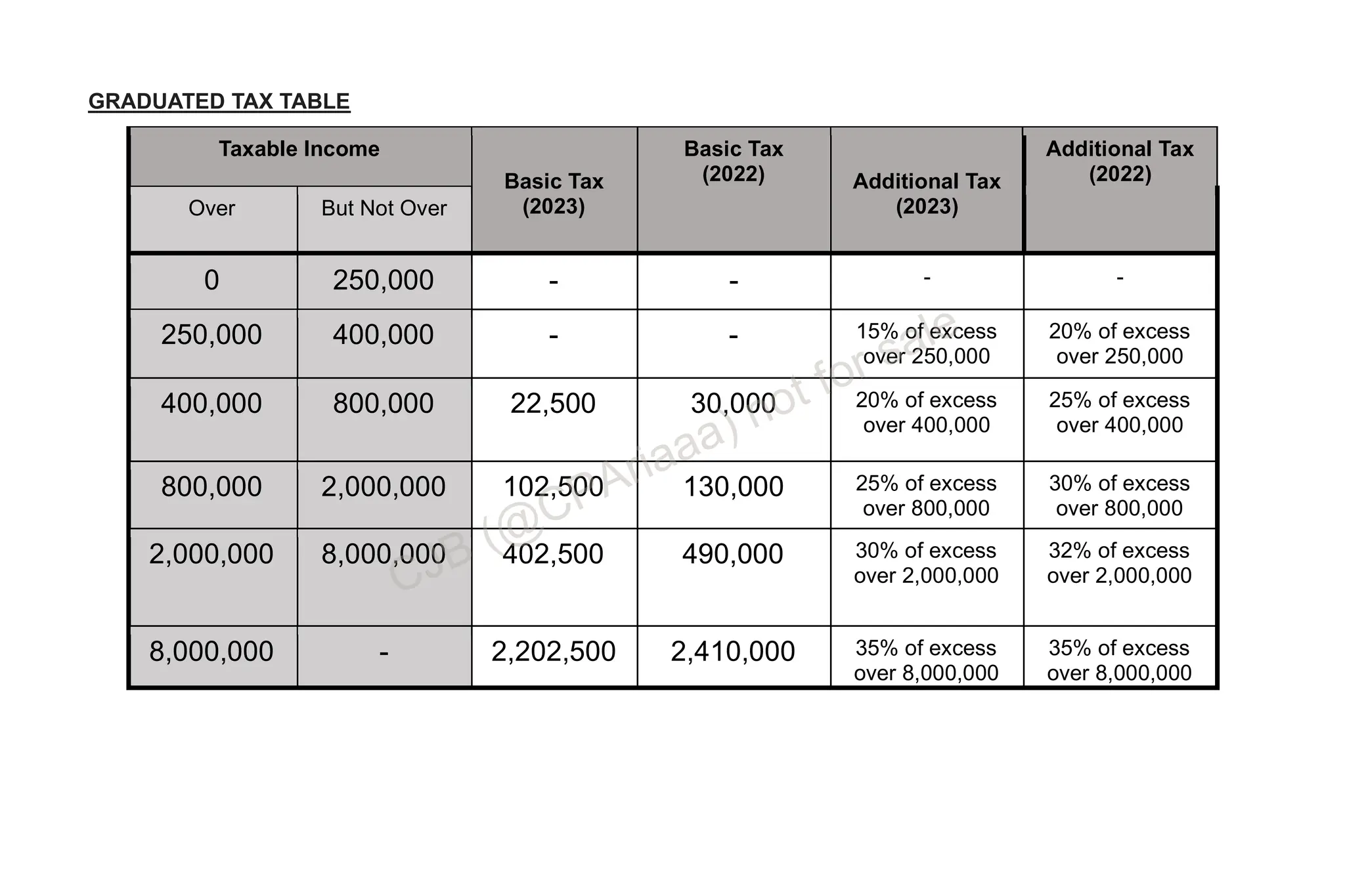

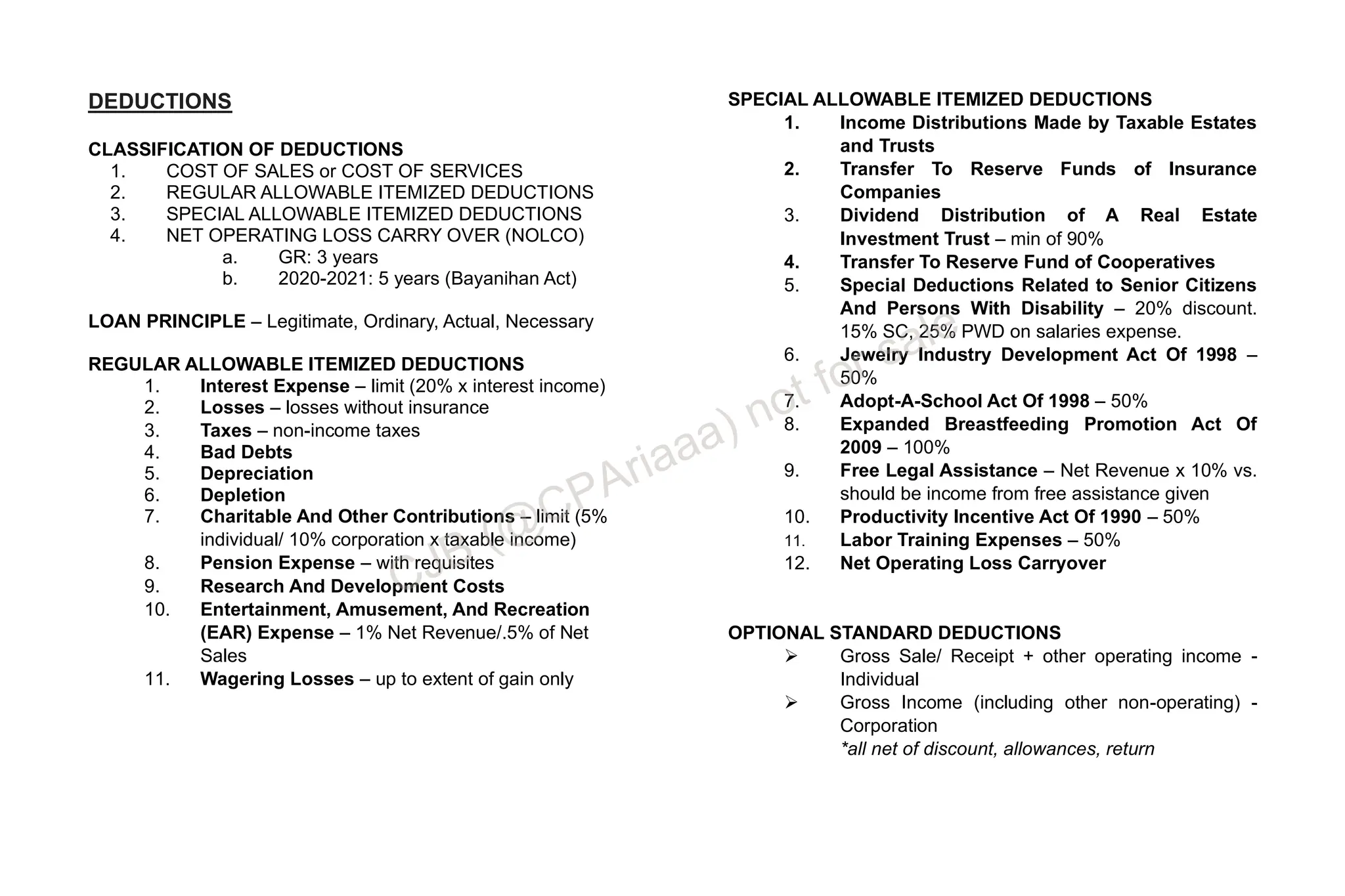

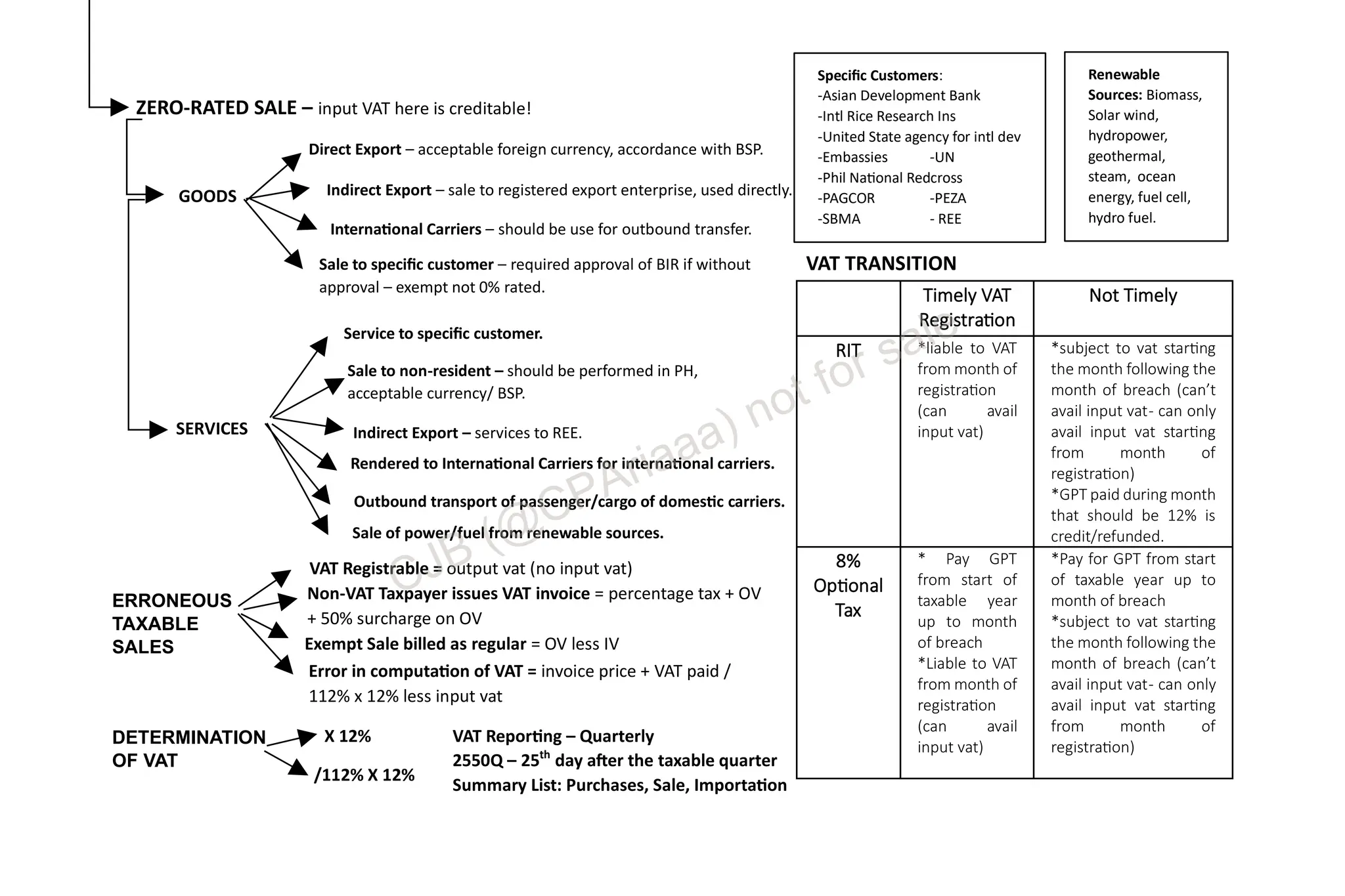

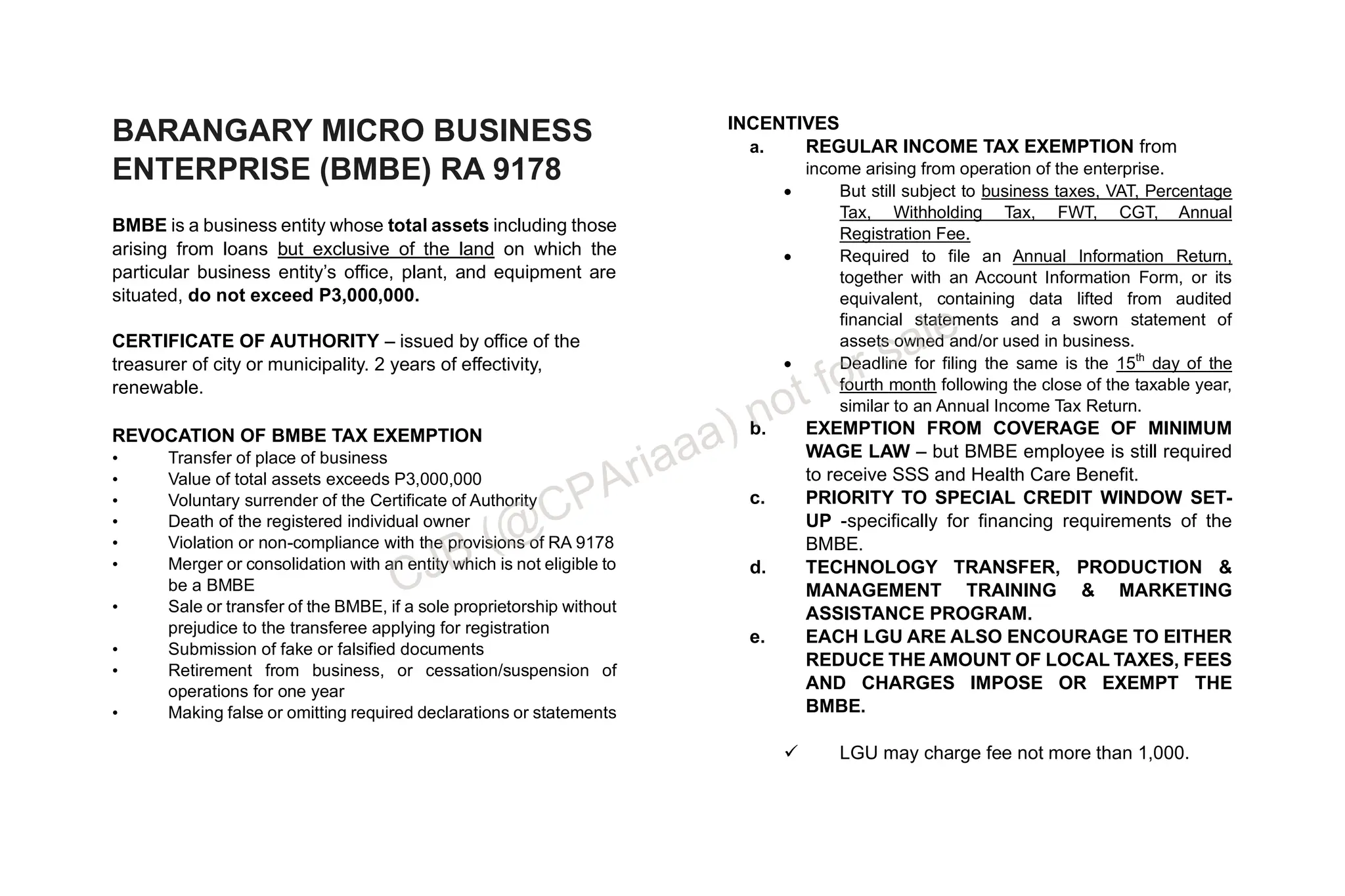

The document provides an overview of principles and laws related to income taxation, including the purpose of taxation, inherent powers of the state, characteristics of taxes, forms of taxation, taxpayer classifications, and tax implications for various entities. It discusses constitutional limitations, taxpayer obligations and rights, different classifications of taxes and taxpayers, and applicable tax rates for individuals and corporations. Additionally, it outlines penalties for late payment, filing methods, and various deductions and exemptions relevant to taxpayers.