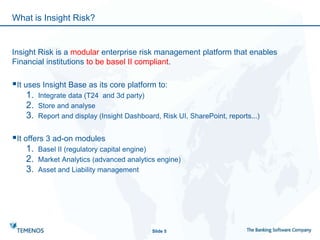

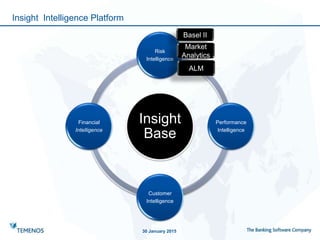

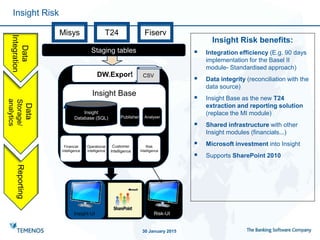

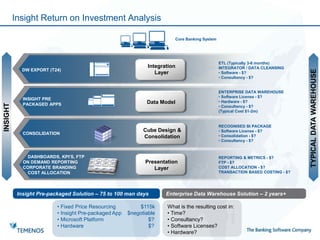

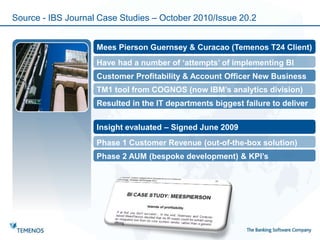

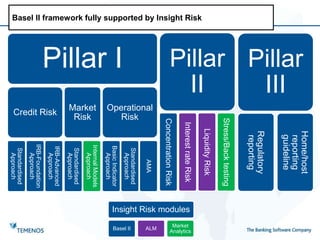

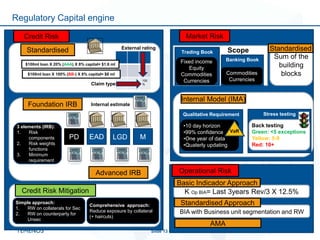

The document outlines the features and modules of the Insight Risk platform, which is designed to help financial institutions achieve Basel II compliance and improve risk management post-credit crisis. It discusses the platform's capabilities in managing credit, market, and operational risks, while also providing advanced analytics and asset-liability management solutions. Additionally, it highlights implementation timelines and costs associated with adopting the various modules, including Basel II, market analytics, and asset-liability management.