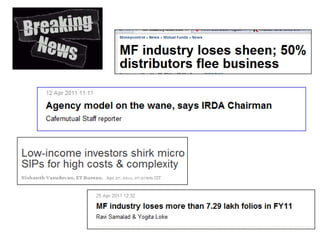

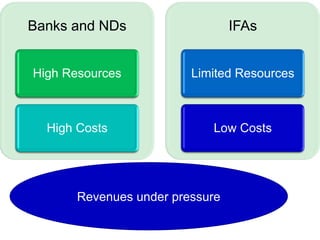

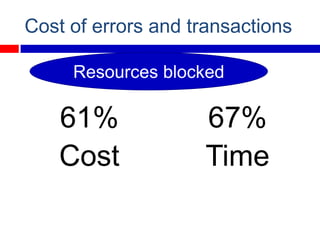

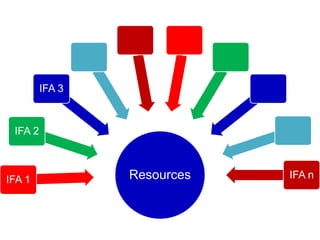

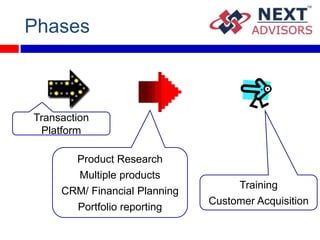

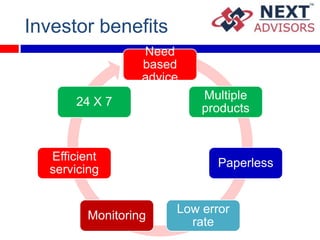

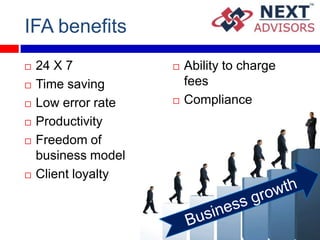

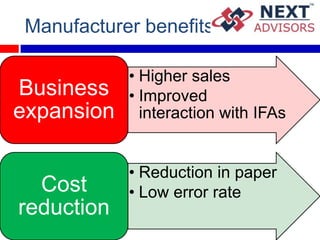

This document discusses creating a technology platform to help independent financial advisors (IFAs) grow their business. It would provide tools like customer relationship management, financial planning, portfolio reporting, order management, and research capabilities. This would save IFAs time and reduce errors while giving them freedom over their business models. It would also benefit investors through need-based advice, access to multiple products anytime, and more efficient servicing. Manufacturers would see higher sales, improved IFA interactions, and lower costs from reducing paper and errors. The overall goal is to create a win-win marketplace for investors, manufacturers, and intermediaries.