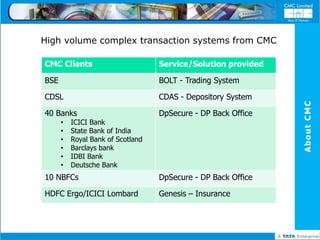

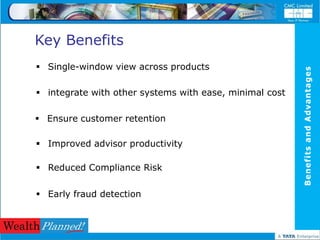

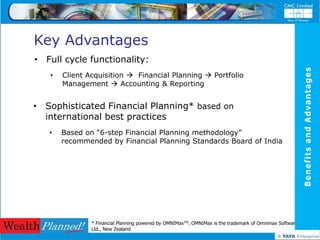

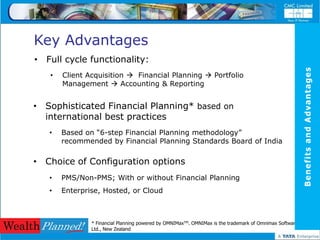

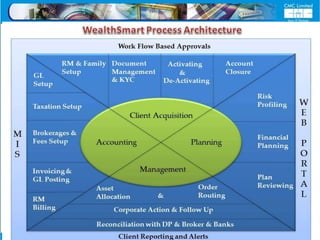

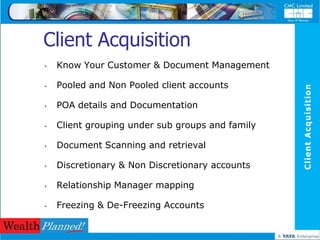

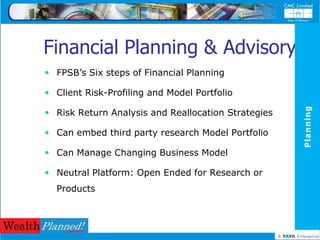

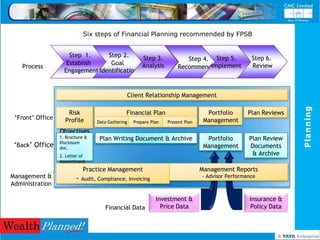

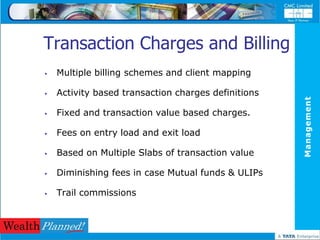

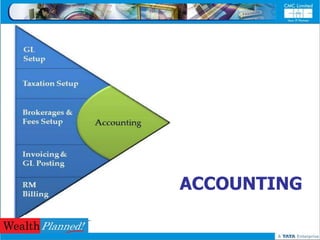

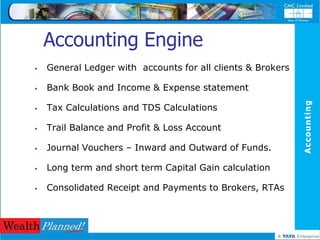

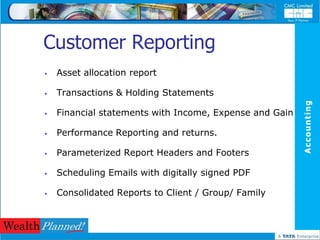

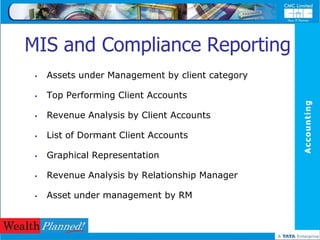

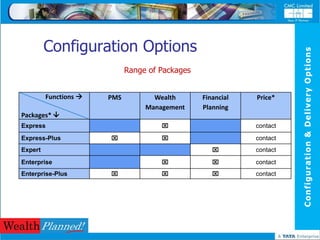

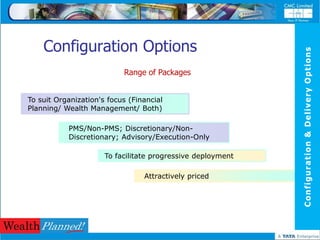

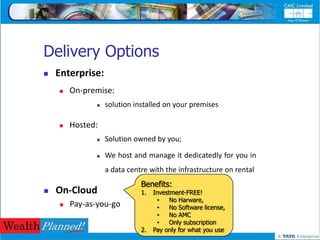

The document describes the services and solutions provided by CMC Ltd., India's oldest IT solutions provider, focusing on integrated financial planning and wealth management through their trademarked product, Wealthplanned. It highlights key benefits such as full cycle functionality, sophisticated financial planning based on international best practices, and a comprehensive suite designed for capital market needs. The text also emphasizes the company's track record and customer-centric approach, showcasing its ability to streamline processes and enhance client management in the financial sector.