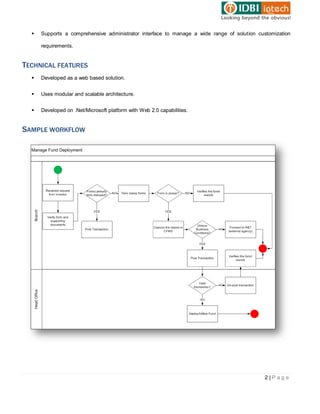

Cash Flow Management Solution (CFMS) is a web-based workflow solution that helps Asset Management Companies (AMCs) instantly process investors' investment requests. CFMS connects AMC branches to the head office to route new fund offers, purchases, redemptions and other transactions for immediate processing. It provides features like customizable reports, user access controls and a scalable architecture. CFMS aims to improve turnaround times for investors and increase operational quality for AMCs.