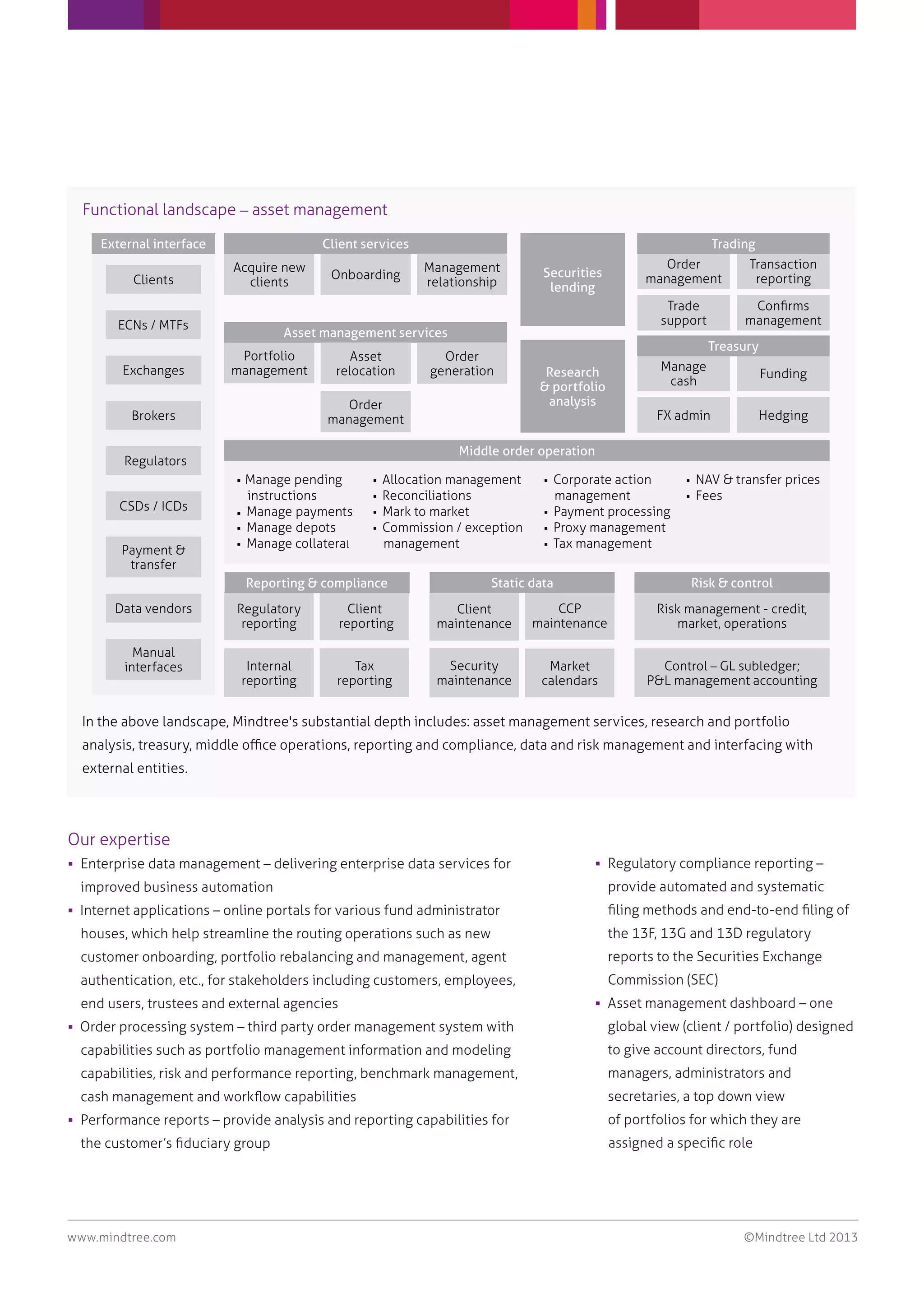

Mindtree specializes in asset management solutions, showcasing significant growth in assets under management since the 2008-09 financial crisis across regions such as Latin America and North America. They offer a wide range of services including enterprise data management, regulatory compliance reporting, and performance analysis, addressing industry challenges like demographic shifts and increasing customer expectations. Through their proprietary products like Cadis and Thinkfolio, they enhance operational efficiency and risk management for financial institutions.