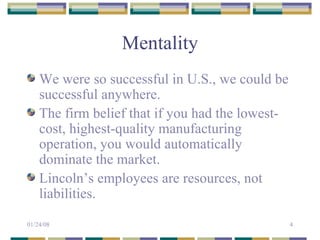

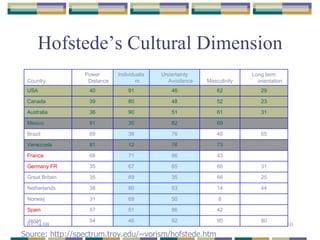

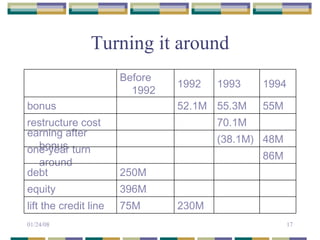

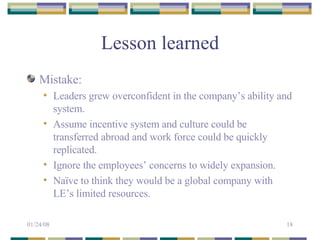

Lincoln Electric, a US-based welding company, aggressively expanded internationally in the 1980s through acquisitions. However, it struggled with low performance overseas due to applying its US management style and incentive system without considering cultural differences. This led to financial losses and crisis. Lincoln Electric subsequently restructured its international operations, installing new leadership and learning to better adapt to local cultures.