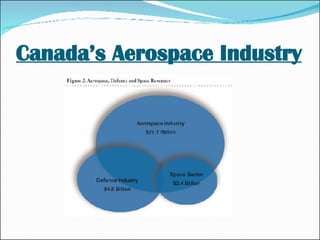

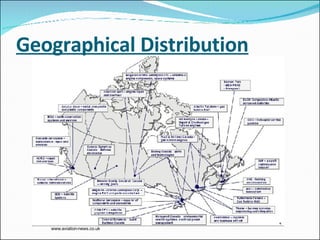

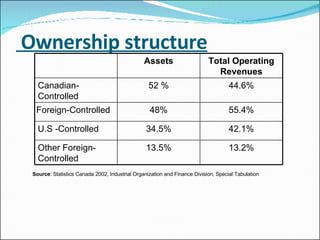

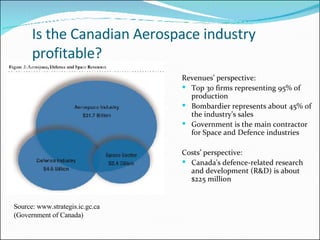

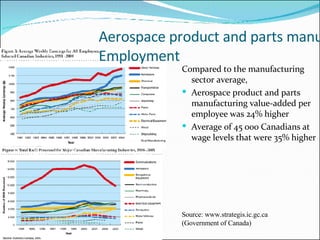

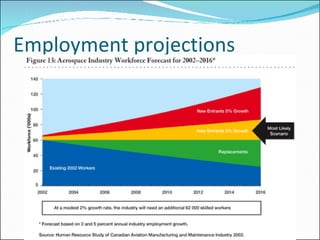

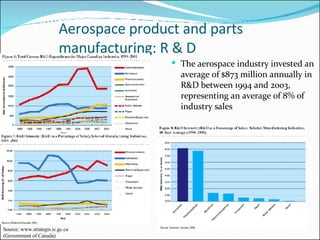

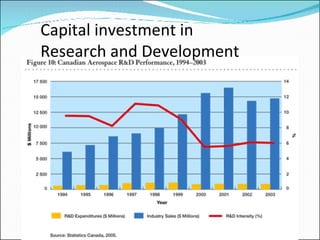

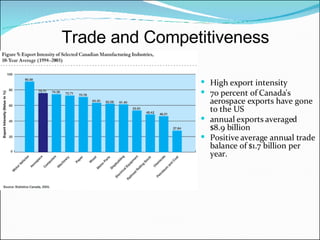

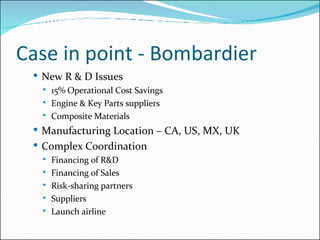

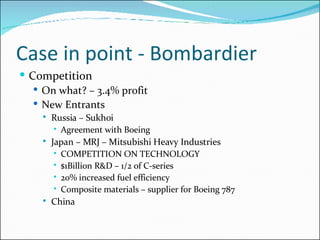

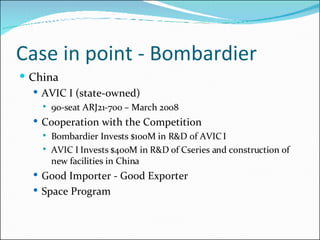

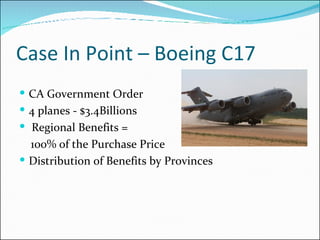

The Canadian aerospace industry is the 5th largest in the world and employs approximately 80,000 people. Two of its largest companies, Bombardier and Pratt & Whitney Canada, have significant global market shares in regional aircraft and small gas turbines. While the industry faces challenges such as currency fluctuations and skills shortages, it also benefits from strong government support for research and development.