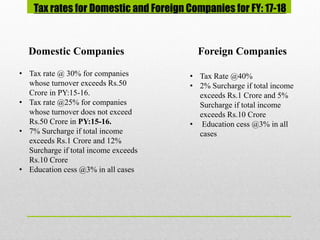

The document summarizes key highlights from the Union Budget 2017 regarding direct taxes and measures to promote economic growth and a digital economy in India. Some of the key points include:

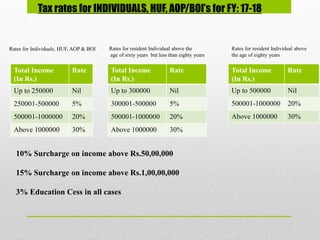

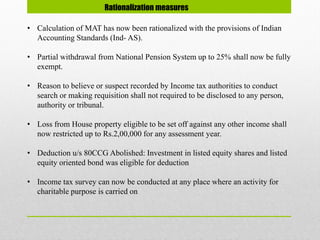

- Income tax rates were reduced for individuals with an annual income up to Rs. 500,000.

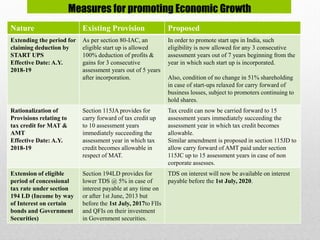

- The period for claiming tax deductions for startups was increased from 3 to 7 years.

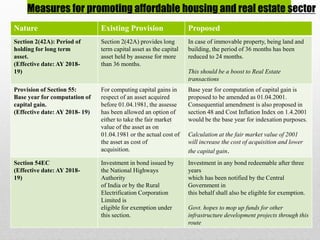

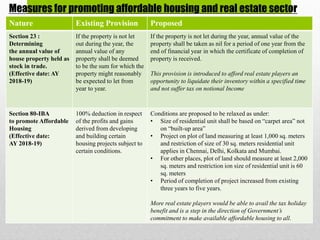

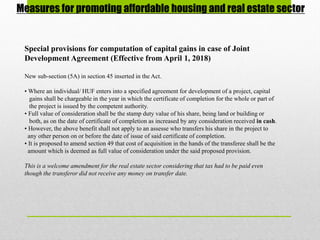

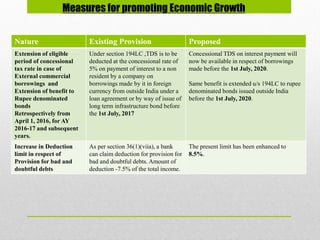

- Measures were introduced to promote affordable housing and the real estate sector, such as relaxing conditions for tax exemptions.

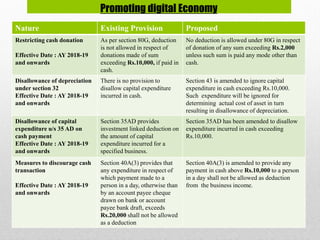

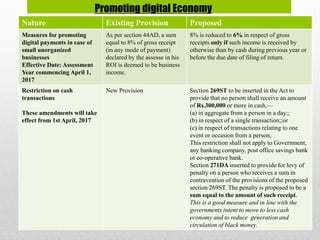

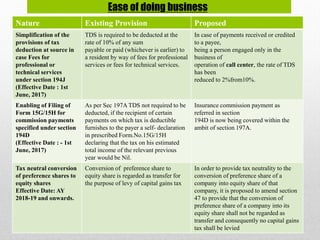

- Cash transaction limits were set to discourage the use of cash and promote digital payments.

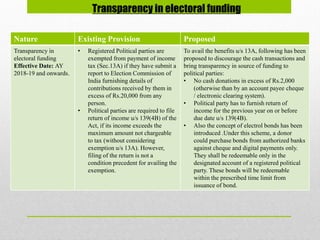

- Transparency in political party funding was increased by introducing electoral bonds and limiting cash donations.