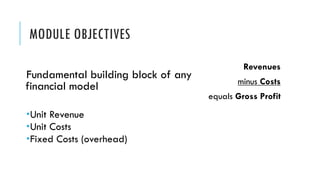

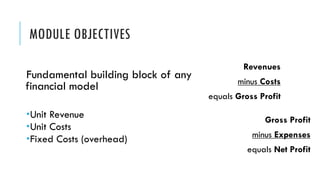

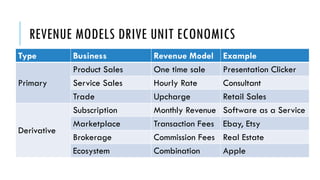

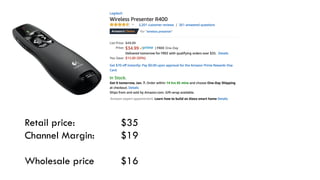

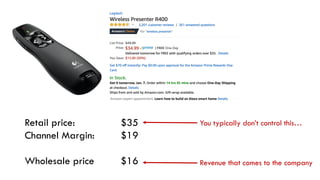

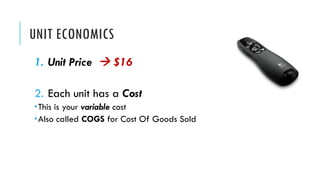

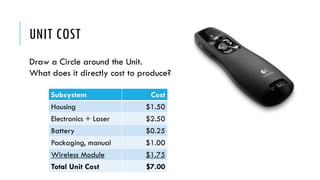

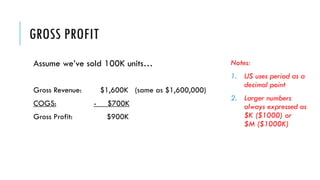

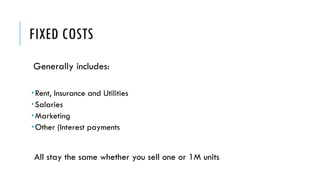

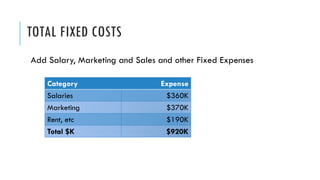

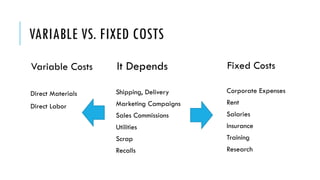

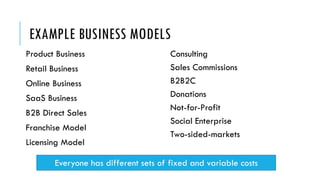

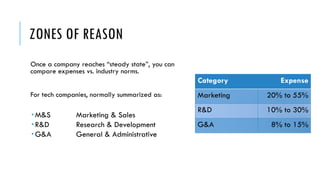

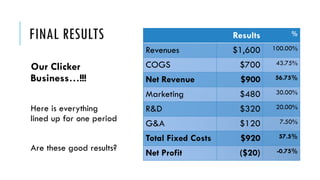

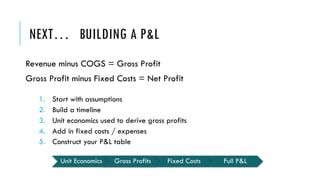

This document discusses unit economics, which is the fundamental building block of any financial model. It examines unit revenue, unit costs, and fixed costs. Key aspects of unit economics include understanding the cost to produce and sell one unit, the unit profit calculated as unit price minus unit cost, and using unit sales to calculate gross profit. The document also discusses differentiating between variable costs that can be attributed to a specific unit, and fixed costs that remain constant regardless of units sold.