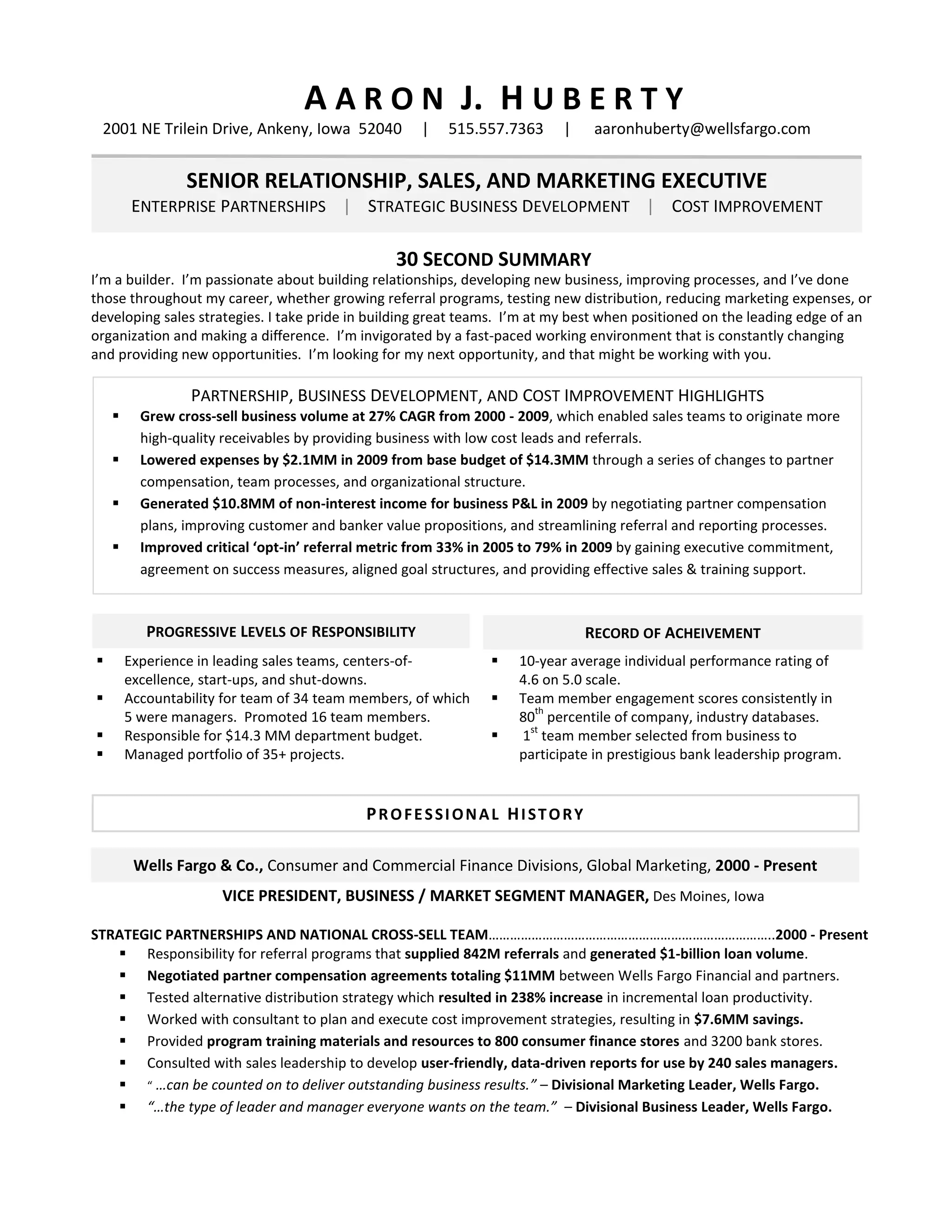

This document is a resume for Aaron J. Huberty, who has over 20 years of experience in senior relationship, sales, and marketing roles. He has a proven track record of growing business, developing strategic partnerships, and improving processes to reduce costs. His career highlights include generating over $1 billion in loan volume, negotiating multi-million dollar partner agreements, and saving over $2 million through cost improvement strategies.