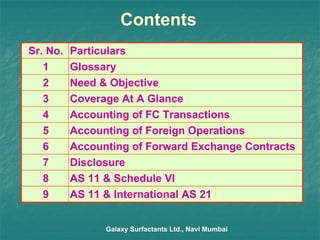

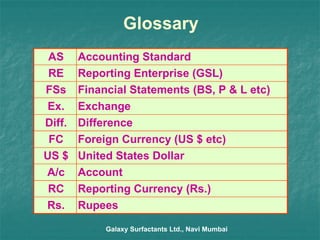

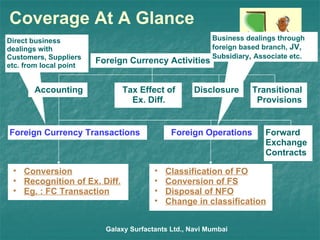

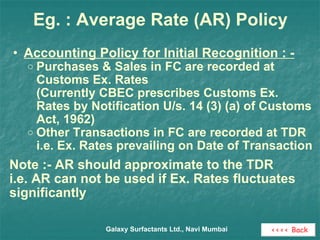

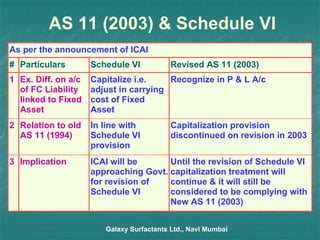

The document summarizes Accounting Standard 11 which provides guidance on accounting for changes in foreign exchange rates. Some key points covered include:

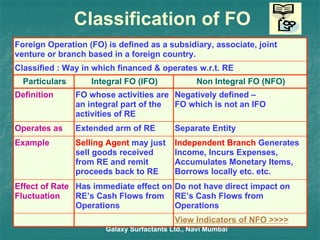

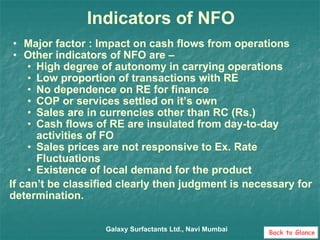

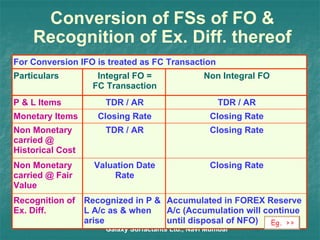

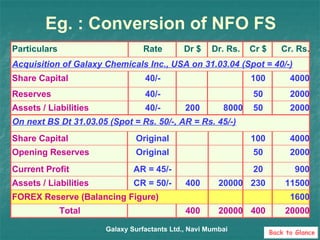

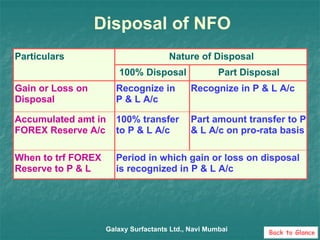

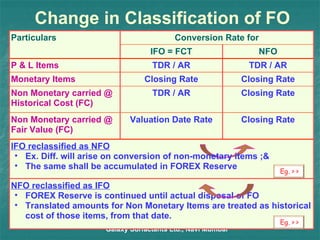

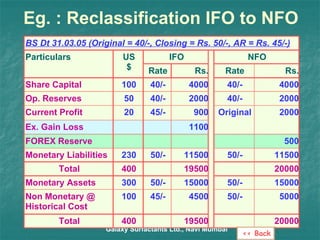

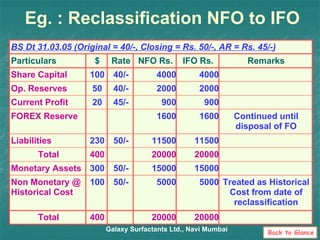

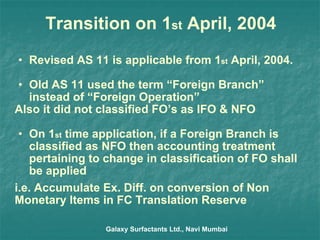

- Foreign currency transactions and foreign operations are classified as integral or non-integral. Exchange differences for non-integral operations are accumulated in a foreign currency translation reserve.

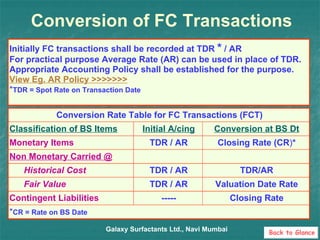

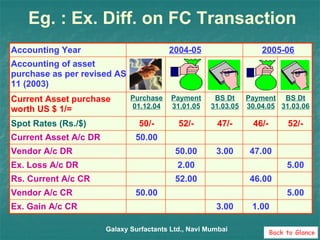

- Monetary items denominated in foreign currency are translated at closing rates. Non-monetary items are recorded based on historical rates.

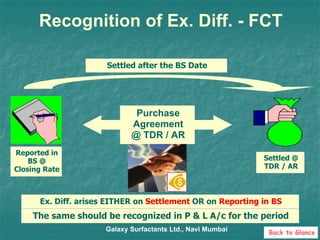

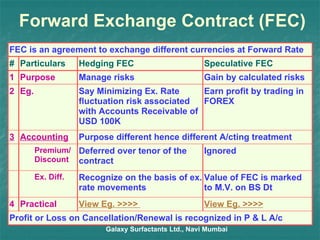

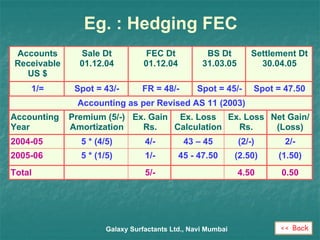

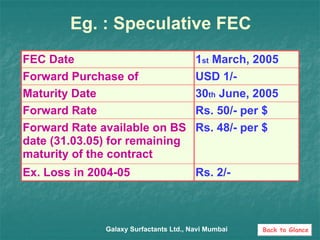

- Forward exchange contracts are marked to market on the balance sheet date and exchange gains or losses are recognized in profit and loss.

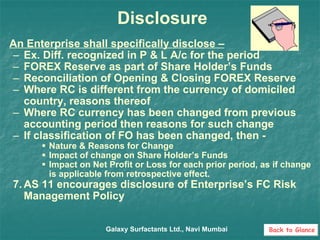

- Disclosure requirements include exchange differences, foreign currency translation reserve, and changes in classifications of foreign operations.