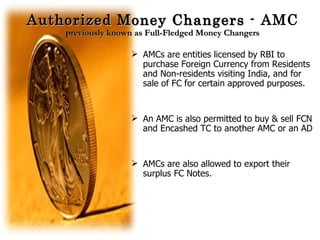

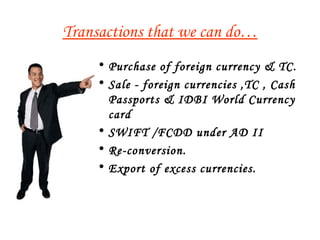

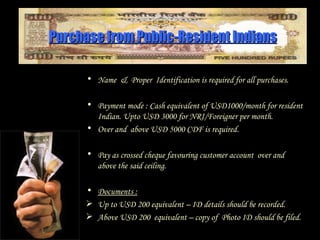

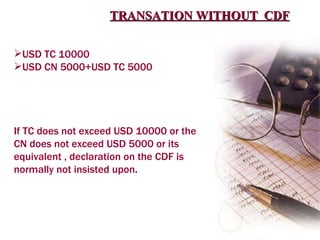

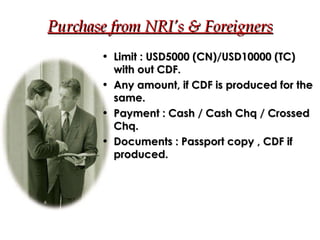

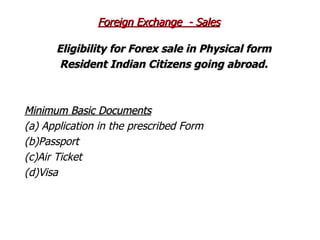

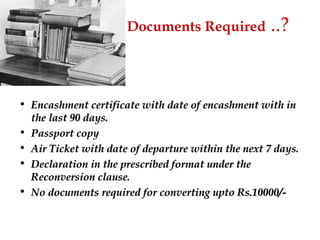

This document provides information on foreign exchange money changing and regulations in India. It discusses the factors that affect exchange rates, the types of entities authorized to deal in foreign exchange, and the rules regarding purchasing, selling, and transporting foreign currency. It also outlines the various reports that must be filed related to foreign exchange transactions.