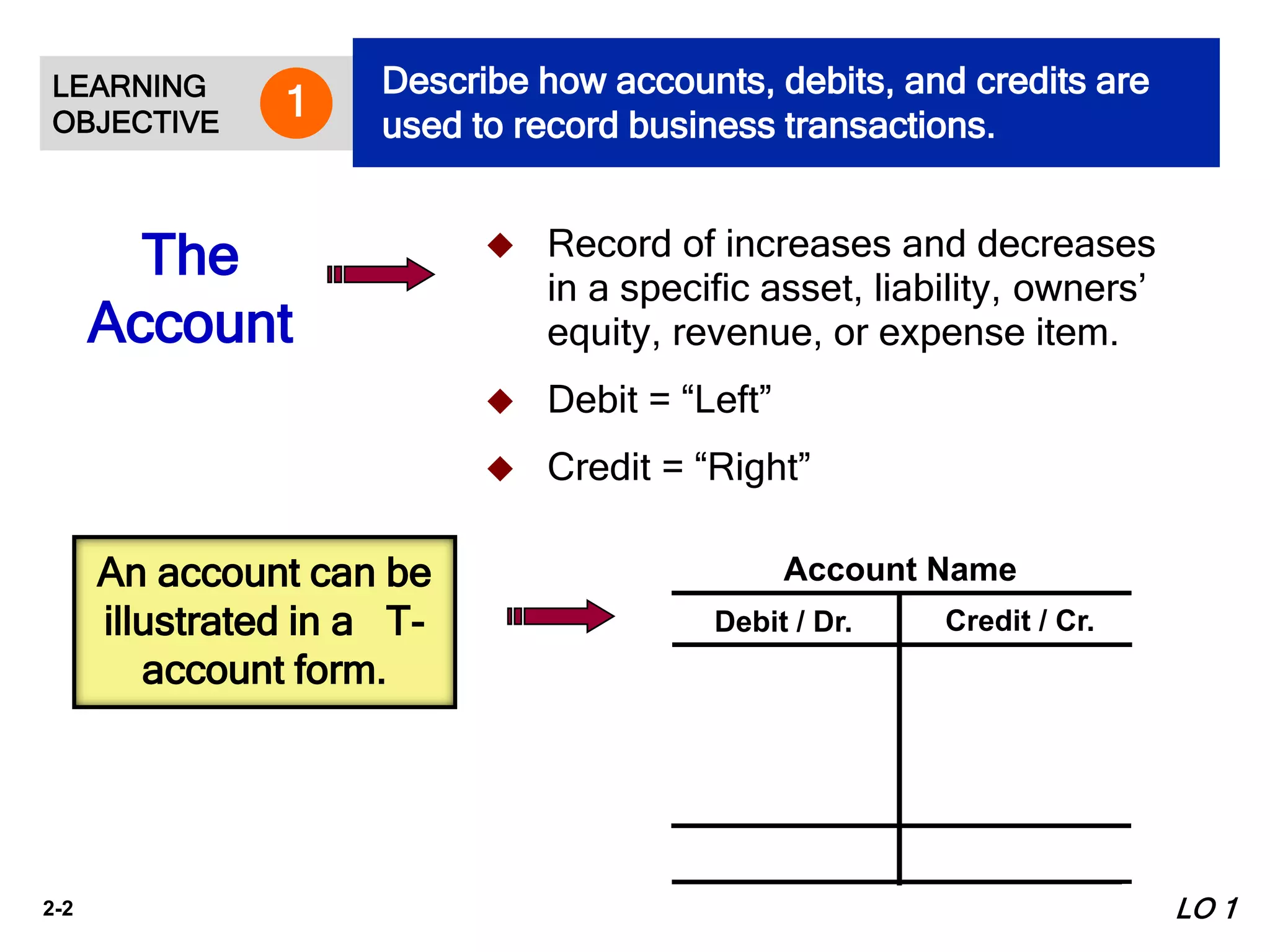

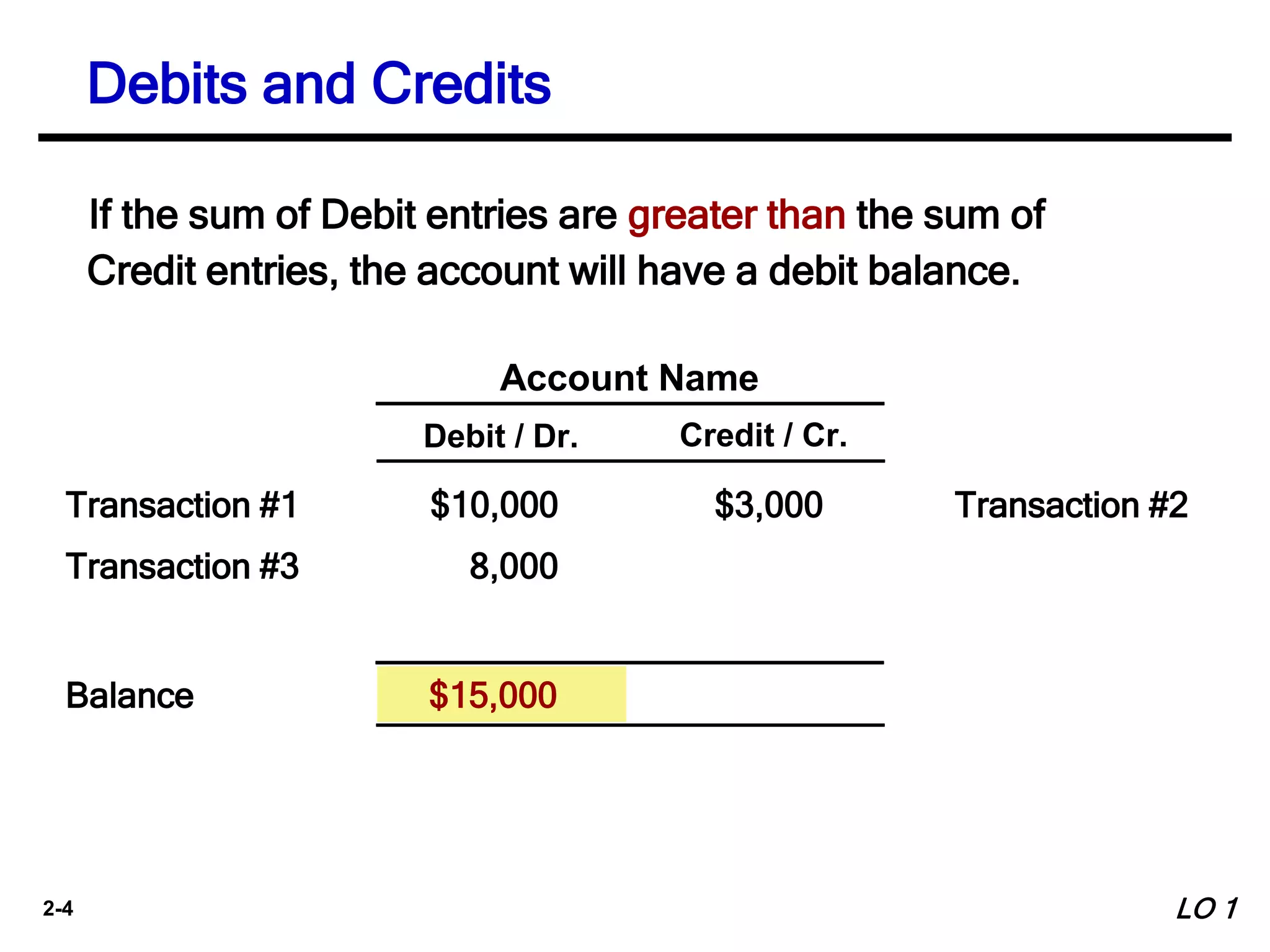

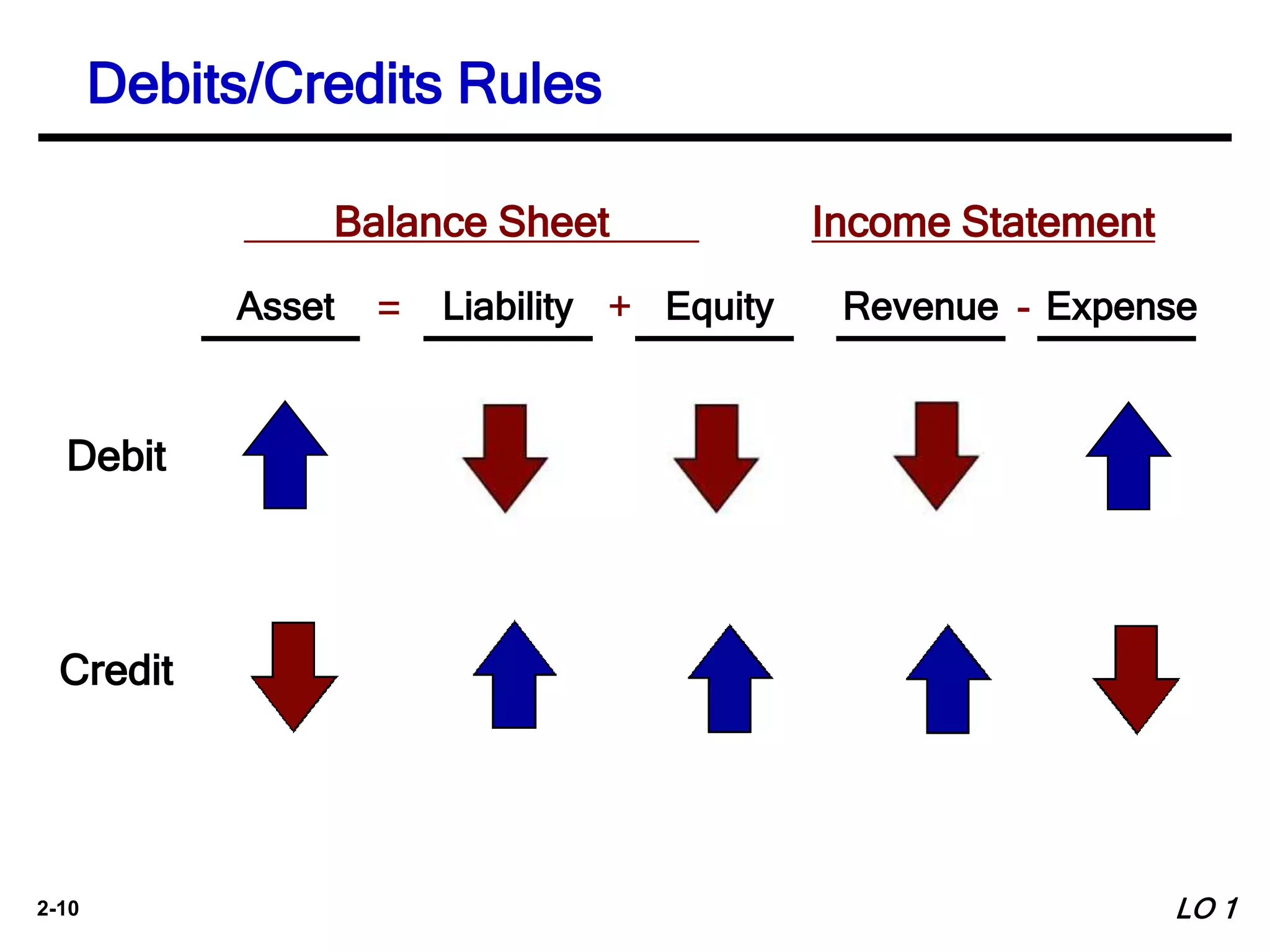

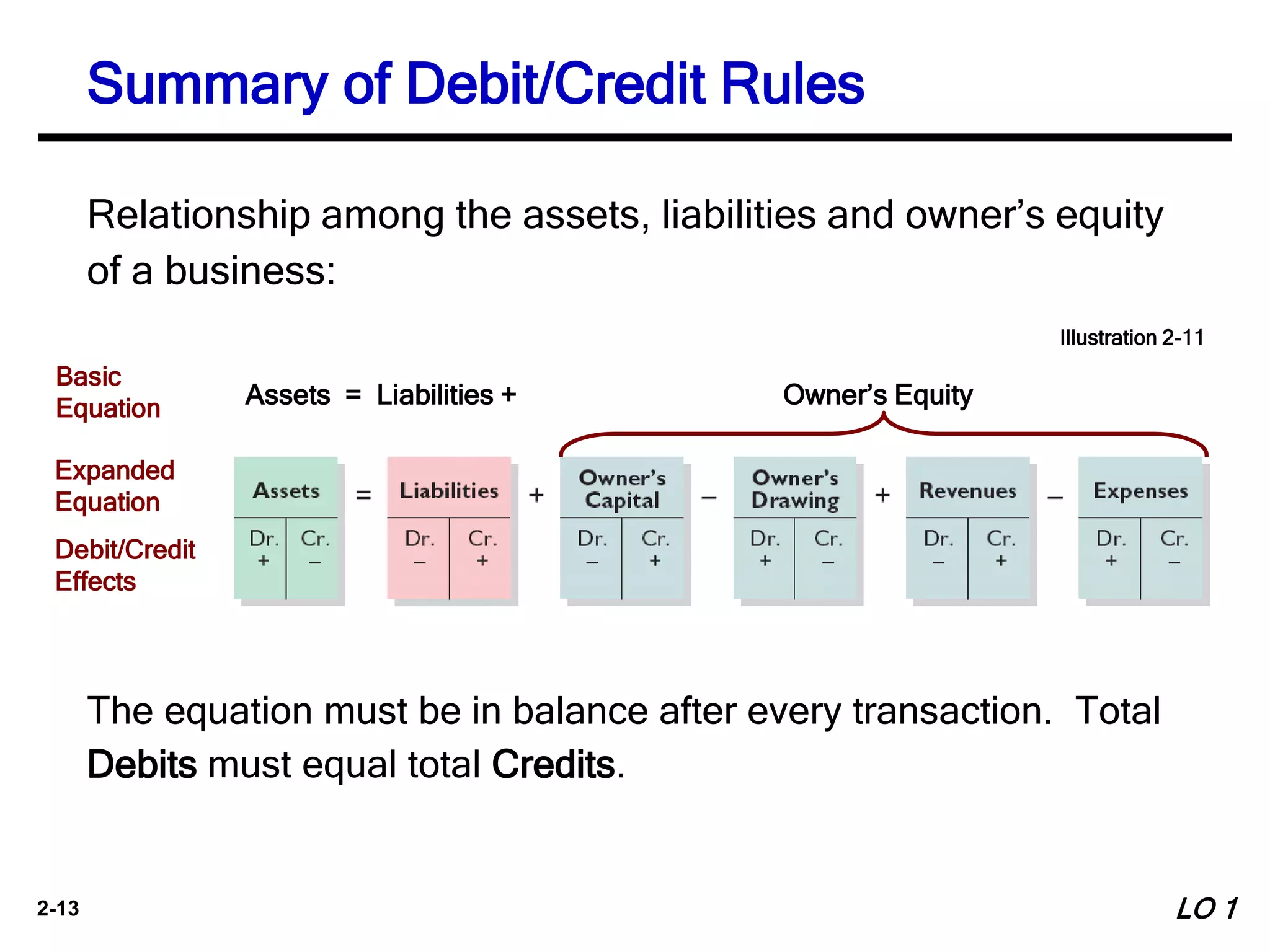

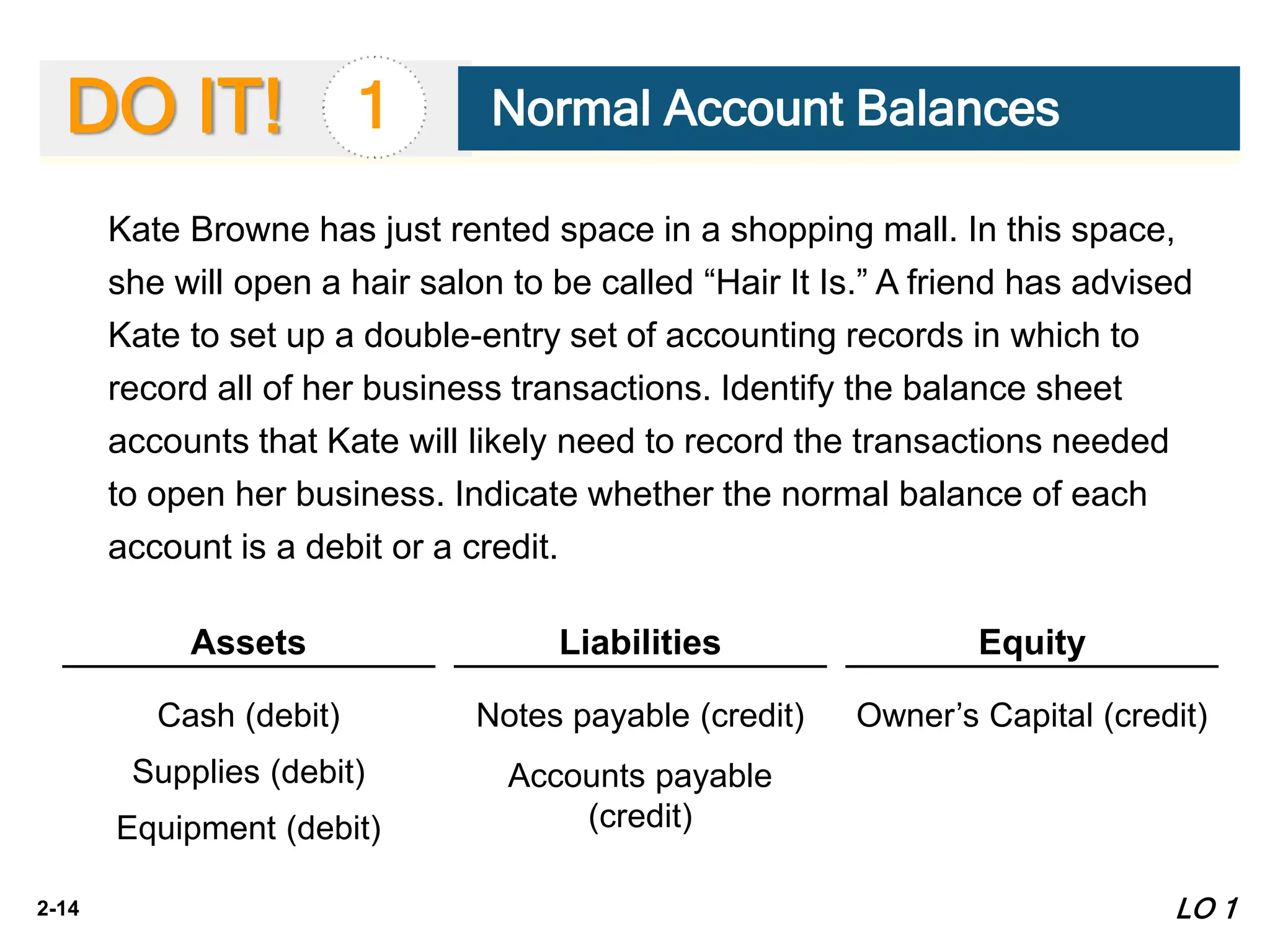

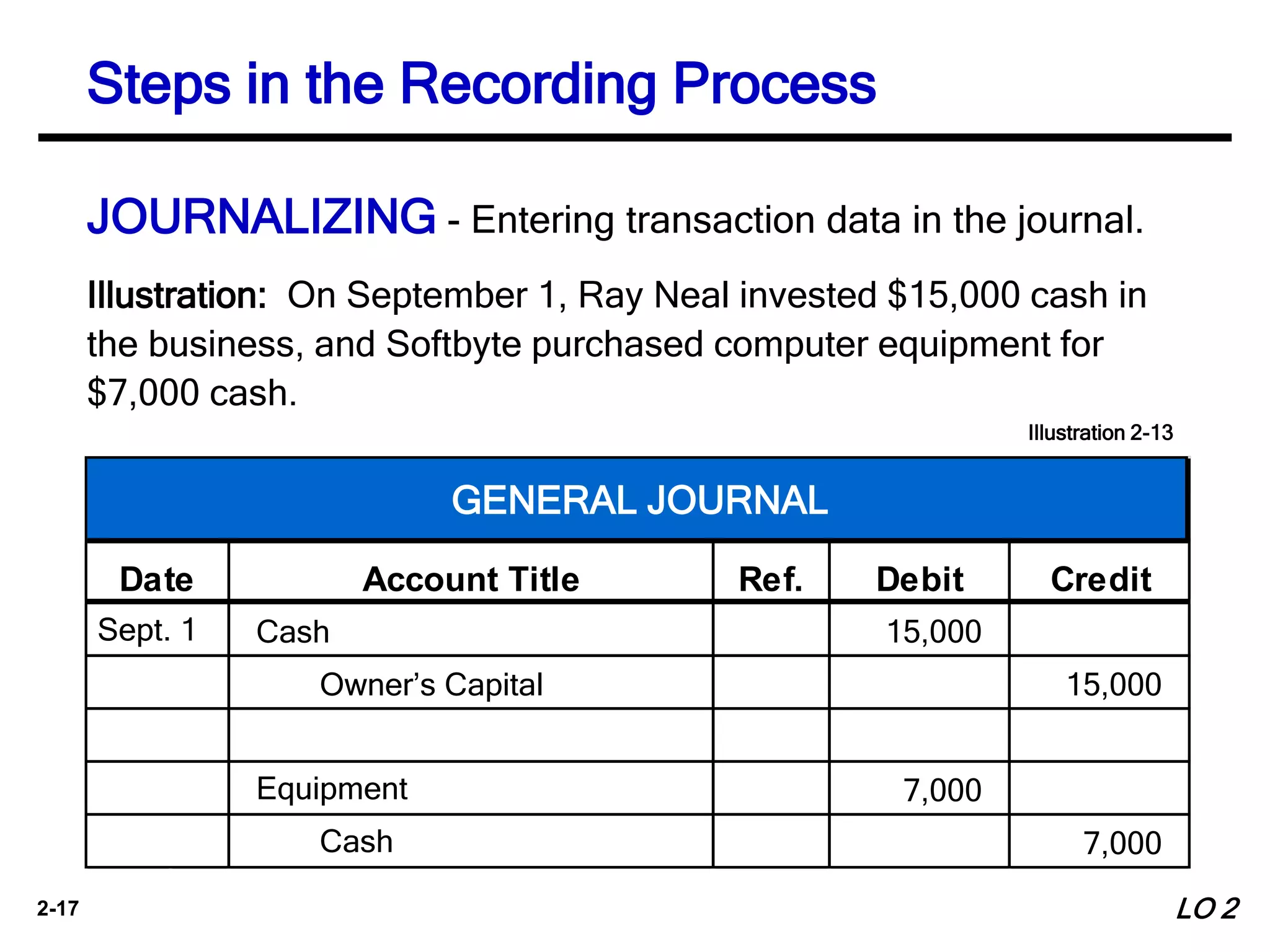

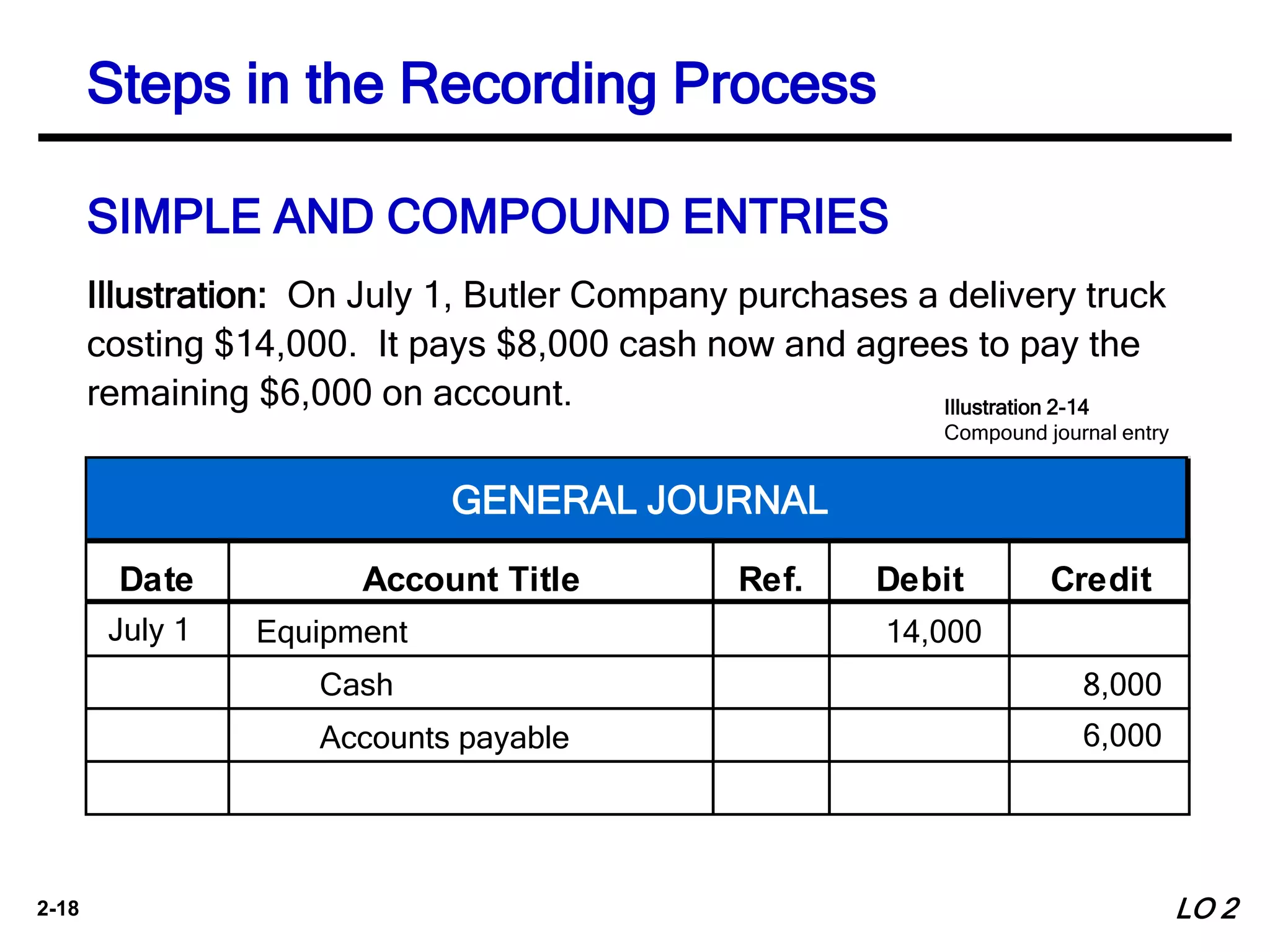

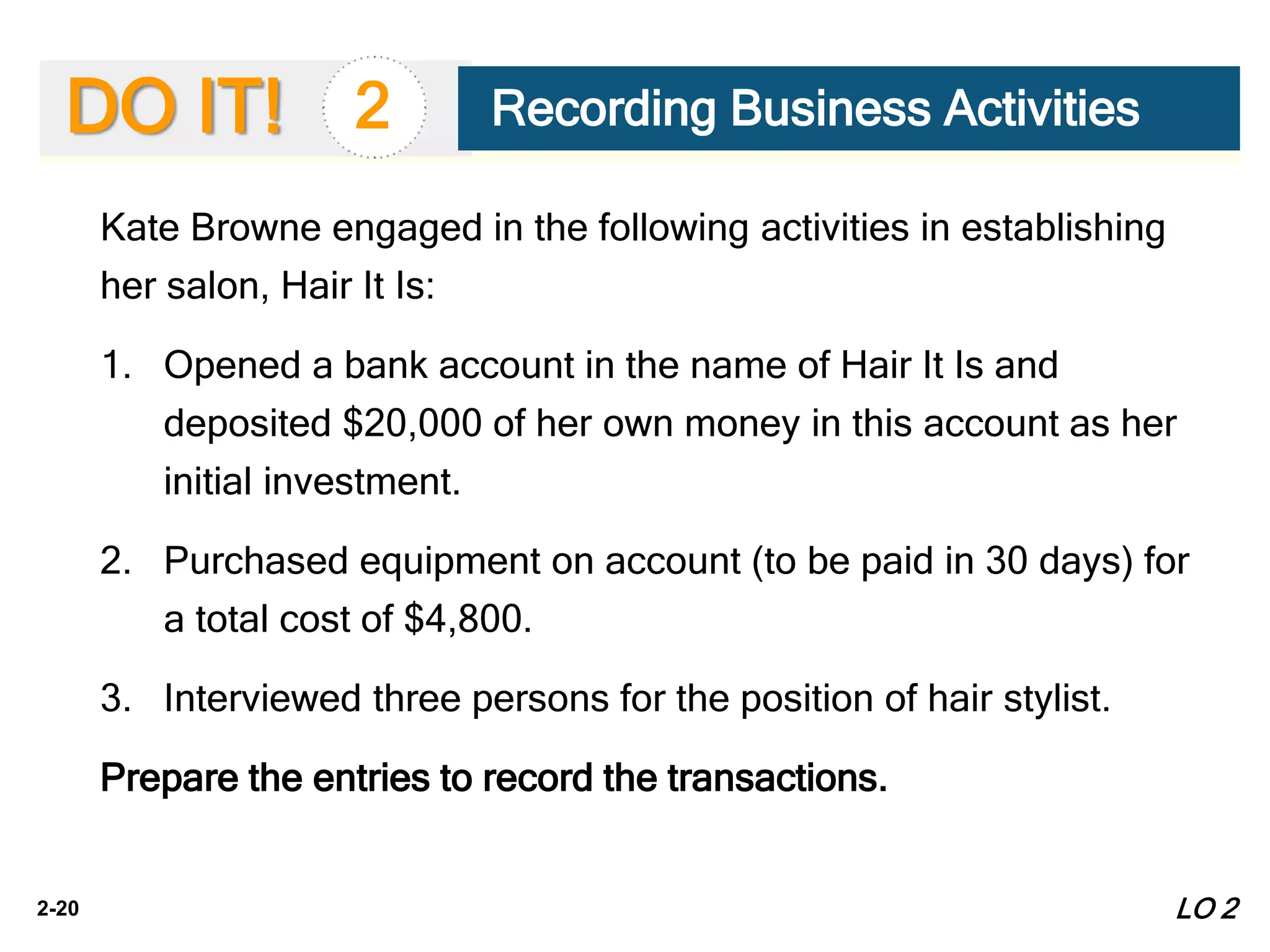

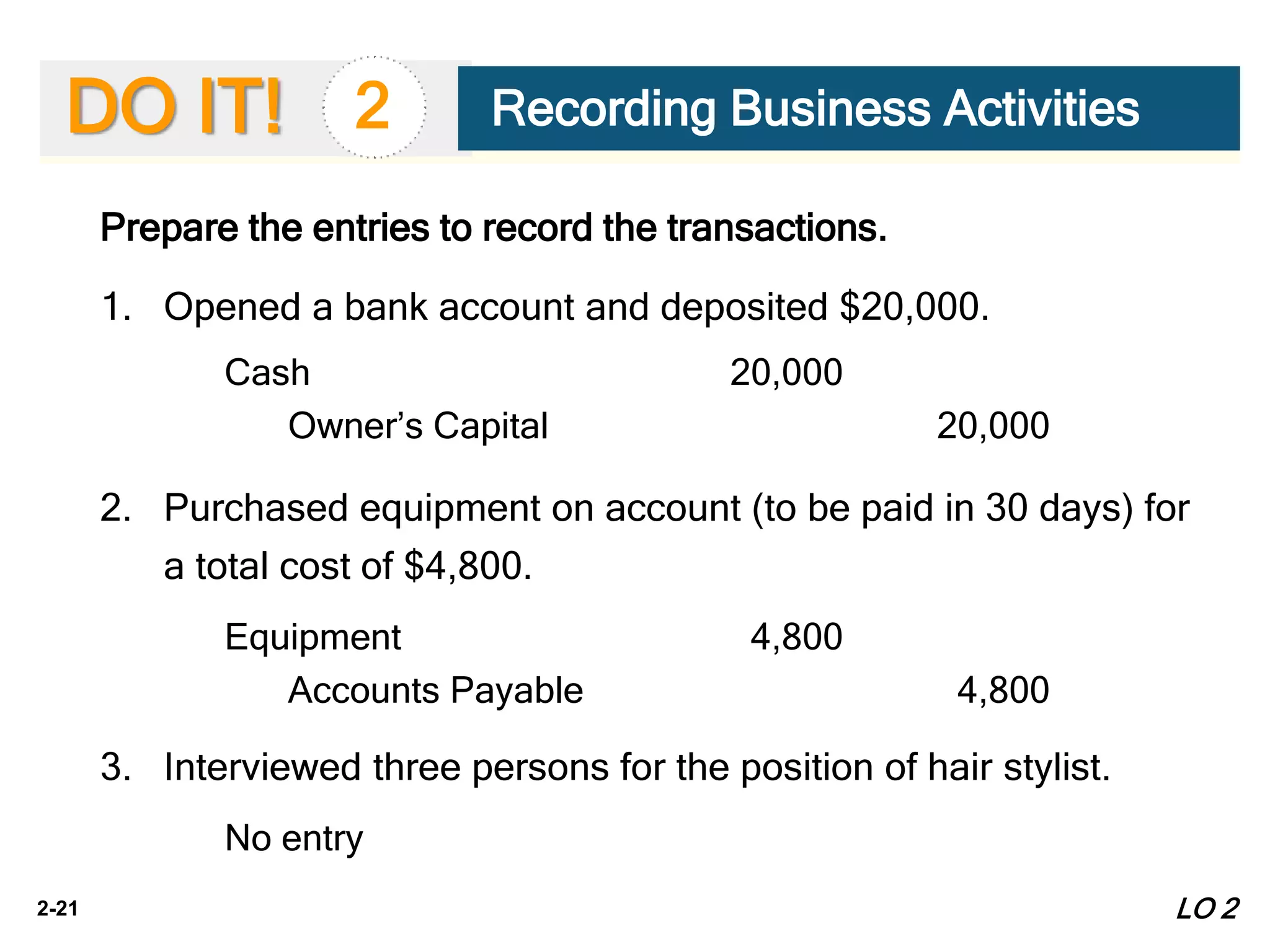

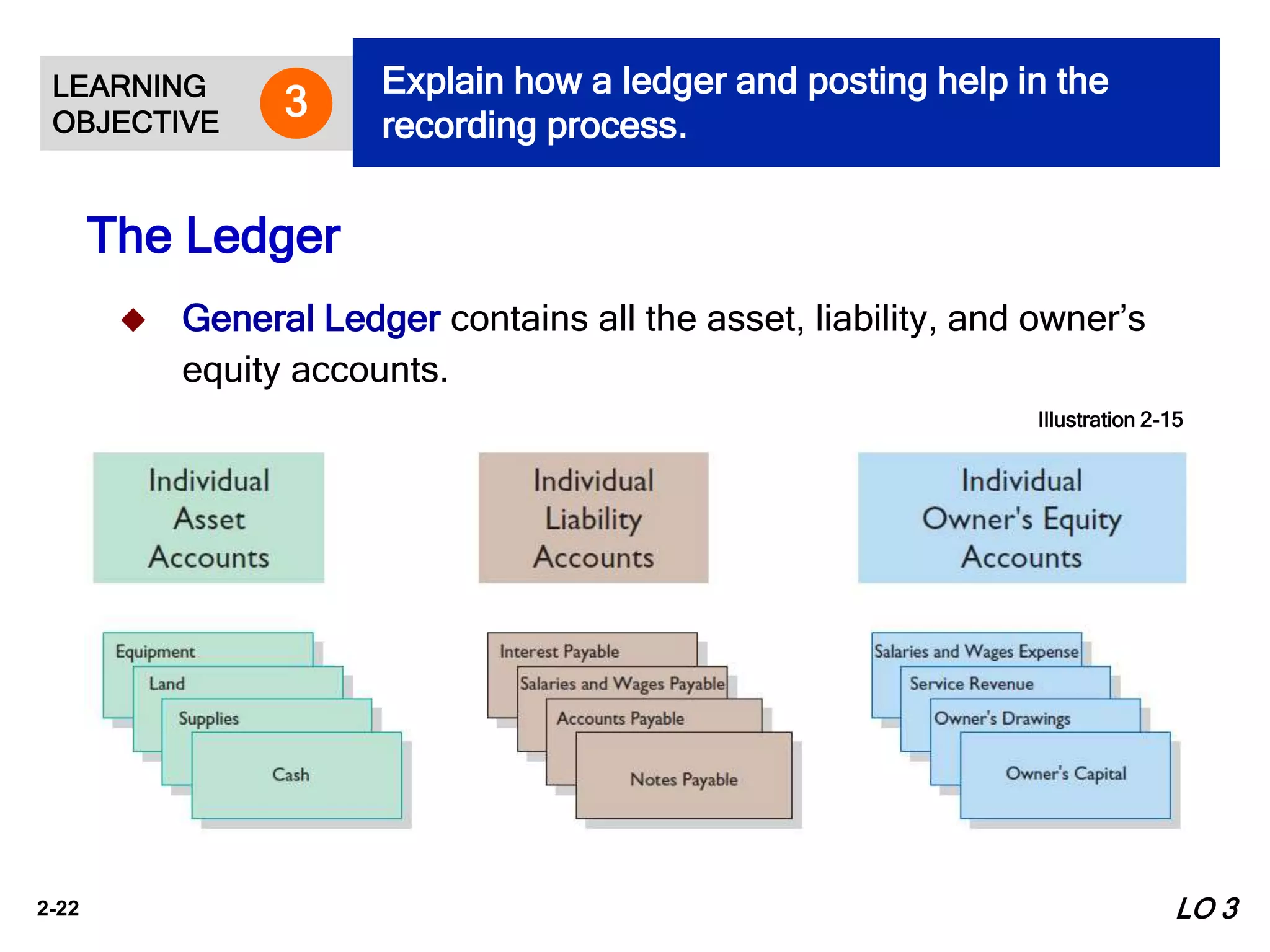

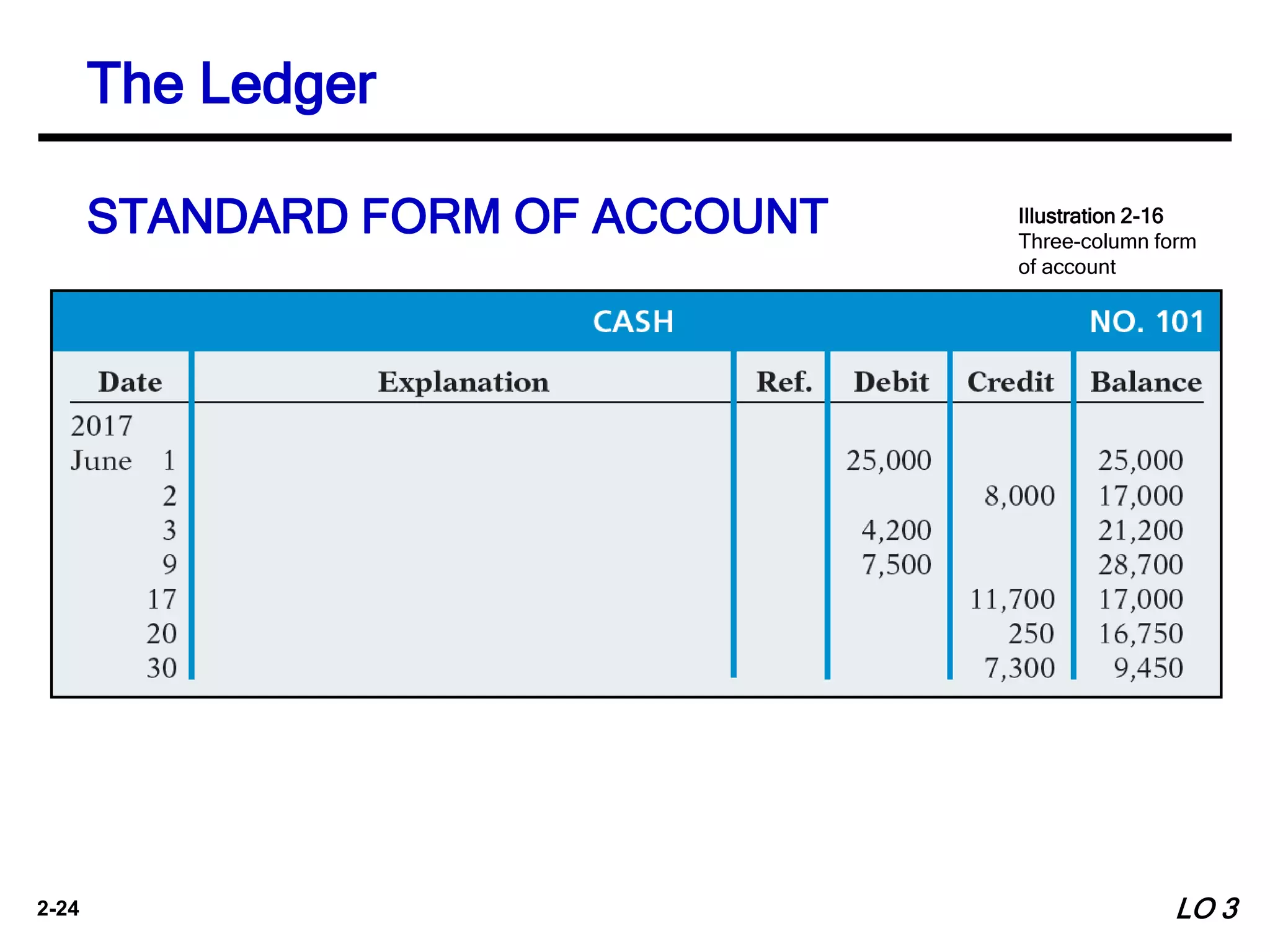

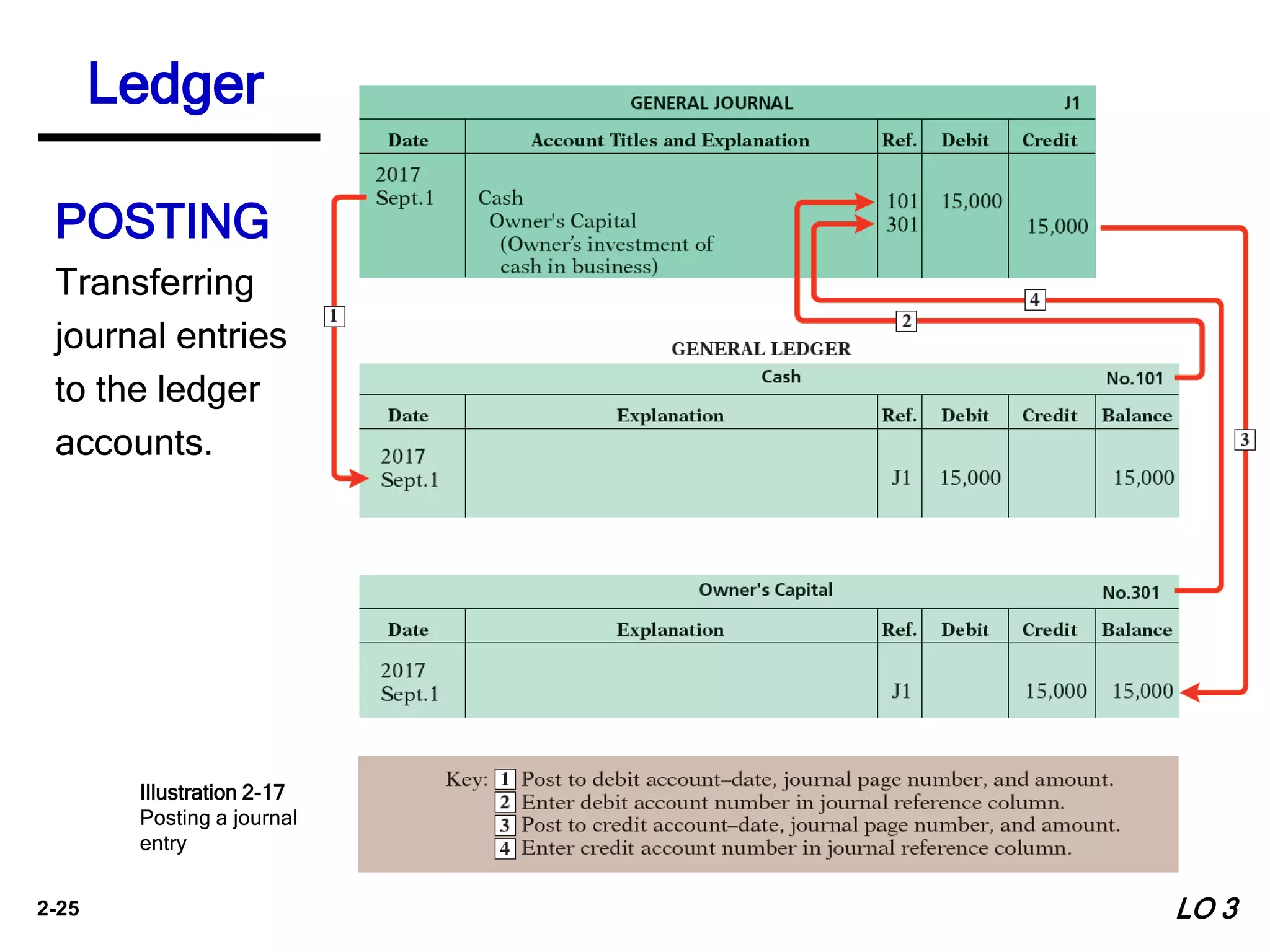

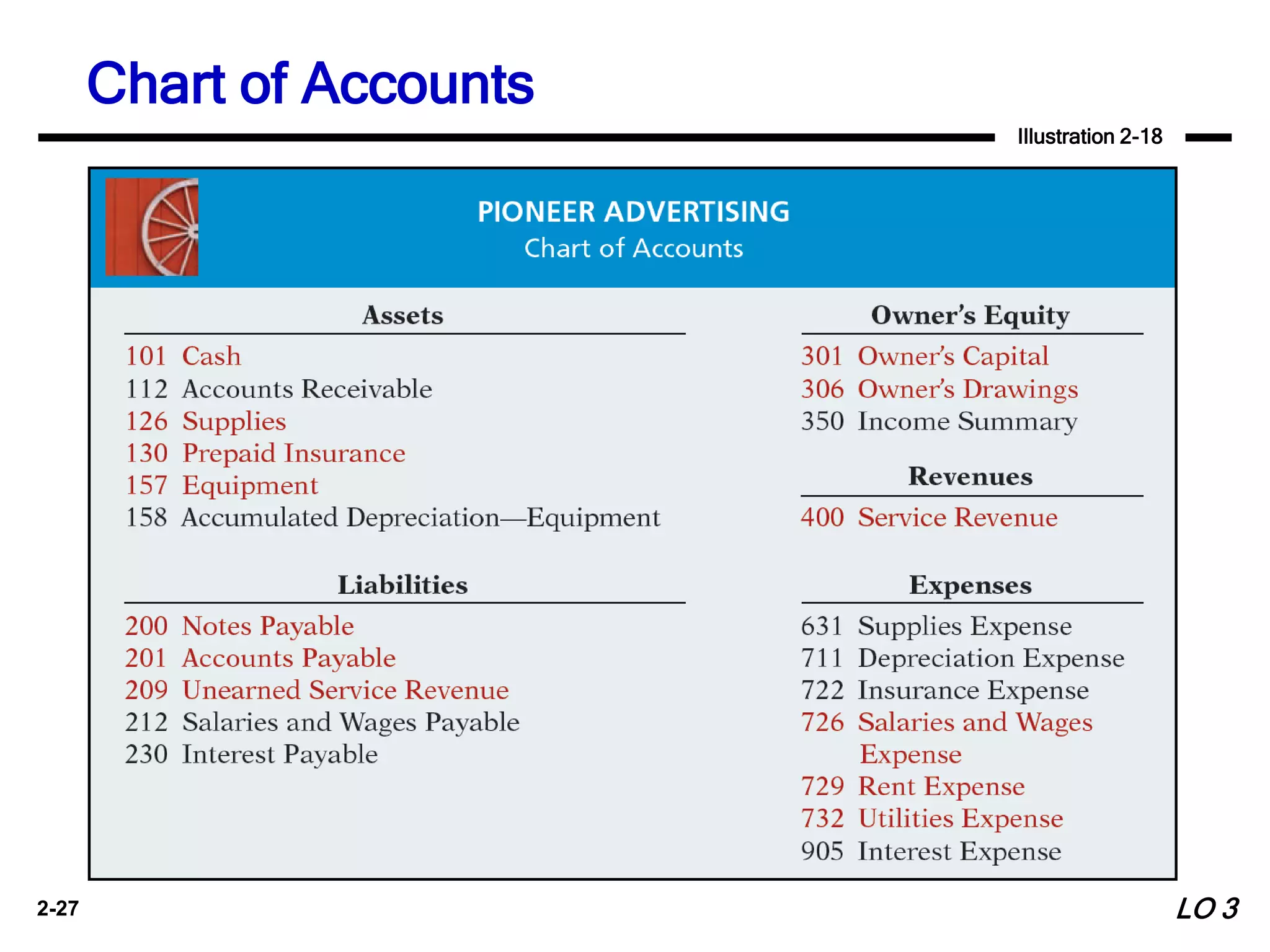

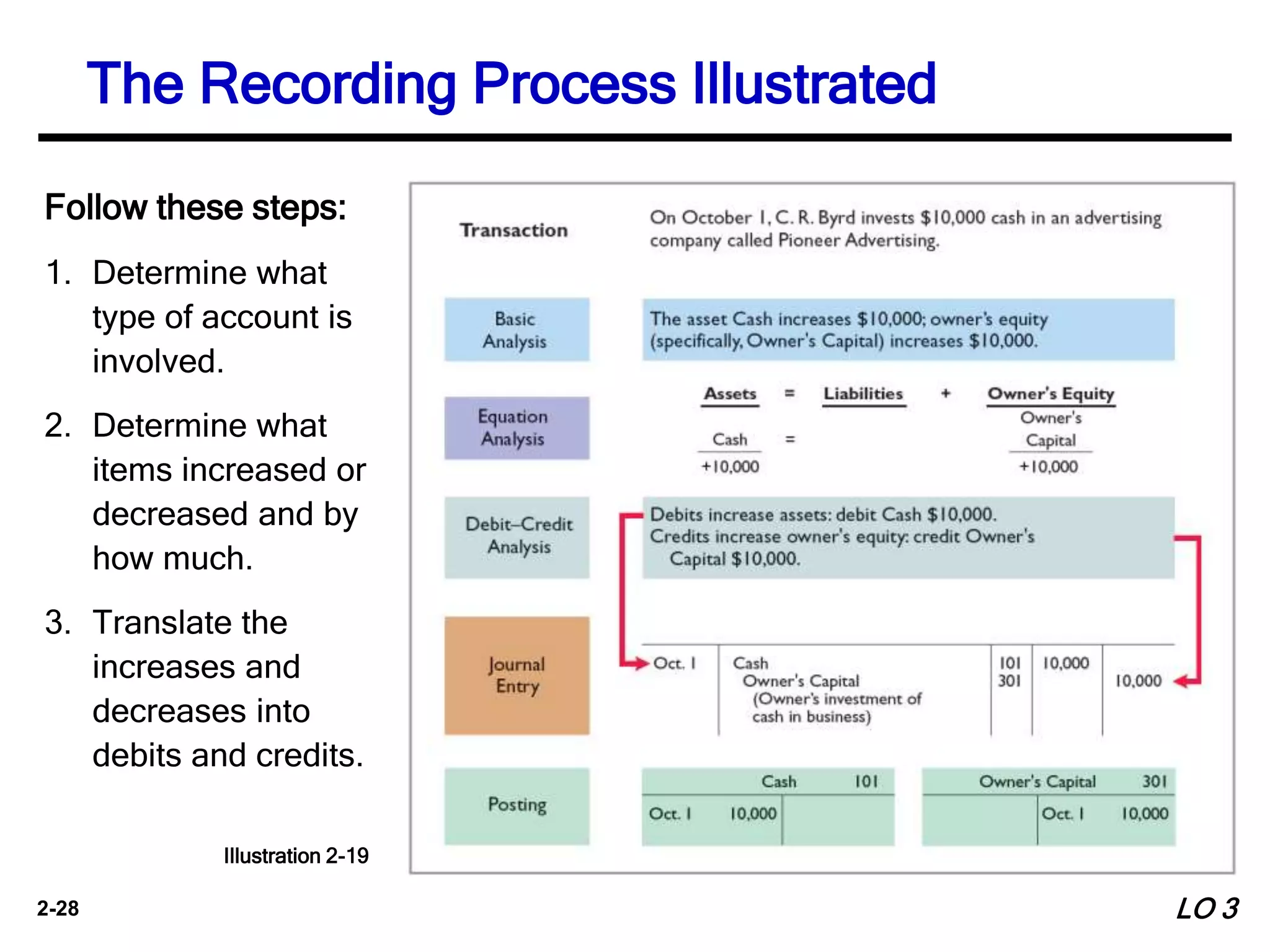

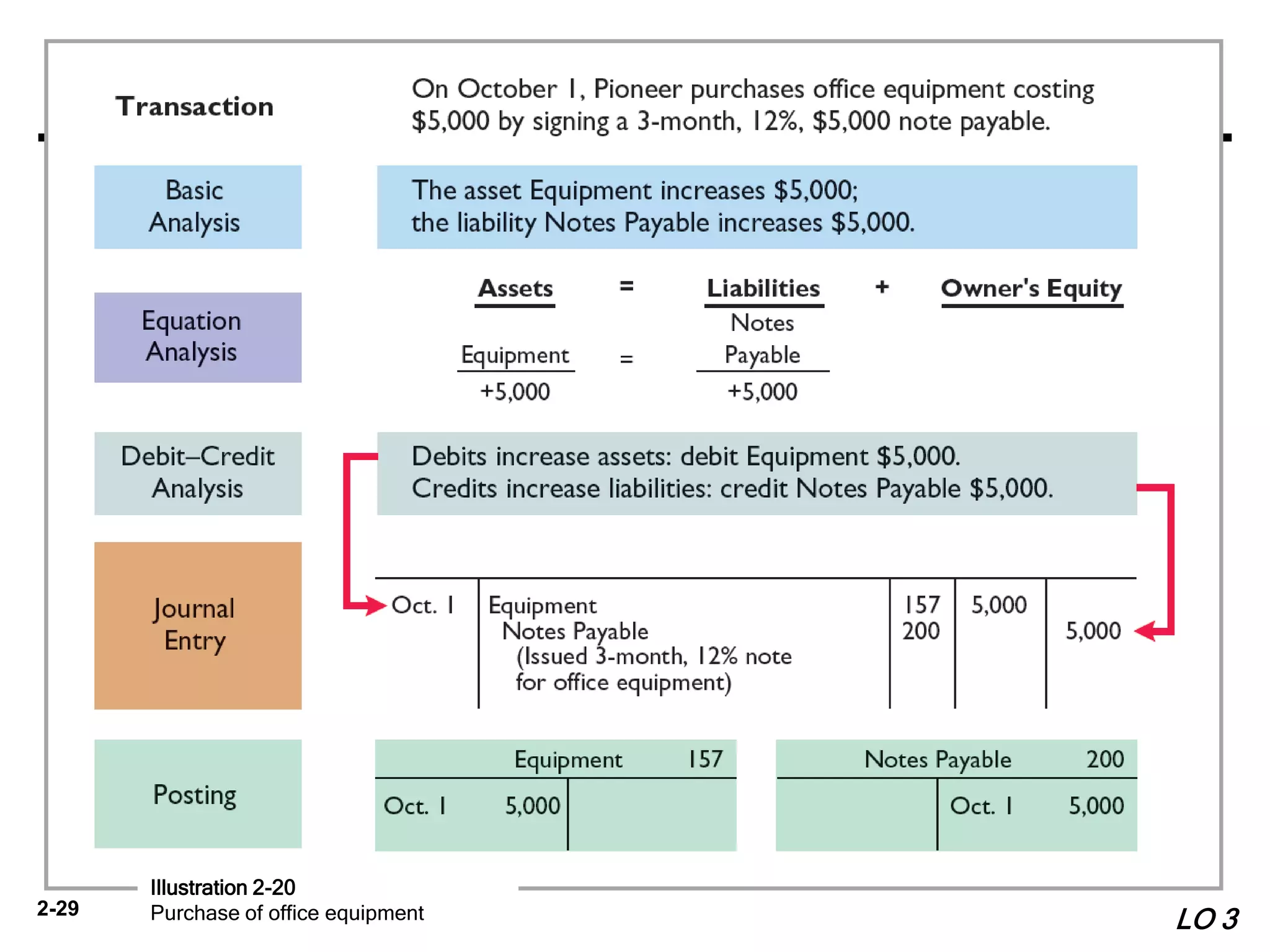

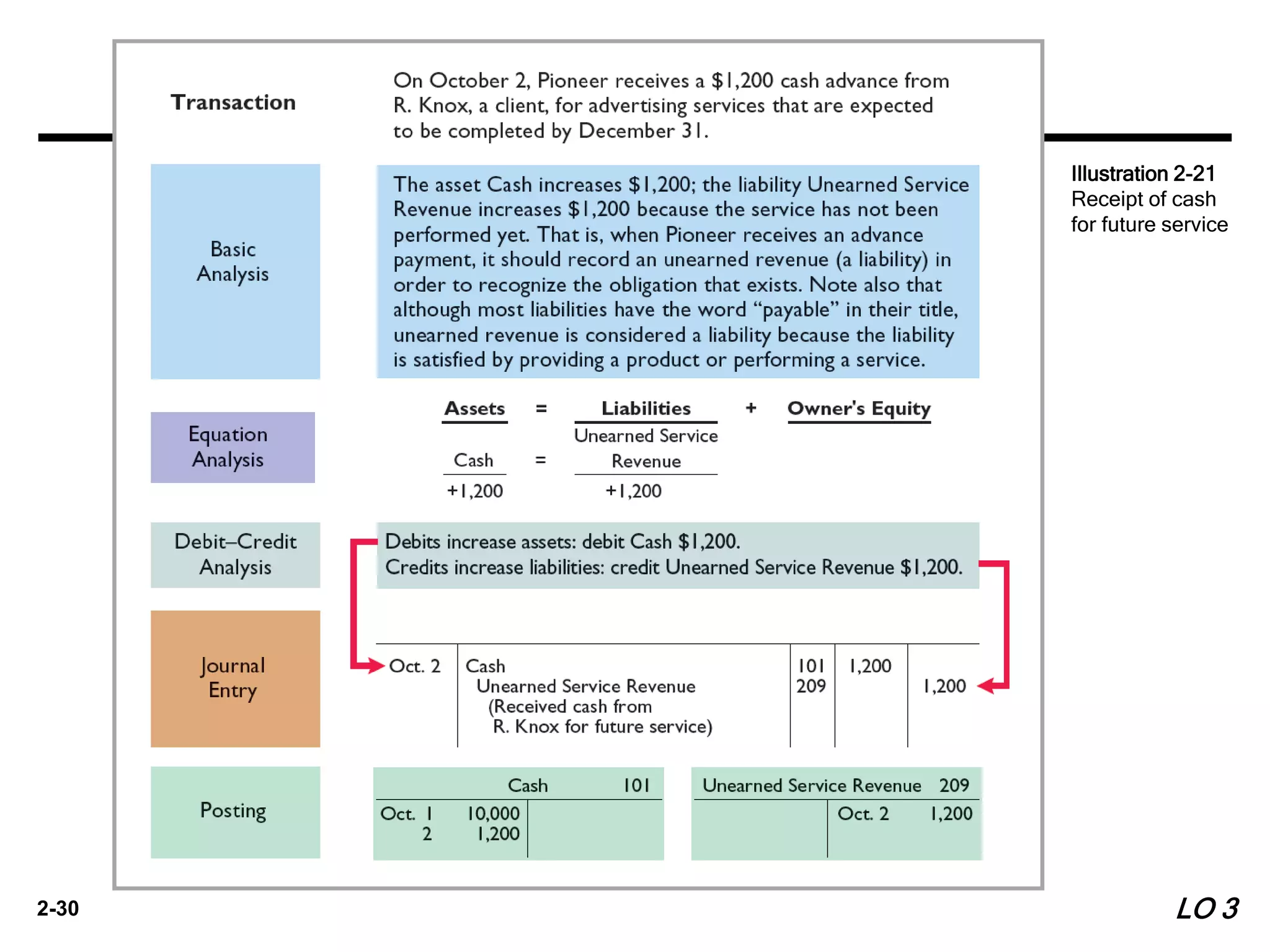

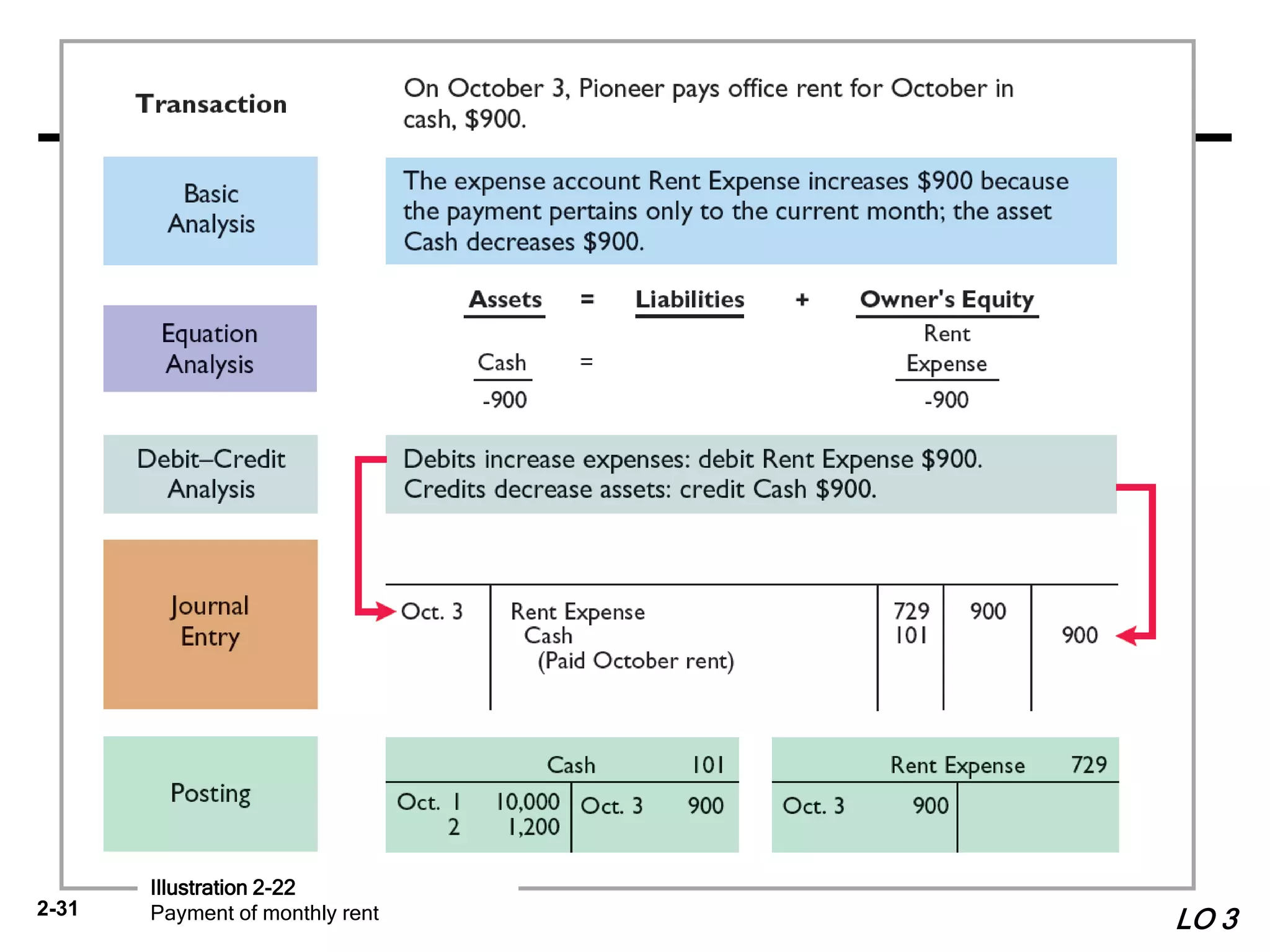

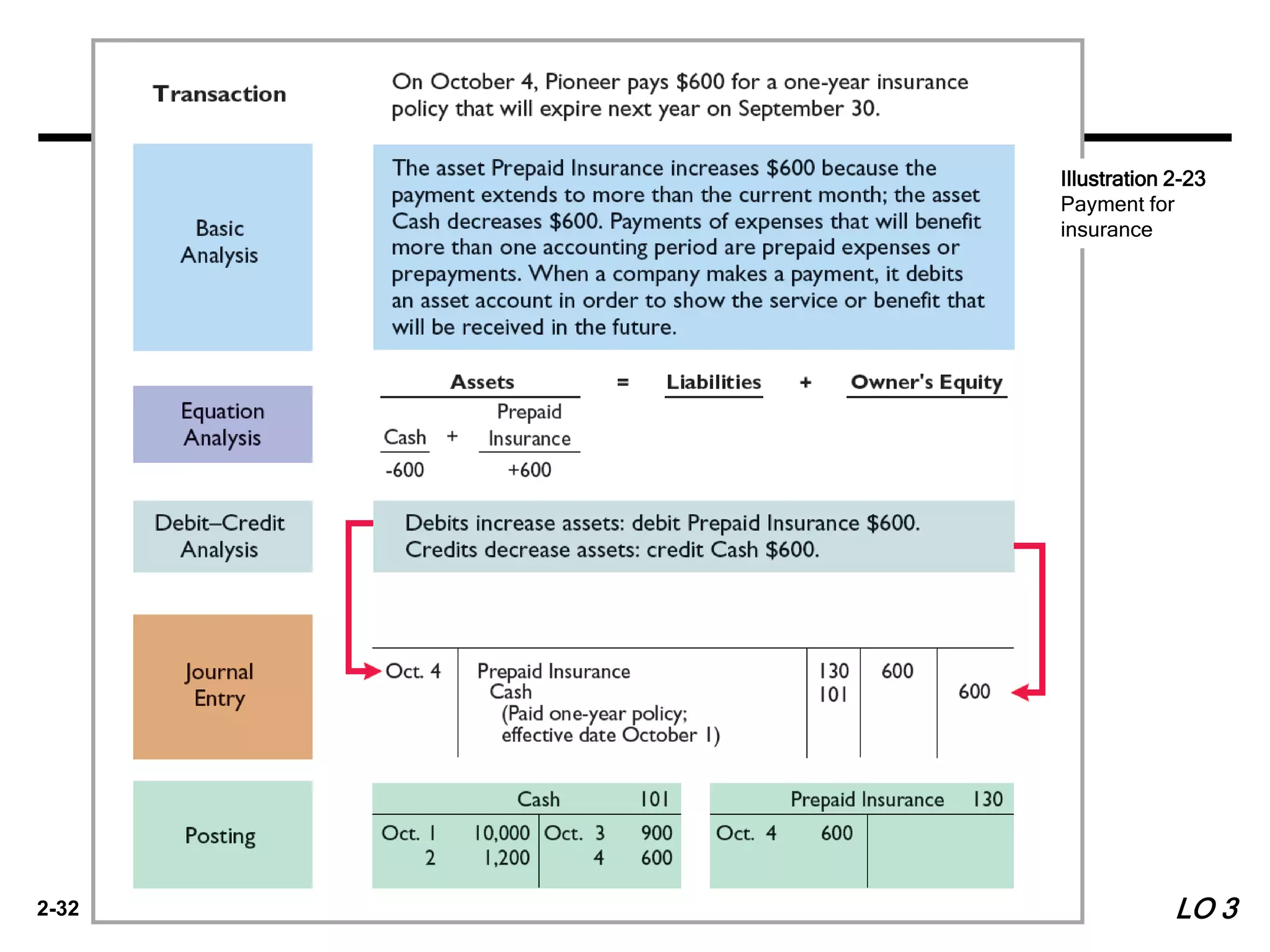

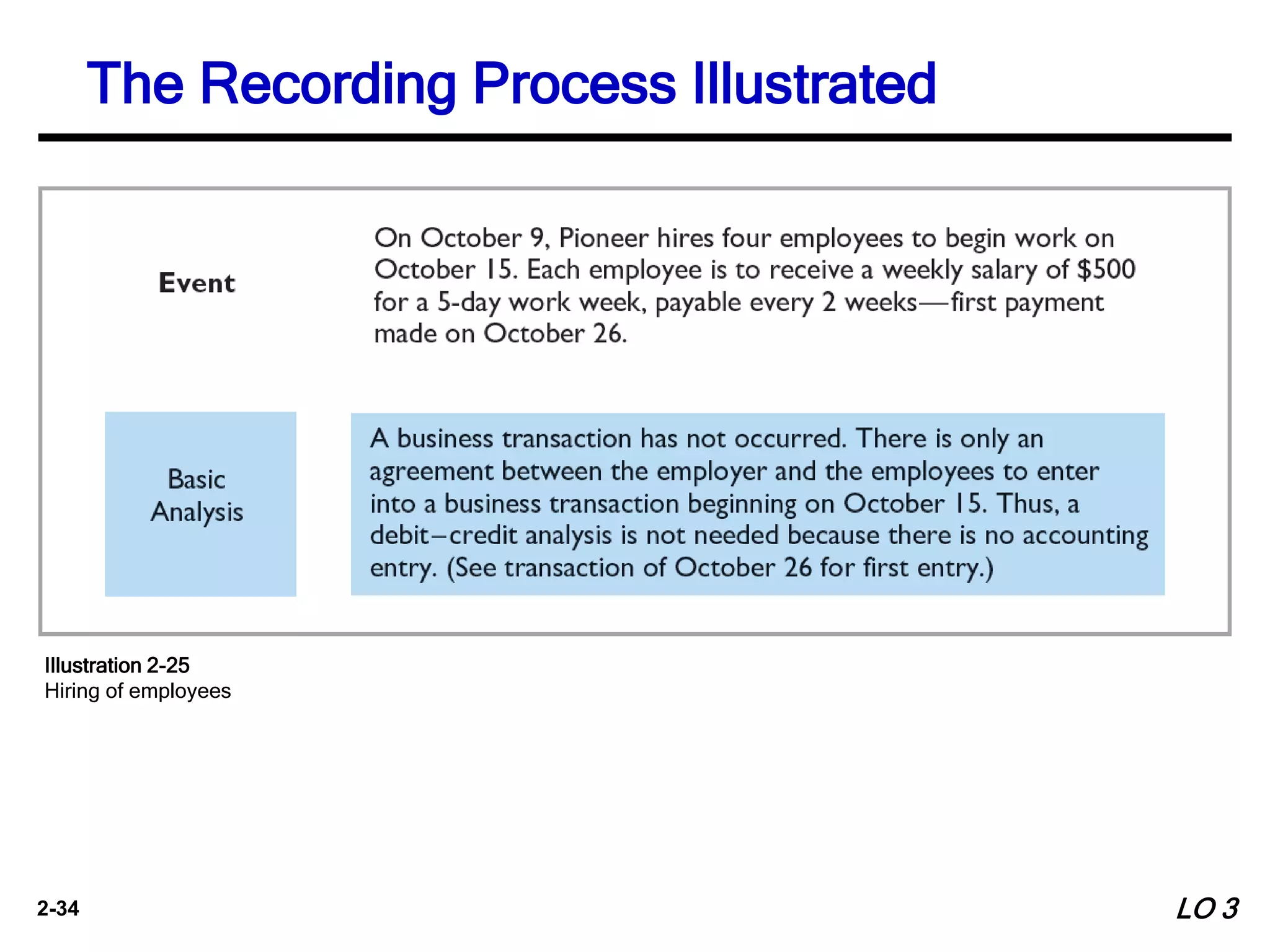

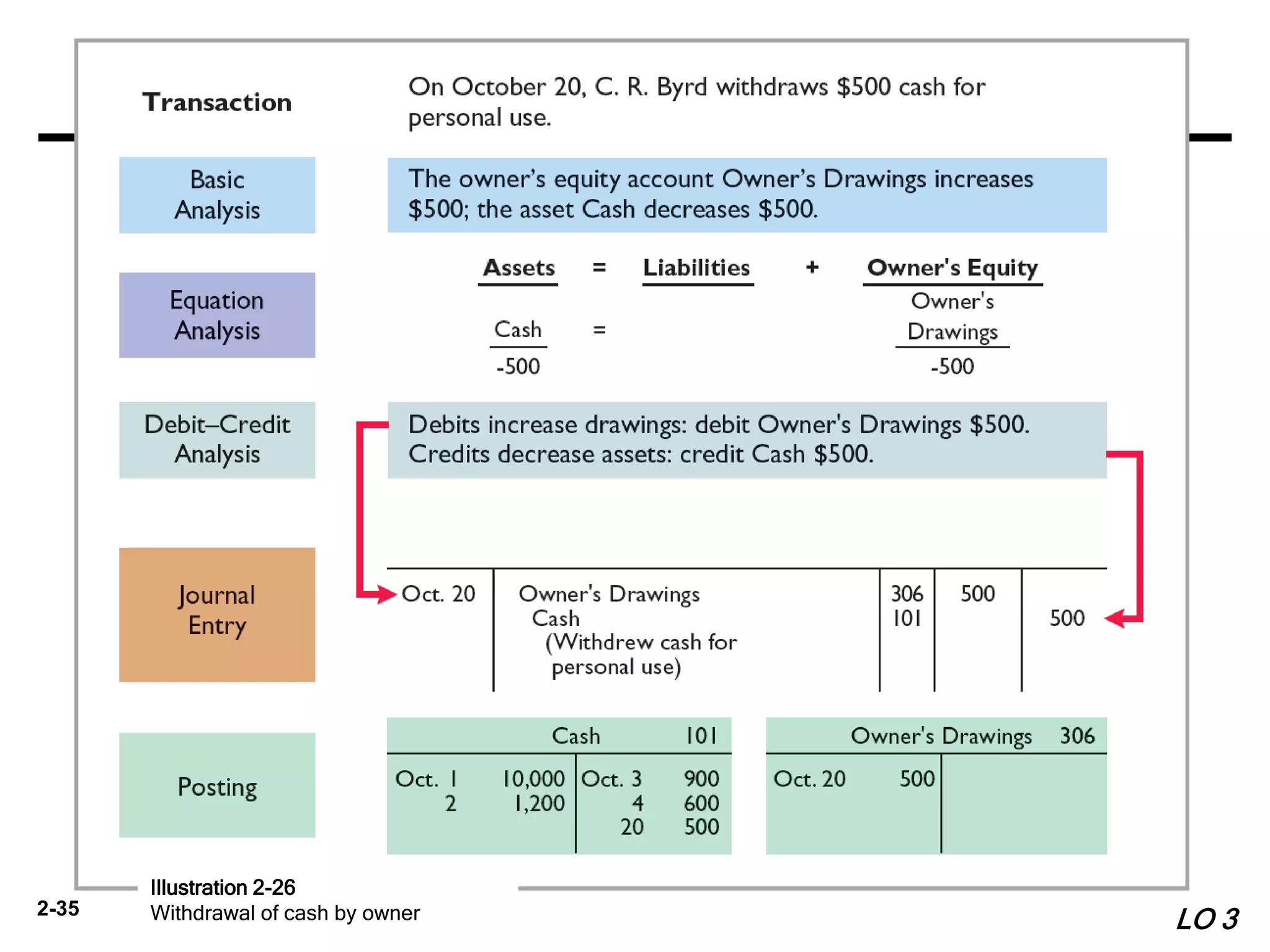

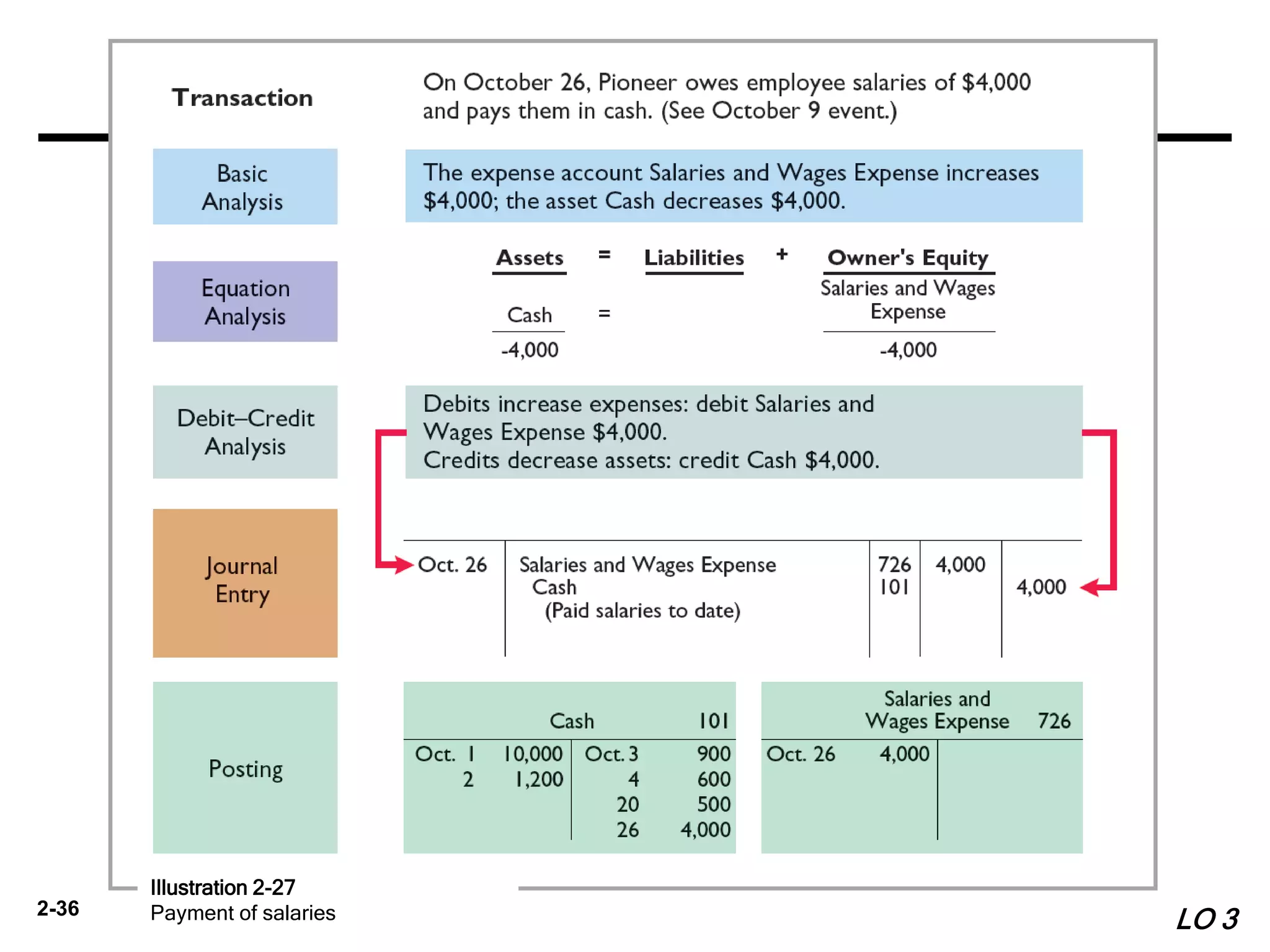

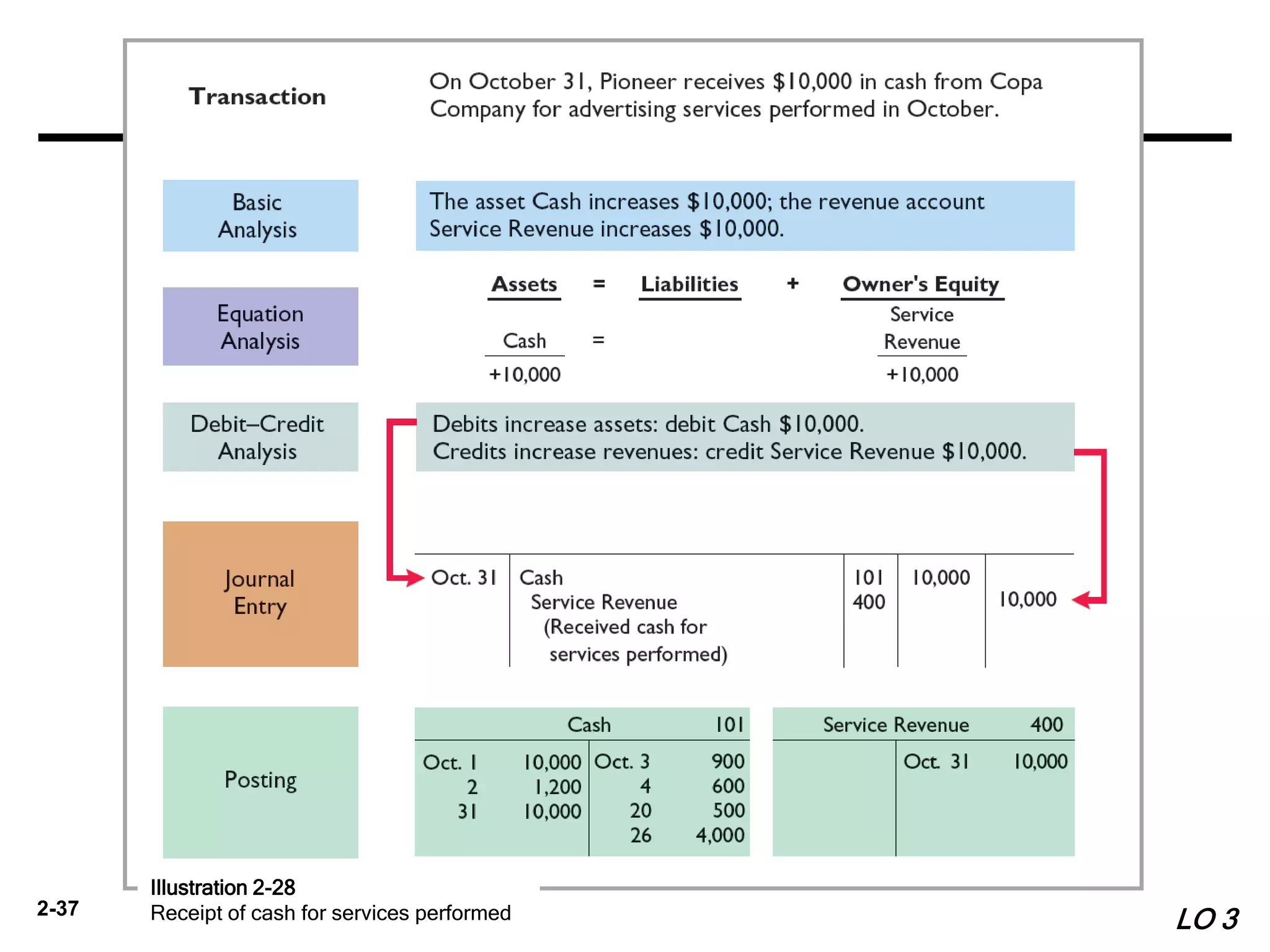

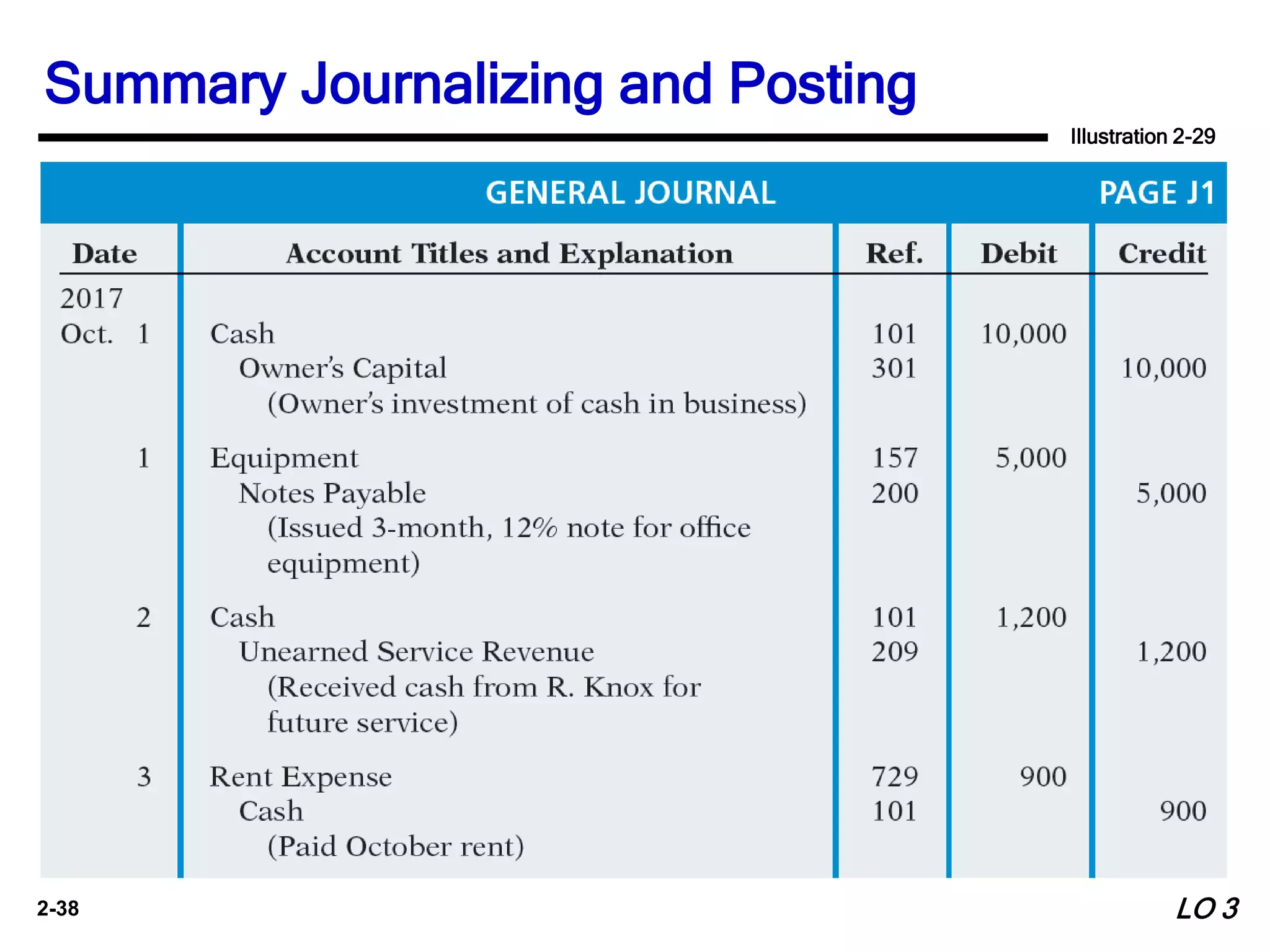

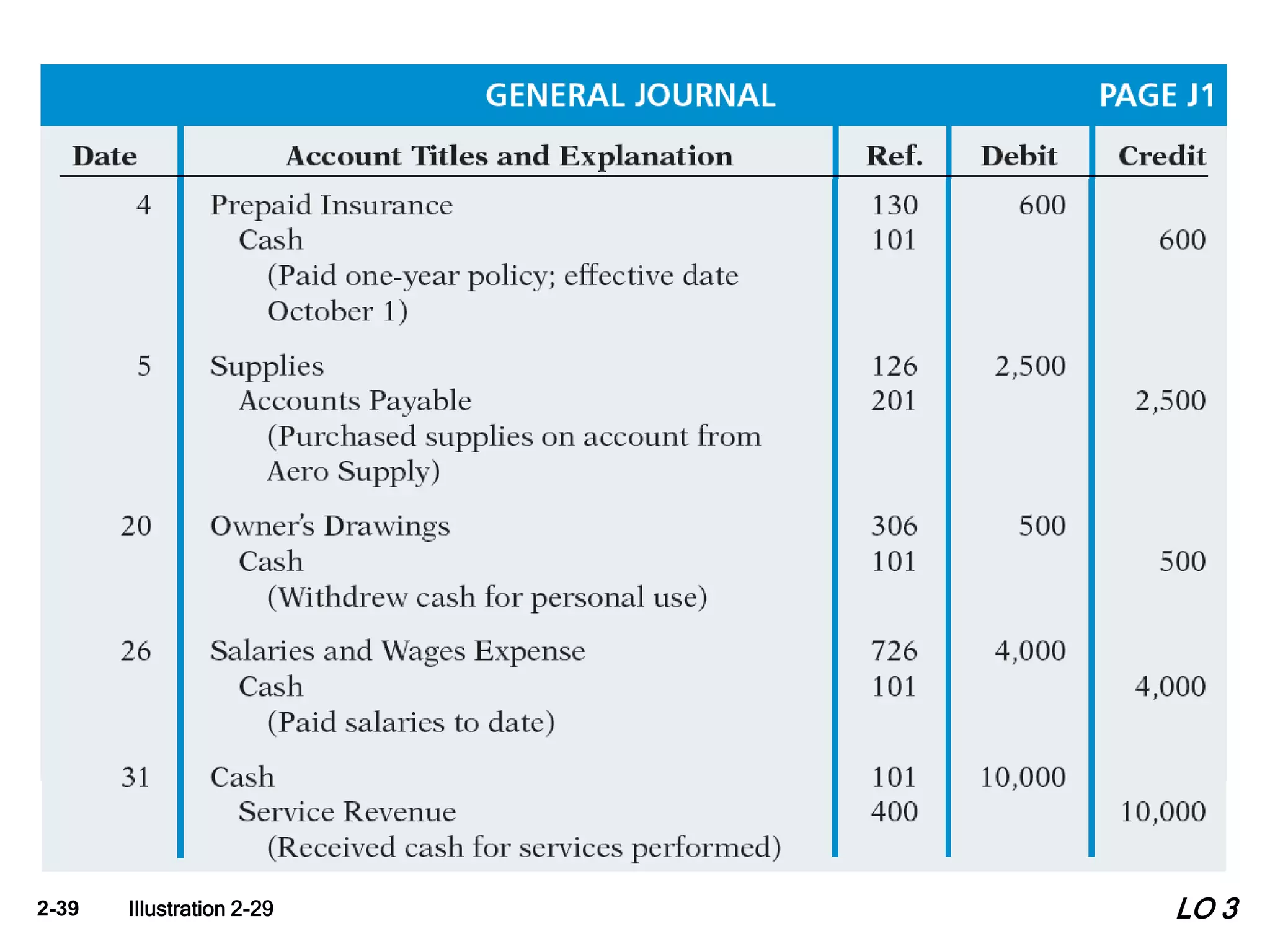

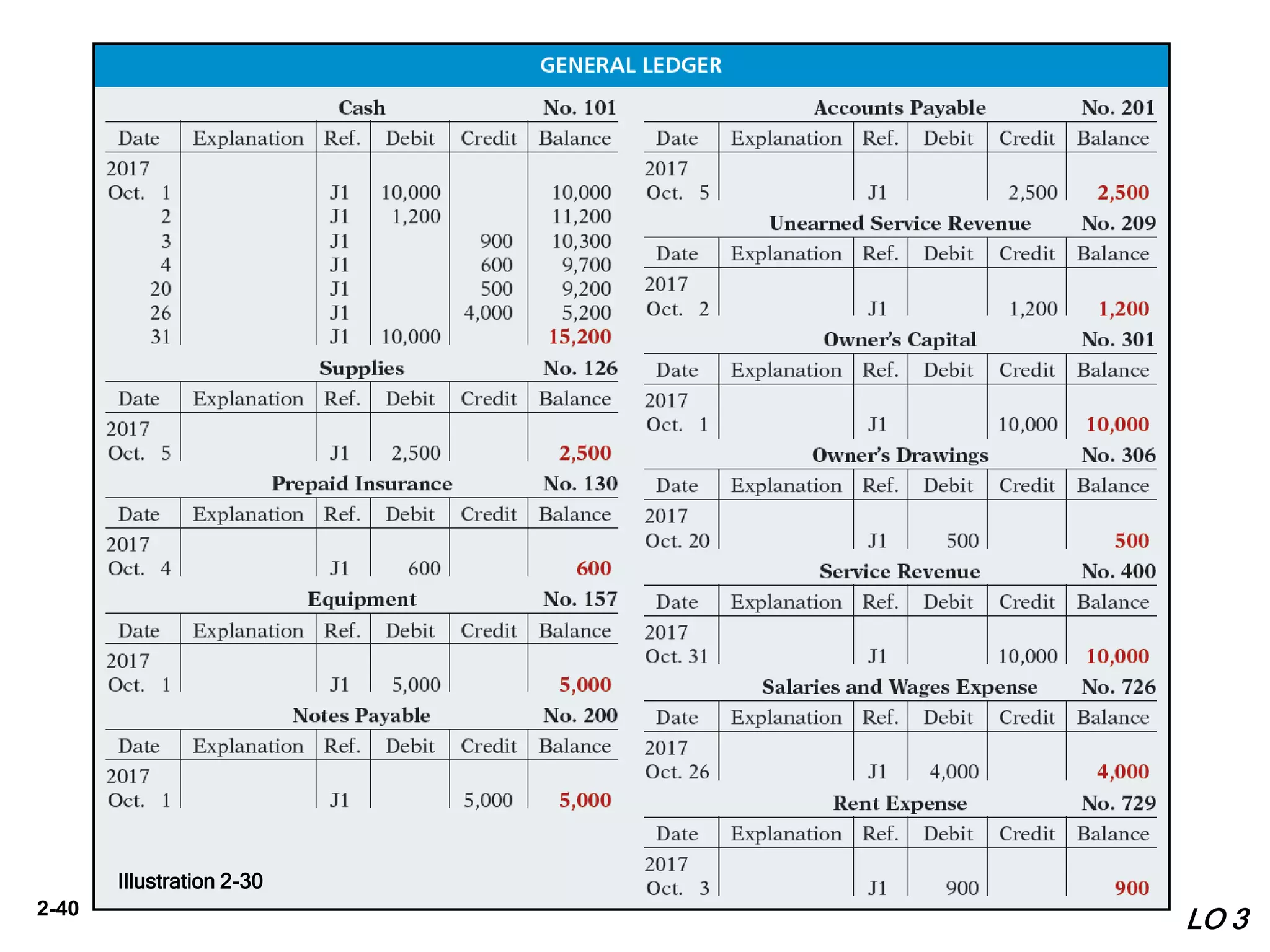

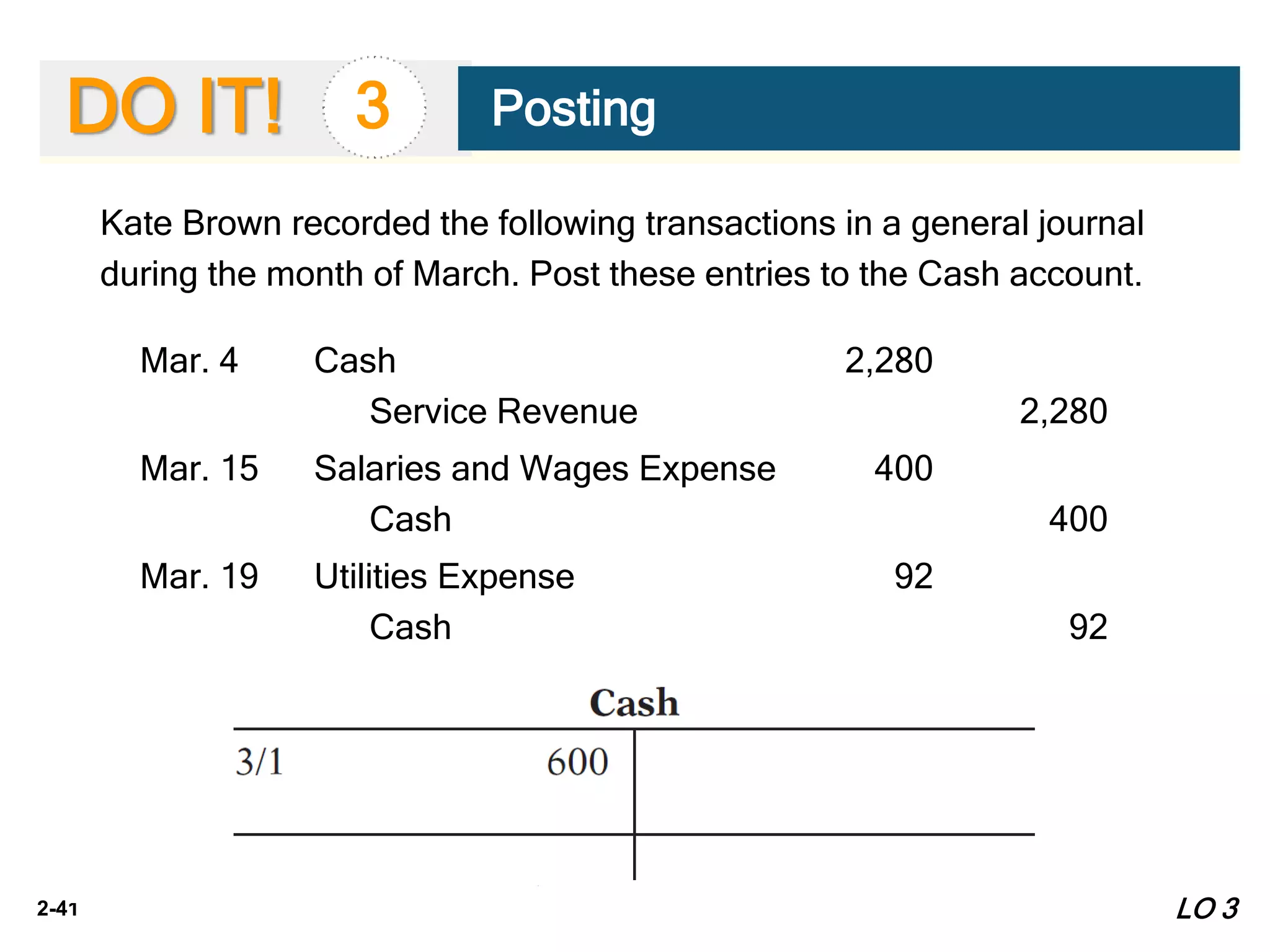

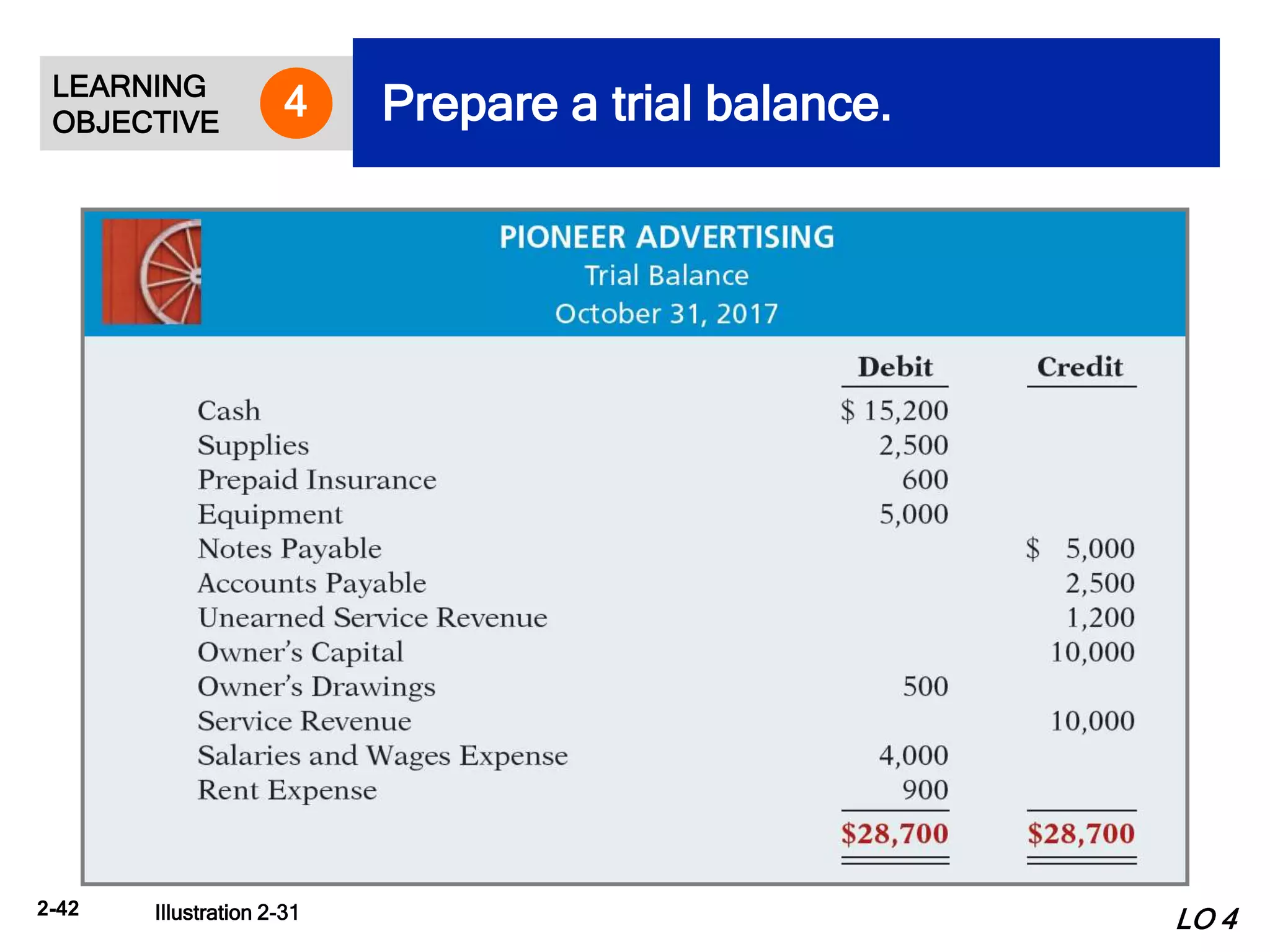

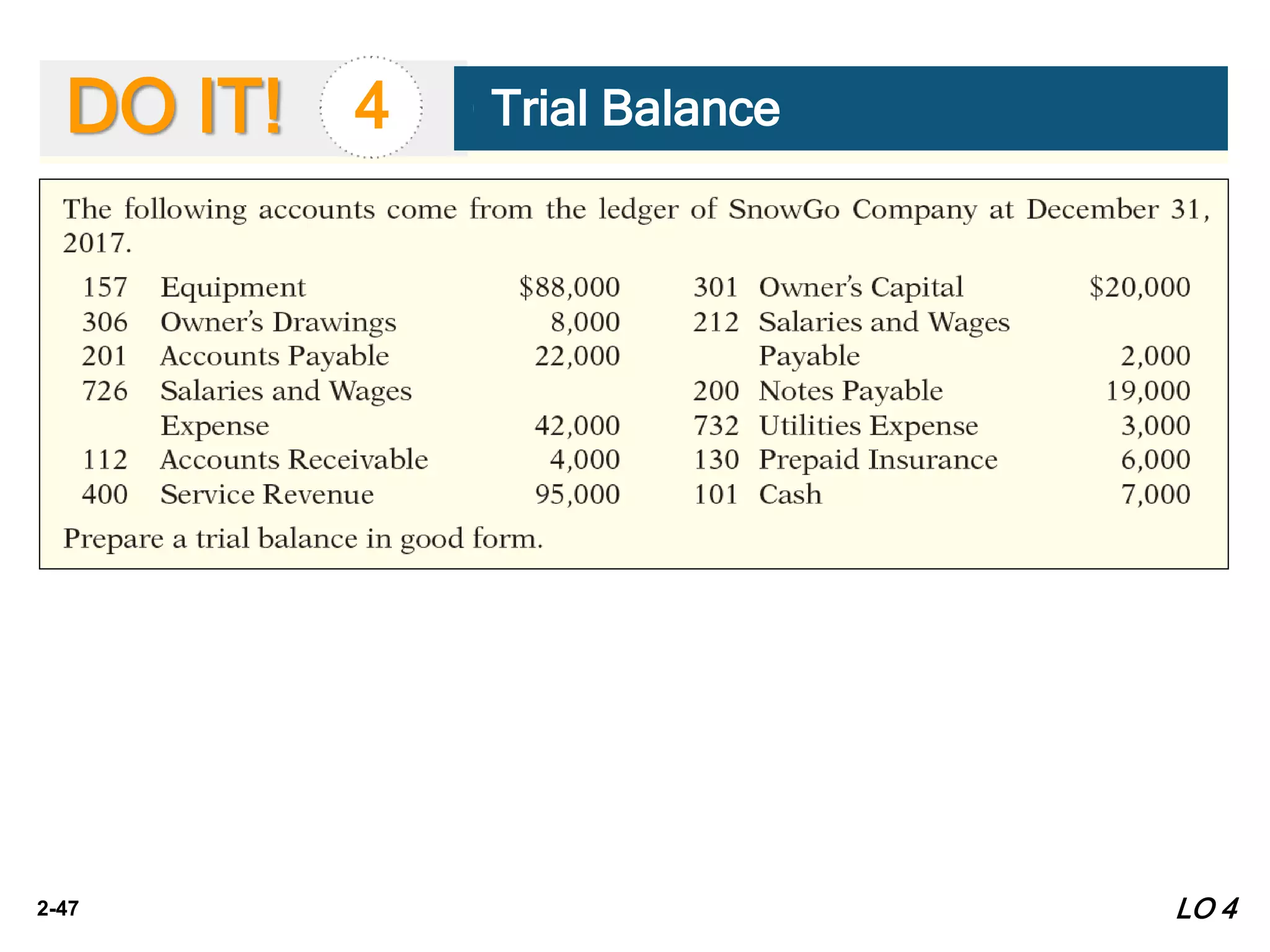

The document describes the accounting recording process, including how accounts, debits, credits, journals, ledgers, and trial balances are used. It explains that journals are used to record transactions chronologically, while ledgers contain accounts for assets, liabilities, equity, revenues, and expenses. Transactions are posted from journals to ledgers to update account balances. A trial balance is prepared to check that total debits equal total credits. While useful, a trial balance does not guarantee accurate records as errors can still exist.